Vodafone 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report 2015

Unifying

communications

Vodafone

Power to you

Table of contents

-

Page 1

Unifying communications Vodafone Group Plc Annual Report 2015 Vodafone Power to you -

Page 2

... 62 Shareholder engagement 63 Board committees 72 Compliance with the 2012 UK Corporate Governance Code 74 75 92 Our US listing requirements Directors' remuneration Directors' report Financials The statutory financial statements of both the Group and the Company and associated audit reports. 93... -

Page 3

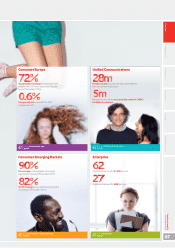

... growth in our emerging markets. 12m Fixed broadband customers We have grown our fixed broadband base by 2.8 million over the year, through organic growth and the acquisitions of Ono and Hellas Online. Vodafone Group Plc Annual Report 2015 19m 3G customers in India We have grown our 3G customer... -

Page 4

...markets with the rapid adoption of unified communications. And this is where the future lies - in the provision of high quality voice, data, business and entertainment services across multiple technologies and screens, in the home, in the office and on the move. Vodafone Group Plc Annual Report 2015... -

Page 5

.... Governance Financials Additional information Aligning management pay to value creation and customer perception Our remuneration policies continue to focus on rewarding long term value creation. The annual bonus this year was slightly higher than last year, reflecting improved performance against... -

Page 6

... UK's first-ever mobile phone call was made 30 years ago on the newly-launched Vodafone network. Michael Harrison, the son of former Vodafone Chairman Sir Ernest Harrison, was the first to test the system, calling his father at midnight on 1 January, 1985. 04 Vodafone Group Plc Annual Report 2015 -

Page 7

...Companies wanting a single source for all communication services Actions a Invest in total communications solutions including Vodafone One Net, Cloud and Hosting, and M2M Impact: percentage of service revenue from enterprise Vodafone Group Plc Annual Report 2015 66% 72% 2015 25% 27% 2015 2012... -

Page 8

...to enjoy a high definition video experience 06 Vodafone Group Plc Annual Report 2015 Note: 1 Next-generation network ('NGN') technology, which includes fibre-tothe-home, cable and very-high-bit-rate digital subscriber lines from the cabinet or central office. 2 Data shown to the nearest thousand. -

Page 9

... to 95% by March 2016 Countries where we offer IP-VPN services Countries where we offer M2M services 3G/4G coverage across AMAP (excluding India), increasing to 84% by March 2016 Vodafone Group Plc Annual Report 2015 More on Consumer Emerging Markets: Page 22 More on Enterprise: Page 27 07 -

Page 10

... 982 petabytes of data were sent across our mobile network alone last year, nearly double the amount handled in the previous year We have over nine million TV customers across six markets Fixed broadband customers Vodafone Group Plc Annual Report 2015 15 12.0 10 6.9 5 More on Strategy: Page 14... -

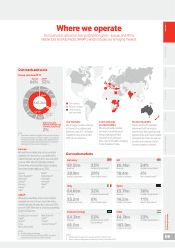

Page 11

...mobile customers India 30% mobile market share 11% fixed market share 3 3 Vodafone Group Plc Annual Report 2015 £4.3bn revenue 68.5m mobile customers 53% mobile market share (South Africa) 3 £4.3bn revenue 183.8m mobile customers 23% mobile market share 4 Notes: # Fixed broadband markets... -

Page 12

... on acquiring new fixed line businesses. Revenue The majority of our revenue comes from selling mobile voice, text and data. Mobile users pay either monthly via fixed term contracts (typically up to two years in length) or prepay by topping up their airtime in advance of usage. Enterprise customers... -

Page 13

...money services Strategy review Key differentiators: a We are typically either number one or number two in mobile enterprise in most of our markets a We have a comprehensive portfolio of total communication services including mobile, fixed, Cloud and Hosting, and M2M business solutions Performance... -

Page 14

... billion mobile phone customers and one billion fixed line customers. The global mobile market Scale and structure The mobile industry has 7.2 billion users, generating around one trillion US dollars of annual service revenue every year. Around 60% of revenue comes from traditional calls. However... -

Page 15

... growth in the future. Therefore this will need to be managed by access to nextgeneration fixed networks, principally cable or fibre, to support increased speed and meet capacity requirements. Internet-based providers often offer "free calls and texts" services, so mobile operators increasingly sell... -

Page 16

... data is taking off. Supported by...An excellent network experience Customer-focused and cost-efficient business model and operations Each of which is accelerated by... 14 Vodafone Group Plc Annual Report 2015 Project Spring Investing £19 billion in mobile and fixed networks, products, services... -

Page 17

... European markets, we are increasingly positioning Vodafone as a top tier, fully integrated provider of high speed fixed and mobile communications to consumers and businesses. Performance Governance Financials Additional information Continues on next page... Vodafone Group Plc Annual Report 2015... -

Page 18

...or 3G in emerging markets, with data growth totalling 80% for the full year, and accelerating every quarter in Europe. As video and music services proliferate, and data coverage widens and becomes more consistent, customers are increasingly using their smartphones and tablets for entertainment, work... -

Page 19

... in strong future cash flow generation. Performance Governance Financials Vittorio Colao Chief Executive Additional information Dividend per share 12 pence Vodafone Group Plc Annual Report 2015 Growth in dividend per share We increased the dividend per share by 2.0% this year and we intend... -

Page 20

... data coverage across them all. Around half our customers still only experience data on 2G so a key goal for us is to increase the number of customers using 3G and 4G. 114.2 94.6 11.3 8.5 19 6.1 68.2 Data not available 2013 2014 2015 2013 2014 2015 2013 2014 2015 Vodafone Group Plc Annual Report... -

