Vodafone 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Measuring nancial

performance

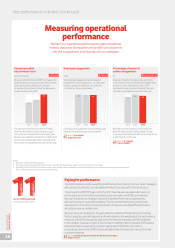

We use four main metrics to track our nancial performance.

Financial indicators

Our nancial performance this year saw strong

performances across our emerging markets

offset by continued weakness across many

of our European businesses, reected in our

service revenue and EBITDA performance.

Despite these pressures, and during a period

of signicant investment through Project

Spring, we met our nancial guidance for both

EBITDA and free cash ow and increased our

dividend per share.

Our results this year include a full year

of Vodafone Italy (consolidated from February

2014) and our acquisitions of Ono, Hellas

Online and Cobra Automotive.

We were unable to grow our organic service revenue

this year, mainly as a result of continued pressures

in many European markets. We did, however,

see continued improvements in the growth trends

throughout the year, with positive growth in the nal

quarter of the year.

Free cash ow fell by £3.3 billion over the year,

with the £2.9 billion increase in capital expenditure

not offset by the free cash ow contribution from

Vodafone Italy and Ono. On a guidance basis,

free cash ow was £1.3 billion, in line with the

guidance range.

More on free cash flow and financial year guidance:

Page 39

Reported EBITDA of £11.9 billion increased mainly

due to the inclusion of Italy and Ono. On an organic

basis, EBITDA decreased by 6.9%*, reecting the

ongoing competitive pressures in Europe and the

increased operating costs as a result of Project

Spring. On a guidance basis, EBITDA was £11.7 billion,

in line with the guidance range.

More on EBITDA and nancial year guidance:

Page 39

We increased our dividend per share to 11.22pence

in the year. Our intention remains to grow the

dividend per share annually.

Organic service revenue growth3

More work to do

Free cash ow3

Achieved

EBITDA3

Achieved

Dividend per share

Achieved

Growth in the top line demonstrates our ability

to grow our customer base and stabilise or increase

ARPU. We aim to return to service revenue growth.

Cash generation is key to delivering strong shareholder

returns. Our free cash flow will be depressed during

the period of Project Spring as we increase our capital

expenditure by around half. Our guidance was for

positive free cash flow in the year.

Growth in EBITDA supports our overall protability

and free cash ow which helps fund investment and

shareholder returns. Our guidance was for EBITDA

of £11.3 billion to £11.9 billion in the year, excluding

the results of Ono.

The ordinary dividend remains the primary method

of shareholder return and we have an outstanding

record of growth here. We intended to increase the

dividend per share annually.

More on Financial performance:

Page 38

-0.1

2013 2014 2015

-2.6

-1.6

11.5

2013 2014 2015

11.1

11.9

5.7

2013 2014 2015

4.4

1.1

10.19

2013 2014 2015

11.00 11.22

%

£ billion

£ billion

pence

Changes to KPIs this year

We have updated our KPIs this year

to better align to our strategy and changing

business model.

For our strategic KPIs, we have changed the

focus of European mobile towards 4G and

increasing data usage to better reect the

investments we are making with Project

Spring. We have also expanded the scope

of our strategic KPIs to address the growing

importance of unied communications and

the growth of data in emerging markets.

With the nancial KPIs, we have moved

to an absolute measure of EBITDA rather

than margin and have removed adjusted

operating prot, following the disposal

of our interest in Verizon Wireless in the

2014 nancial year.

We have also removed mobile market

share as a KPI as our focus is on improving

our customer experience and we monitor

the results of that through our nancials.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

19