Vodafone 2015 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

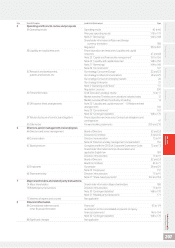

Australia

In December 2014, the federal government put the nal policy touches

to their revised National Broadband Network (‘NBN’) policy which gives

greater scope for infrastructure competition provided those investing

xed access networks wholesale their network on a structurally

separated basis. NBN Co, the government-owned company responsible

for the design, build and operation of the NBN, has also nalised new

Telstra and Optus deals that now passes ownership of the copper

and coaxial networks to NBN. While these steps are an improvement

on the previous government’s arrangements they still provide Telstra

with a signicant new revenue stream (AUD 20 billion over the next

ten years). Vodafone is asserting that this payment and the increased

market strength of Telstra will have signicant impacts on competition

in Australia.

After extensive lobbying by the industry, the government has

commenced the most comprehensive review of spectrum

management in 15 years. Vodafone Australia are asking for a framework

that better considers the competition effects of spectrum policy (60%

of regional spectrum is held by Telstra) and the establishment of more

market orientated spectrum licences and a better renewal process

and more exible payment terms. The Australian Communications and

Media Authority (‘ACMA’) has also announced that they will auction

up to 60MHz of regional 1800MHz spectrum to be made available

in two to three years’ time (currently allocated for xed link wireless

services). This will also clear the way for some portions of currently

unused regional spectrum to be provided on an interim basis.

Egypt

The Administrative Court ruling in favour of Vodafone Egypt’s case

led against Telecom Egypt and the national regulator (‘NTRA’)

regarding the NTRA’s authority to set MTRs between operators is yet

to be implemented.

The nalisation and implementation of the Unied Licence is still

pending and is, under a decision made by NTRA in December 2014,

dependent on the nalisation of ‘KAYAN’, the proposed second

infrastructure company. Telecom Egypt is expected to exit Vodafone

Egypt within 12 months once a unied licence has been approved

and activated.

For information on litigation in Egypt, see note 30 “Contingent liabilities”

to the consolidated nancial statements.

Ghana

The national regulator, the National Communication Authority

(‘NCA’) announced in the last quarter of 2014, that in line with its

plans to introduce unied licences in 2019, from 23 December 2014,

all existing licensed MNOs became entitled to apply for a xed access

service licence, to provide services including xed telephony, broadband

and other value added services. Vodafone Ghana and Airtel Ghana were

the only MNOs with xed licences prior to this announcement.

In December 2014, the NCA announced the mobile and xed wholesale

termination rates for the period from 2015 to 2017. SMS rates will

remain at 5 peswas per minute up until 2017 and both FTRs and MTRs

will increase to 6 peswas per minute in the same period. Additionally,

from 1 January 2016, operators will be entitled to a 20% discount of the

MTR and FTR based on the trafc volume exchanged between two

operators. The asymmetric rate or discount on the MTR and FTR will

apply where the outgoing trafc is equal to or greater than 60% of the

total trafc exchanged between two operators in a calendar month.

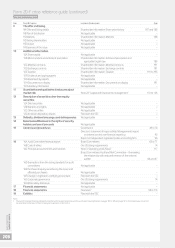

New Zealand

In June 2014, Vodafone New Zealand secured 2x15MHz of 700MHz

for NZ$68 million (£35 million), securing blocks that support devices

covering both of the “APT700” sub-bands.

In September 2014, the incumbent government announced its

intention, if re-elected, to increase government funding to expand

the existing Ultra-fast Broadband FTTP initiative from 75% to 80%

of premises passed at a projected cost between NZ$152 million and

NZ$210 million. In addition, a further NZ$150 million was committed

to improve broadband and mobile coverage in rural areas by extending

the Rural Broadband Initiative.

In April 2014, the MTR rate reduced from NZ$ 3.72 cents per minute

to NZ$ 3.56 cents per minute.

Safaricom: Kenya

In June 2014, the national regulator, the Communications Authority

of Kenya (‘CAK’) renewed Safaricom’s operating and spectrum licence

for ten years with effect from July 2014 up until June 2024. The renewed

licence includes Safaricom’s spectrum resources in 2x10MHz in the

900MHz band and 2x10MHz in the 1800MHz band. Safaricom still

maintains the 2x10 2.1GHz under a separate 15 year licence issued

in 2007.

In December 2014, Safaricom acquired the base transceiver station

assets and spectrum of Essar Telecom Kenya Limited, one of the three

other licensed mobile operators in Kenya (this was a joint acquisition

with Airtel Kenya who acquired the business and operating licences).

Safaricom acquired Essar’s spectrum assets of 2x7.5 in the 900MHz

band and 2x10 in the 1800MHz band under a ten year licence which the

CAK aligned with our previously renewed spectrum licence to run from

July 2014 up to June 2024.

Safaricom is in the process of acquiring additional spectrum in the

4G band. Specically, the government will grant Safaricom 2x15MHz

in the 800MHz band ( total allocation is expected to be 2x20 after

full migration out of the band by broadcasters). From February 2015,

Safaricom was given access to the 2x15MHz on a trial basis for a three

month period, after which a full commercial licence will be issued.

In July 2014, the Central Bank of Kenya requested that each mobile

network operator submit its views on interoperability of their money

transfer services. The National Payment Systems Regulations took

effect in August 2014 and now provides the management framework

for payment services in Kenya. No timelines have been set for the

implementation of interoperability.

In July 2014, the MTR was reduced from KES 1.15 to KES 0.99 per

minute. This is the last step in the CAK’s imposed glide-path.

Qatar

In December 2013, the Ministry of Information and Communications

Technology (‘MICT’) released a national broadband plan. One objective

of the plan, is for 98% of households to have access to 100 Mbps

download and 50 Mbps upload speeds and a choice of at least two

service providers. This includes an intention to consolidate the access

network infrastructure of the incumbent Ooredoo and the Qatar

National Broadband Network (‘QNBN’), both of which are deploying

FTTP networks.

The Communications Regulatory Authority (‘CRA’) granted Vodafone

Qatar additional spectrum of 2x5MHz in the 1800MHz band and

2x10MHz in the 800MHz band, to support 4G deployment.

During the CRA’s review of three retail mobile markets, the CRA

amended the remedies applied to the Signicant Market Power (‘SMP’)

operator (Ooredoo) in those markets without notice or consultation.

Both of these amendments were successfully appealed with the

MICT’s Appeals Advisory Committee nding the amendments

to be legally invalid.

The CRA announced a shift in emphasis to wholesale regulation.

This includes requesting reference offers for passive infrastructure

from Ooredoo and QNBN. Vodafone and Ooredoo are also required

to prepare reference offers for interconnection.

Overview Strategy review Performance Governance Financials Additional

information Vodafone Group Plc

Annual Report 2015

199