Page 21

...year. 5.7 The ordinary dividend remains the primary method of shareholder return and we have an outstanding record of growth here. We intended to increase the dividend per share annually. 11.22 11.00 10.19 4.4 1.1 2013 2014 2015 2013 2014 2015 Vodafone Group Plc Annual Report 2015 Free cash flow... -

Page 22

... used to reward the performance of our Directors and our senior managers, with some local variances, include measures linked to our key performance indicators. The annual bonus ('GSTIP') pay-out for the 2015 financial year was dependent upon our performance across three financial measures (service... -

Page 23

... time equivalent Vodafone job we generate an average of 2.2 full time employment opportunities among our European suppliers. For more information see our EU Economic Impact report online at vodafone.com/policy. Vodafone Group Plc Annual Report 2015 Note: 1 KPMG analysis based on data from Eurostat... -

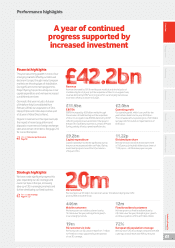

Page 24

... Project Spring achievements a Taking 4G coverage to 72% a Reducing dropped calls to 0.6% a Increasing average smartphone data usage to 755MB a Modernising around 3,250 retail stores 0 2013 2014 2015 60 48 40 20 37 37 Vodafone Group Plc Annual Report 2015 % Roamers registered on "Daily offer" 30... -

Page 25

... in the use of our mobile and online based care products. We now have 12.5 million 'My Vodafone App' users who can check their balance and usage, and access help and support, wherever they are. Governance Financials A major fixed operator The story is not just about mobile data. As a result of... -

Page 26

... fibre or cable broadband Fixed service revenue percentage of total service revenue 20 15 12 10 5 0 2013 2014 2015 16 20 % Fixed broadband and TV customers 15 12.1 10 6.9 5 0.2 0 2013 2014 Fixed broadband customers 2015 TV customers 9.2 8.3 million 24 Vodafone Group Plc Annual Report 2015 9.1 -

Page 27

... in one easy to use package. During the year we expanded the service to more markets and the number of users increased by 400,000 to 3.9 million. Performance Governance Financials Our fixed broadband assets and performance The successful execution of our strategy has given us a strong unified... -

Page 28

... of 3G data users in India to 19 million; Vodacom delivered a 16% increase in active data users to 26 million or 39% of total customers; and smartphone penetration in Turkey rose to 46% from 34% last year. M-Pesa: increasing access to mobile financial services Our mobile money transfer and payment... -

Page 29

... costs and increasing flexibility. Our Cloud and Hosting business serves more than 1,200 public sector and enterprise customers globally using our 18 data centres in the UK, Ireland, Germany and Africa, complemented by a partner network of data centre facilities. Additional information Vodafone... -

Page 30

... academies for key areas such as marketing, technology, enterprise sales, retail, finance and supply chain. Employee engagement 100 75 50 25 78 77 77 % index 60,000 30,000 UK 16% India 18% 0 2013 2014 2015 0 2013 2014 2015 Employee turnover rates Vodafone Group Plc Annual Report 2015 20... -

Page 31

... vary depending on conditions and practices in local markets. Global short-term incentive plans are offered to a large percentage of employees and global long-term incentive plans are offered to our senior managers. Our incentive arrangements are subject to company performance measures, comprising... -

Page 32

... GHG emissions) 30 Vodafone Group Plc Annual Report 2015 Notes: 1 Deloitte and the GSMA. 2 Calculated using local market actual or estimated data sourced from invoices, purchasing requisitions, direct data measurement and estimations. Carbon emissions calculated in line with DEFRA guidance... -

Page 33

... conditions, using their mobile phones, in collaboration with Good World Solutions. Responses to the surveys are aggregated anonymously and provided directly to Vodafone and the supplier to identify areas for improvement. Performance Governance Enhancing our enterprise customers' sustainability... -

Page 34

... contact in each market on risk, help to coordinate all activities including enterprise risk management exercise and reporting to the local Chief Executive on overall risk management a Local audit committees - track remedial actions for principal risks in market 32 Vodafone Group Plc Annual Report... -

Page 35

... working closely with our local market security teams a We work closely with a variety of security communities of interest which include relevant government bodies, commercial groups, suppliers and enterprise customers a We are continually assessing our security policies, standards and procedures... -

Page 36

... value of our deferred tax assets, which would affect the results of the business. Strategic risk Assessment In all markets where we are present, political decisions can be made that can have an adverse effect on our business, in relation to a range of issues, from retail price regulation to access... -

Page 37

... a A single sales governance process has been developed and will be implemented across Vodafone Global Enterprise and the local markets during the 2016 financial year. This process will interlock with a single governance board for design, deliver, operate and billing teams to support the business in... -

Page 38

..., could lead to commercial exploitation and subsequent increased costs of maintaining and extending our networks. Vodafone Group Plc Annual Report 2015 Unchanged Assessment The threat from OTT competition is relevant for all markets where alternative services are commonly available (e.g. VoIP... -

Page 39

... functions and local markets; a ensuring our global risk community is better connected and therefore better placed to share best practices; and Vodafone Group Plc Annual Report 2015 a developing an integrated assurance plan to help identify any gaps and overlaps in the management of our principal... -

Page 40

...% year-onyear. Cash flow generation was, as expected, depressed by the level of spending. I remain very confident that, once Project Spring is completed, we will return to a more normal level of capital intensity and generate strong and growing cash flows. 38 Vodafone Group Plc Annual Report 2015 -

Page 41

...2014. In total we expect to generate combined annual cost and capex synergies of approximately â,¬540 million in the 2018 financial year, mainly from migrating fixed and mobile customers onto our own infrastructure and combining backhaul and core networks. In terms of standalone business performance... -

Page 42

...markets and the net result of unallocated central Group costs. Revenue Group revenue increased by 10.1% to £42.2 billion and service revenue increased 9.4% to £38.5 billion. Reported growth rates reflect the acquisitions of KDG in October 2013 and of Ono in July 2014, as well as the consolidation... -

Page 43

Overview Strategy review Amortisation of intangible assets in relation to customer bases and brands are recognised under accounting rules after we acquire businesses and amounted to £1,269 million (2014: £551 million). Amortisation charges increased in the year as a result of the acquisitions of ... -

Page 44

... 2015 £m 2014 £m Profit attributable to owners of the parent Adjustments: Impairment loss Amortisation of acquired customer base and brand intangible assets Restructuring costs Other income and expense Non-operating income and expense Investment income and financing costs (see net financing costs... -

Page 45

... in service revenue was partially offset by continued strong cost control, with operating expenses down 3.1%* and customer investment down 3.0%*. Note: 1 "Other activity" includes the impact of M&A activity. Refer to "Organic growth" on page 203 for further detail. Vodafone Group Plc Annual Report... -

Page 46

... service revenue grew 0.5%*. Consumer contract service revenue grew strongly, supported by customer growth and a successful commercial strategy bundling content with 4G. Enterprise mobile revenue returned to growth in H2, as a result of growing data demand. During the year we acquired 139 stores... -

Page 47

... 3G customer base increased to over 19 million, reflecting the significant investment in our 3G network build. During the year we added 12,585 new 3G sites, taking the total to over 35,000 and our coverage of target urban areas to 90%. 3G internet revenue rose 140%. Vodafone Group Plc Annual Report... -

Page 48

... decline in EBITDA margin. Associates Vodafone Hutchison Australia ('VHA'), in which Vodafone owns a 50% stake, continued its good recovery, returning to local currency service revenue growth in Q4 as a result of improving trends in both customer numbers and ARPU, supported by significant network... -

Page 49

... Total dividends for the year increased by 2.0 % to 11.22 pence per share. At 31 March 2015, Vodafone Group Plc had profits available for distribution of approximately £20 billion. Further disclosures in relation to profits available for distribution are set out on page 184. EBITDA Working capital... -

Page 50

..."Non-GAAP information" for further details. Vodafone Group Plc Annual Report 2015 This year's report contains a strategic report on pages 1 to 48, which includes an analysis of our performance and position, a review of the business during the year, and outlines the principal risks and uncertainties... -

Page 51

... and training Board diversity Shareholder engagement Board committees Compliance with the 2012 UK Corporate Governance Code Our US listing requirements Directors' remuneration Directors' report Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2015 49 -

Page 52

... Good corporate governance provides the foundation for long-term value creation and is therefore a core focus for your Board. Dear shareholder The Board's primary role is to exercise objective and informed judgement in determining the strategy of the Group, having the best team in place to execute... -

Page 53

... responsible for the long-term success of the Company; a sets the Group strategy; a appoints senior management; a is responsible for ensuring the effectiveness of and reporting on our system of corporate governance; and a is accountable to shareholders for the proper conduct of the business. More on... -

Page 54

... to use this experience to oversee the development of Vodafone's strategy and the effectiveness of its operations as a total communications company. Other current appointments: a Royal Dutch Shell - non-executive director and member of the audit committee a IBEX Global Solutions plc - non-executive... -

Page 55

...of the Vodafone Group, makes him a valued member of the Board. Philip's financial expertise is an asset to his role as member of the Audit and Risk Committee. Other current appointments: a Aberdeen Asian Smaller Companies Investment Trust PLC - non-executive director a Rocket Internet SE - member of... -

Page 56

..., programme execution, financial and competitive performance, succession planning, organisational development and Group-wide policies. The Executive Committee includes the Executive Directors, details of whom are shown on page 52, and the senior managers who are listed below. From left to right... -

Page 57

... Company (1986-1992) Performance Governance Financials Nick Jeffery Group Enterprise Director Tenure: 2 years Nationality: British Career history: a Cable & Wireless Worldwide - chief executive (2012-2013) a Vodafone Global Enterprise - chief executive (2006-2012) a Vodafone Group Plc - marketing... -

Page 58

... stations to KDG fibre backhaul, migrated broadband customers from Vodafone's broadband onto KDG's cable infrastructure, and launched our bundled fixed and mobile bundle product. More on KDG integration: Page 39 Vodafone Group Plc Annual Report 2015 Project Spring We have made strong progress on... -

Page 59

... treasury policy and dealing mandate; a renewal of the Group's insurance arrangements; a assessment of risks and internal controls; a reports on compliance and litigation; a reports on health & safety and EMF; People The Board reviewed the Company's people management, including succession planning... -

Page 60

... increase its focus on customers' experience and it should continue to monitor management's success in delivering operational strategic objectives. The Board will continue to review its procedures, its effectiveness and development in the financial year ahead. 58 Vodafone Group Plc Annual Report... -

Page 61

... opportunities for training and development. The Board is confident that all its members have the knowledge, ability and experience to perform the functions required of a director of a listed company. Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2015 59 -

Page 62

..., we focused on improving our employees' cultural awareness. We launched the Vodafone Cultural Navigator, an online tool to help employees understand different cultural preferences so they can work successfully with colleagues and customers around the world 60 Vodafone Group Plc Annual Report 2015 -

Page 63

... 24% Sector experience of Board Media 77% Gender of total employees Financials 8% Female Additional information 16% Finance 36% 50% 25% Consumer goods Male 64% Setting the standard in maternity benefits for women globally In 2015, we launched a global maternity policy that sets a worldwide... -

Page 64

..., capital expenditure, debt and dividend cover; a fixed broadband and TV strategy; a performance outlook; a Project Spring strategy; a regulation in Europe and emerging markets; a shareholder returns; a spectrum renewal costs; and a the Verizon Wireless transaction. Our investor calendar Set out... -

Page 65

...Group's system of internal control including the work of the internal audit function; a Group's system of risk management; and a Group's system of compliance activities. Following the publication of the revised UK Corporate Governance Code, which will be adopted in the 2016 financial year, the Board... -

Page 66

... the Annual Report, taken as a whole, is fair, balanced and understandable and provides the information necessary for shareholders to assess the Company's performance, business model and strategy. Accounting policies and practices The Committee received reporting from management in relation to... -

Page 67

... of acquired tangible and intangible assets. See note 28 "Acquisitions and disposals" for further details. IT controls in relation to privileged user access The Group's IT infrastructure platform hosts a number of financial reporting related applications. In the 2014 financial year, an issue was... -

Page 68

... in relation to the recognition of deferred tax assets which is reflected in this Annual Report. Whether the Annual Report, taken as a whole, is fair, balanced and understandable and provides the information necessary for shareholders to assess the Company's performance, business model and strategy... -

Page 69

...Audit Director's annual objectives and I meet with him regularly in the year to be briefed on his team's activity and the nature of any significant issues arising from their work. Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2015... -

Page 70

...IT controls including customer and noncustomer related data security; a the control environments in Vodafone Italy, Vodafone Australia and Vodafone UK, with the latter focusing on the integration of the recently acquired Cable and Wireless business and a major new billing system project; a risks and... -

Page 71

... of each of the Non-Executive Directors; and a is responsible for the oversight of all matters relating to corporate governance, bringing any issues to the attention of the Board. Governance Financials Additional information Vodafone Group Plc Annual Report 2015 Attendance at scheduled meetings... -

Page 72

... of good governance practices. Remuneration Committee "Our remuneration policy and executive pay packages are designed to be competitive and drive behaviour in order to achieve long-term strategic goals. When making decisions we are mindful of the wider economic conditions and shareholder feedback... -

Page 73

... for example, the Group Financial Controller, the Group Audit Director and the Group Risk and Compliance Director; and a competitor performance analysis. Annually, the Executive Committee, together with the chief executives of the major operating companies, conducts a strategy review to identify key... -

Page 74

... in the 2016 financial year and we intend to be in compliance. We describe how we have applied the main principles of the 2012 Code in this table, cross referring to other parts of this Annual Report for further information on internal control and risk management and Directors' remuneration. This... -

Page 75

... the strategy proposed by the Executive Directors, scrutinising and challenging performance across the Group's business, assessing the risk and integrity of the financial information and controls and determining the Company's policy for executive remuneration and the remuneration packages for... -

Page 76

...the Listing Rules, whether shareholder approval is required for a transaction depends on, among other things, whether the size of a transaction exceeds a certain percentage of the size of the listed company undertaking the transaction. Vodafone Group Plc Annual Report 2015 Committees Related party... -

Page 77

...policy The remuneration policy table Chairman and Non-Executive Directors' remuneration Annual Report on remuneration Remuneration Committee 2015 remuneration 2016 remuneration Further remuneration information Page 77 Page 78 Page 82 Page 83 Page 83 Page 84 Page 90 Page 91 Vodafone Group Plc Annual... -

Page 78

...as follows: a we offer competitive and fair rates of pay and benefits to attract and retain the best people; a our policy and practices aim to drive behaviours that support our Company strategy and business objectives; a our "pay for performance" approach means that our incentive plans only deliver... -

Page 79

... of maximum long-term incentive vesting levels and pension provision); and a impact of Project Spring on Free Cash Flow performance under the global long-term incentive plan ('GLTI'). We have not consulted with employees on the executive remuneration policy nor is any fixed remuneration comparison... -

Page 80

... line with the benefits offered to other employees for example, all-employee share plans, mobile phone discounts, maternity/paternity benefits, sick leave, paid holiday, etc. Benefits a To aid retention and remain competitive within the marketplace. Annual Bonus - Global ShortTerm Incentive Plan... -

Page 81

... (but are not limited to) internal promotions, changes to role, material changes to the business and exceptional company performance. None. Strategy review Performance a The pension contribution or cash payment is equal to 30% of annual gross salary. In light of pension levels elsewhere in the... -

Page 82

.... Vodafone Group Plc Annual Report 2015 Remuneration policy for other employees While our remuneration policy follows the same fundamental principles across the Group, packages offered to employees reflect differences in market practice in the different countries, role and seniority. For example... -

Page 83

...Fixed Consists of base salary, benefits and pension. Base salary is at 1 July 2014. Benefits are valued using the figures in the total remuneration for the 2014 financial year table on page 78 (of the 2014 report) and on a similar basis for Nick Read (promoted to the Board on 1 April 2014). Pensions... -

Page 84

... expenses in relation to attending Board meetings should be treated as a taxable benefit therefore we also cover the tax liability for these expenses. Allowances Incentives Benefits Vodafone Group Plc Annual Report 2015 82 Non-Executive Director service contracts Non-Executive Directors are... -

Page 85

...-Executive Director fee levels a Chairman's fees May 2014 a 2014 Directors' remuneration report a Large local market CEO remuneration a Corporate governance matters a 2015 Directors' remuneration report a Committee's effectiveness and terms of reference a Risk assessment Vodafone Group Plc Annual... -

Page 86

Directors' remuneration (continued) Annual Report on remuneration (continued) 2015 remuneration In this section we summarise the pay packages awarded to our Executive Directors for performance in the 2015 financial year versus 2014. Specifically we have provided a table that shows all remuneration ... -

Page 87

...358,321 £1,581,248 £3,402,484 1/5th 31 Mar 2017 1/5th 31 Mar 2017 1/5th 31 Mar 2017 Vodafone Group Plc Annual Report 2015 Note: 1 Face value calculated based on the share prices at the date of grant of 189.8 pence. Dividend equivalents on the shares that vest are paid in cash after the vesting... -

Page 88

...' remuneration (continued) Annual Report on remuneration (continued) All-employee share plans The Executive Directors are also eligible to participate in the UK all-employee plans. Summary of plans Sharesave The Vodafone Group 2008 Sharesave Plan is an HM Revenue & Customs ('HMRC') approved scheme... -

Page 89

.... Performance shares The maximum number of outstanding shares that have been awarded to Directors under the long-term incentive ('GLTI') plan are currently as follows: 2013 award Awarded: July 2012 Performance period ending: March 2015 Vesting date: July 2015 Share price at grant: 179.4 pence 2014... -

Page 90

... Chief Executive (Vittorio Colao) 279 190 155 137 170 168 167 193 227 03/10 03/11 03/12 03/13 03/14 03/15 STOXX Europe 600 Index 20101 2011 2012 2013 2014 2015 Single figure of total remuneration £'000 Annual variable element (actual award versus maximum opportunity) Long-term incentive... -

Page 91

...the total cost of remuneration in the Group. Relative importance of spend on pay 50,000 40,566 40,000 Overview £m Strategy review 30,000 20,000 10,000 0 2,930 2014 2015 Distributed by way of dividends 3,875 4,194 2014 2015 Overall expenditure on remuneration for all employees Performance For... -

Page 92

... performance condition for the GLTI and we expect an initial drop in FCF that will then build again as the investment pays off over the longer term. The impact is predicted as follows: Financial year of award Performance period end Impact 90 Vodafone Group Plc Annual Report 2015 2014 March 2016... -

Page 93

... if their appointments are terminated. This report on remuneration has been approved by the Board of Directors and signed on its behalf by: Governance Financials Luc Vandevelde Chairman of the Remuneration Committee 19 May 2015 Additional information Vodafone Group Plc Annual Report 2015 91 -

Page 94

... disclosures Our disclosures relating to the employment of disabled persons, the number of women in senior management roles, employee engagement and policies are included in "Our people" on pages 28 and 29. By Order of the Board 92 Vodafone Group Plc Annual Report 2015 Directors' conflicts of... -

Page 95

... information: 175 Prior year operating results 180 Company balance sheet of Vodafone Group Plc 181 Notes to the Company financial statements: 181 1. Basis of preparation 182 2. Fixed assets 182 3. Debtors 183 4. Other investments 183 5. Creditors 183 6. Share capital 184 7. Share-based payments... -

Page 96

..., financial position and profit of the Company; and a the strategic report includes a fair review of the development and performance of the business and the position of the Group together with a description of the principal risks and uncertainties that it faces. 94 Vodafone Group Plc Annual Report... -

Page 97

... the Group's consolidated financial statements. Their audit report on internal control over financial reporting is on page 96. By Order of the Board Overview Strategy review Performance Governance Financials Additional information Management's report on internal control over financial reporting As... -

Page 98

... from our audit of internal control over financial reporting. As of 31 March 2015, the Company owned 100% of Ono's outstanding shares; Ono's total segment assets and total revenues represent 4.5% and 1.6%, respectively, of the related consolidated total assets and consolidated revenues as of and for... -

Page 99

... the requirements of the Companies Act 2006 and, as regards the Group financial statements, Article 4 of the IAS Regulation. Performance Overview Strategy review Separate opinion in relation to IFRSs as issued by the IASB As explained in note 1 to the financial statements, the Group, in addition to... -

Page 100

... address these specific areas in order to provide an opinion on the financial statements as a whole, and any comments we make on the results of our procedures should be read in this context. This is not a complete list of all risks identified by our audit. 98 Vodafone Group Plc Annual Report 2015 -

Page 101

... margin trends, capital expenditure on network assets and of recoverable amount, being the higher of fair value spectrum, market share and customer churn, foreign exchange rates and discount less costs to sell and value-in-use, requires judgement rates, against external data where available, using... -

Page 102

... relate to the purchase intangible assets. price allocation to the assets and liabilities acquired and fair value and accounting policy adjustments. Based on our procedures, we noted no significant issues and are satisfied with the Refer to the Audit and Risk Committee Report, note 1 associated... -

Page 103

... Financials Additional information a tested user access rights in relation to the Group's common finance ledger application ERP solution and at the infrastructure level. a Controls over user access - a detailed review of access rights to the Group's common ERP system was conducted by management... -

Page 104

..., taking into account the geographic structure of the Group, the accounting processes and controls including those performed at the Group's shared service centres, and the industry in which the Group operates. Our planning procedures included a review of the predecessor auditor's working papers at... -

Page 105

...Overview Strategy review a the information given in the Corporate Governance Statement set out on pages 72 to 73 with respect to internal control and risk management system and about share capital structures is consistent with the financial statements. ISAs (UK and Ireland) reporting Under ISAs (UK... -

Page 106

... Group Plc Annual Report 2015 Notes: 1 The maintenance and integrity of the Vodafone Group Plc website is the responsibility of the Directors; the work carried out by the auditors does not involve consideration of these matters and, accordingly, the auditors accept no responsibility for any changes... -

Page 107

... value gains transferred to the income statement Other, net of tax Total items that may be reclassified to profit or loss in subsequent years Items that will not be reclassified to profit or loss in subsequent years: Net actuarial (losses)/gains on defined benefit pension schemes, net of tax Total... -

Page 108

... and joint ventures Other investments Deferred tax assets Post employment benefits Trade and other receivables Current assets Inventory Taxation recoverable Trade and other receivables Other investments Cash and cash equivalents Assets held for sale Total assets Equity Called up share capital... -

Page 109

... net gain (2014: £171 million net loss) recycled to the income statement. 7 Amount for 2013 includes a commitment for the purchase of own shares of £1,026 million. 8 Includes £7 million tax credit (2014: £12 million charge; 2013: £18 million credit). Vodafone Group Plc Annual Report 2015... -

Page 110

... from associates and joint ventures Dividends received from investments Interest received Net cash flow from investing activities Cash flows from financing activities Issue of ordinary share capital and reissue of treasury shares Net movement in short-term borrowings Proceeds from issue of long-term... -

Page 111

... recognition of deferred tax assets in respect of losses in Luxembourg, Germany, Spain, India and Turkey and capital allowances in the United Kingdom. Vodafone Group Plc Annual Report 2015 Additional information The recognition of deferred tax assets, particularly in respect of tax losses, is based... -

Page 112

... on the consolidated financial statements. The Group's share of assets, liabilities, revenue, expenses and cash flows of joint operations are included in the consolidated financial statements on a line-by-line basis, whereas the Group's investment and share of results of joint ventures are shown... -

Page 113

... of future capital expenditure; Overview Strategy review Performance Governance a long-term growth rates; and a appropriate discount rates to reflect the risks involved. Management prepares formal five year forecasts for the Group's operations, which are used to estimate their value in use. In... -

Page 114

... fair value gain or loss and are included in equity. For the purpose of presenting consolidated financial statements, the assets and liabilities of entities with a functional currency other than sterling are expressed in sterling using exchange rates prevailing at the reporting period date. Income... -

Page 115

... activities. The Group will not consider early adoption of IFRS 9 until the standard has been endorsed by the EU which is currently expected in the second half of 2015. Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2015 113 -

Page 116

... goods or services. This restriction typically applies to revenue recognised for devices provided to customers, including handsets. Commissions Intermediaries are given cash incentives by the Group to connect new customers and upgrade existing customers. Vodafone Group Plc Annual Report 2015... -

Page 117

... comprise our US group whose principal asset was a 45% interest in Verizon Wireless, which was sold on 21 February 2014. Refer to note 7 "Discontinued operations" to the consolidated financial statements for further details. Total revenue recorded in respect of the sale of goods for the year... -

Page 118

...analysis (continued) 2015 £m 2014 £m 2013 £m EBITDA Depreciation, amortisation and loss on disposal of fixed assets Share of results in associates and joint ventures Adjusted operating profit Impairment loss Restructuring costs Amortisation of acquired customer based and brand intangible... -

Page 119

...through to completion and are included in the table above. A description of the work performed by the Audit and Risk Committee in order to safeguard auditor independence when non-audit services are provided is set out in "Corporate governance" on page 67. Vodafone Group Plc Annual Report 2015 117 -

Page 120

... indicative of the long-term future performance as operations may not have reached maturity. For these operations, the Group may extend the plan data for an additional five year period. Property, plant and equipment and finite lived intangible assets At each reporting period date, the Group reviews... -

Page 121

... 2015, no impairment charges were recorded in respect of the Group's goodwill balances. The table below shows key assumptions used in the value in use calculations. Assumptions used in value in use calculation Germany % Italy % Spain % Pre-tax risk adjusted discount rate Long-term growth rate... -

Page 122

... trading and economic conditions. The table below shows key assumptions used in the value in use calculations. Assumptions used in value in use calculation Germany % Italy % Spain % Portugal % Czech Republic % Romania % Greece % Pre-tax risk adjusted discount rate Long-term growth rate... -

Page 123

... plans, resulting from our reassessment of expected future business performance in light of current trading and economic conditions and adverse movements in discount rates driven by the credit rating and yields on ten year government bonds. The table below shows key assumptions used in the value... -

Page 124

... five years for all cash-generating units of the plans used for impairment testing. 2 Budgeted capital expenditure is expressed as a percentage of revenue in the initial five years for all cash-generating units of the plans used for impairment testing. 122 Vodafone Group Plc Annual Report 2015 -

Page 125

... used to manage foreign exchange and interest rate movements. 2015 £m 2014 £m 2013 £m Overview Strategy review Investment income: Available-for-sale investments: Dividends received Loans and receivables at amortised cost Fair value through the income statement (held for trading... -

Page 126

... UK operating profits are more than offset by statutory allowances for capital investment in the UK network and systems plus ongoing interest costs including those arising from the £6.8 billion of spectrum payments to the UK government in 2000 and 2013. Vodafone Group Plc Annual Report 2015 124 -

Page 127

... information Notes: 1 See commentary regarding deferred tax asset recognition on page 127. 2 Includes the US tax charge of £2,210 million on the rationalisation and reorganisation of non-US assets prior to the disposal of our interest in Verizon Wireless. Vodafone Group Plc Annual Report 2015... -

Page 128

... of open issues, future planning, corporate acquisitions and disposals, the use of brought forward tax losses and changes in tax legislation and tax rates. The Group is routinely subject to audit by tax authorities in the territories in which it operates and, specifically, in India these are... -

Page 129

.... Vodafone Group Plc Annual Report 2015 We have losses amounting to £6,735 million (2014: £6,651 million) in respect of UK subsidiaries which are only available for offset against future capital gains and since it is uncertain whether these losses will be utilised, no deferred tax asset has... -

Page 130

...below. Income statement and segment analysis of discontinued operations 2015 £m 2014 £m 2013 £m Share of result in associates Net financing income/(costs) Profit before taxation Taxation relating to performance of discontinued operations Post-tax profit from discontinued operations Gain on... -

Page 131

...,833,492 ordinary shares held in Treasury) as at the close of business on 18 February 2014 to 28,811,864,298 new ordinary shares in issue immediately after the share consolidation on 24 February 2014. Governance 9. Equity dividends Dividends are one type of shareholder return, historically paid to... -

Page 132

...use, on a straight-line basis, with the exception of customer relationships which are amortised on a sum of digits basis. The amortisation basis adopted for each class of intangible asset reflects the Group's consumption of the economic benefit from that asset. 130 Vodafone Group Plc Annual Report... -

Page 133

... other intangible assets, amortisation is included within the cost of sales line within the consolidated income statement. Licences and spectrum with a net book value of £2,059 million (2014: £3,885 million) have been pledged as security against borrowings. The net book value and expiry dates of... -

Page 134

...the relevant lease. The gain or loss arising on the disposal or retirement of an item of property, plant and equipment is determined as the difference between any sale proceeds and the carrying amount of the asset and is recognised in the income statement. 132 Vodafone Group Plc Annual Report 2015 -

Page 135

... 22,851 26,603 Strategy review Performance Governance Financials Additional information The net book value of land and buildings and equipment, fixtures and fittings includes £24 million and £468 million respectively (2014: £48 million and £413 million) in relation to assets held under finance... -

Page 136

... in joint ventures are carried in the consolidated statement of financial position at cost as adjusted for post-acquisition changes in the Group's share of the net assets of the joint venture, less any impairment in the value of the investment. The Group's share of post-tax profits or losses are... -

Page 137

... and associates 2015 £m 2014 £m Overview Investment in joint ventures Investment in associates 31 March (331) 328 (3) (158) 272 114 Strategy review Joint ventures The financial and operating activities of the Group's joint ventures are jointly controlled by the participating shareholders... -

Page 138

...31 March 2015 the fair value of Safaricom Limited was KES 273 billion (£1,989 million) based on the closing quoted share price on the Nairobi Stock Exchange. On 21 February 2014, the Group disposed of its 45% interest in Cellco Partnership which traded under the name Verizon Wireless. Results from... -

Page 139

... net profit or loss for the period. Other investments classified as loans and receivables are stated at amortised cost using the effective interest method, less any impairment. 2015 £m 2014 £m Overview Strategy review Performance Included within non-current assets: Equity securities: Listed... -

Page 140

... their present location and condition. 2015 £m 2014 £m Goods held for resale Inventory is reported net of allowances for obsolescence, an analysis of which is as follows: 2015 £m 482 441 2014 £m 2013 £m 1 April Exchange movements Amounts credited/(debited) to the income statement... -

Page 141

... written off when management deems them not to be collectible. 2015 £m 2014 £m Overview Strategy review Included within non-current assets: Trade receivables Amounts owed by associates and joint ventures Other receivables Prepayments and accrued income1 Derivative financial instruments Included... -

Page 142

... also include taxes and social security amounts due in relation to our role as an employer. Derivative financial instruments with a negative market value are reported within this note. Accounting policies Trade payables are not interest bearing and are stated at their nominal value. 2015 £m 2014... -

Page 143

... settle the obligation at the reporting date and are discounted to present value where the effect is material. Asset retirement obligations In the course of the Group's activities, a number of sites and other assets are utilised which are expected to have costs associated with de-commissioning. The... -

Page 144

...) Limited ('LDC'). On 8 May 2015, we repurchased and then subsequently cancelled all deferred shares. Allotted during the year Number Nominal value £m Net proceeds £m UK share awards US share awards Total share awards 863,970 - 863,970 - - - 2 - 2 142 Vodafone Group Plc Annual Report... -

Page 145

... insignificant risk of changes in value. 2015 £m 2014 £m Additional information Cash at bank and in hand Money market funds Repurchase agreements Commercial paper Short-term securitised investments Cash and cash equivalents as presented in the statement of financial position Bank overdrafts... -

Page 146

...-term and long-term issuances in the capital markets including bond and commercial paper issues and bank loans. We manage the basis on which we incur interest on debt between fixed interest rates and floating interest rates depending on market conditions using interest rate derivatives. The Group... -

Page 147

... value hierarchy using quoted market prices or discounted cash flows with a discount rate based upon forward interest rates available to the Group at the reporting date. Further information can be found in note 23 "Capital and financial risk management". Vodafone Group Plc Annual Report 2015 145 -

Page 148

... a gross basis. The net effect of discount/financing rates is £192 million (2014: £7 million), leaving a £1,248 million (2014: £326 million) net receivable in relation to foreign exchange financial instruments. This is split £291 million (2014: £246 million) within trade and other payables and... -

Page 149

... indicate an increase in fixed interest debt and figures shown in brackets indicate a reduction in fixed interest debt. 2 Figures shown as "in more than five years" relate to the periods from March 2020 to December 2043 (2014: March 2019 to December 2043). Vodafone Group Plc Annual Report 2015... -

Page 150

... Bonds Commercial paper1 Put options over non-controlling interests2 Bank loans Other short-term borrowings3 Long-term borrowings Put options over non-controlling interests Bonds, loans and other long-term borrowings Other financial instruments4 Net debt Vodafone Group Plc Annual Report 2015 6,882... -

Page 151

... which are held in accordance with the counterparty and settlement risk limits of the Board approved treasury policy. The main forms of liquid investment at 31 March 2015 were managed investment funds, money market funds, UK index linked government bonds, tri-party repurchase agreements and bank... -

Page 152

...associates and to non-controlling shareholders Dividends from our associates are generally paid at the discretion of the Board of Directors or shareholders of the individual operating and holding companies, and we have no rights to receive dividends except where specified within certain of the Group... -

Page 153

... in the income statement. If a forecast transaction is no longer expected to occur, the gain or loss accumulated in equity is recognised immediately in the income statement. Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2015 151 -

Page 154

... risk committee comprising the Group's Chief Financial Officer, Group General Counsel and Company Secretary, Group Financial Controller, Group Treasury Director and Director of Financial Reporting meets three times a year to review treasury activities and its members receive management information... -

Page 155

.... The Group has two managed investment funds. These funds hold fixed income sterling securities and the average credit quality is high double A. Money market investments are in accordance with established internal treasury policies which dictate that an investment's long-term credit rating is no... -

Page 156

... by £65 million (FY14: US$190 million) and £186 million (FY14: £189 million) for US dollar and euro respectively. Equity risk There is no material equity risk relating to the Group's equity investments which are detailed in note 13 "Other investments". 154 Vodafone Group Plc Annual Report 2015 -

Page 157

... instrument fair values are present values determined from future cash flows discounted at rates derived from market sourced data. 4 Listed and unlisted securities are classified as held for sale financial assets and fair values are derived from observable quoted market prices for similar items... -

Page 158

...management compensation Aggregate compensation for key management, being the Directors and members of the Executive Committee, was as follows: 2015 £m 2014 £m 2013 £m Short-term employee benefits Share-based payments 18 18 36 17 21 38 17 23 40 156 Vodafone Group Plc Annual Report 2015 -

Page 159

...592 Performance Governance Financials 2015 £m 2014 £m 2013 £m Wages and salaries Social security costs Other pension costs (note 26) Share-based payments (note 27) 3,469 442 195 88 4,194 3,261 364 158 92 3,875 2,989 350 157 124 3,620 Additional information Vodafone Group Plc Annual... -

Page 160

..., New Zealand, Portugal, South Africa, Spain and the UK. Income statement expense 2015 £m 2014 £m 2013 £m Defined contribution schemes Defined benefit schemes Total amount charged to income statement (note 25) 155 40 195 124 34 158 118 39 157 158 Vodafone Group Plc Annual Report 2015 -

Page 161

...'s defined benefit pension schemes during the year ending 31 March 2016. The Group has also provided certain guarantees in respect of the Vodafone UK plan; further details are provided in note 30 "Contingent liabilities" to the consolidated financial statements. Overview Strategy review Performance... -

Page 162

... contributions Member cash contributions Benefits paid Liabilities assumed in business combinations Exchange rate movements Other movements 31 March 2014 Service cost Interest income/(cost) Return on plan assets excluding interest income Actuarial losses arising from changes in financial assumptions... -

Page 163

... of the Vodafone UK plan, a substantial insured pensioner buy-in policy. The actual return on plan assets over the year to 31 March 2015 was £897 million (2014: £48 million). Sensitivity analysis Measurement of the Group's defined benefit retirement obligation is sensitive to changes in certain... -

Page 164

... Group executive plans No share options have been granted to any Directors or employees under the Company's discretionary share option plans in the year ended 31 March 2015. There are options outstanding under the Vodafone Group 1999 Long-Term Stock Incentive Plan and the Vodafone Global Incentive... -

Page 165

... Months Governance Outstanding shares Millions Weighted average exercise price Exercisable shares Millions Weighted average exercise price Vodafone Group savings related and Sharesave Plan: £0.01-£1.00 £1.01-£2.00 Vodafone Group 1999 Long-Term Stock Incentive Plan: £1.01... -

Page 166

... services. The results of the acquired entity have been consolidated in the Group's income statement from 23 July 2014 and contributed £691 million of revenue and a loss of £313 million to the profit attributable to owners of the parent during the year. The acquisition date fair values... -

Page 167

... Trade and other payables Provisions Post employment benefits Net identifiable assets acquired Non-controlling interests2 Goodwill3 Total consideration4 1,641 4,381 8 34 154 619 (1,423) (2,784) (1,190) (63) (62) 1,315 (308) 3,848 4,855 Additional information Vodafone Group Plc Annual Report 2015... -

Page 168

...) the value attributable to access future customers. Disposals Verizon Wireless ('VZW') On 21 February 2014, the Group sold its US sub-group which included its entire 45% shareholding in VZW to Verizon Communications Inc. for a total consideration of £76.7 billion before tax and transaction costs... -

Page 169

... intangible assets. Capital commitments includes £2,682 million in relation to spectrum acquired in 12 telecom circles in India. This included spectrum in all six of our 900MHz circles due for extension in December 2015. We also acquired new 3G spectrum in seven circles. Vodafone Group Plc Annual... -

Page 170

... venture, Vodafone Hutchison Australia Pty Limited. UK pension schemes At the start of the year, the Group had two main UK defined benefit schemes being the Vodafone UK Group Pension Scheme ('Vodafone UK plan') and the Cable & Wireless Worldwide Retirement Plan ('CWWRP'). On 6 June 2014, all assets... -

Page 171

... reporting dates. Other Indian tax cases VIL and Vodafone India Services Private Limited ('VISPL') (formerly 3GSPL) are involved in a number of tax cases with total claims exceeding £1.5 billion plus interest, and penalties of up to 300% of the principal. Overview Strategy review Performance... -

Page 172

... Director of Vodafone Greece. The balance of the claim (approximately â,¬285.5 million) is sought from Vodafone Greece and Vodafone Group Plc on a joint and several basis. The cases are scheduled to come to trial in November 2015 and April 2016. Tanzania Cats-Net Limited v Vodacom Tanzania Limited... -

Page 173

... and the non-controlling shareholder's share of changes in equity since the date of the combination. Total comprehensive income is attributed to non-controlling interests even if this results in the non-controlling interests having a deficit balance. Vodafone Group Plc Annual Report 2015 171 -

Page 174

... indirectly held by Vodafone Group Plc. 12 Vodafone Sales & Services Limited is directly held by Vodafone Group Plc. 13 Cobra Automotive Technologies S.P.A. was acquired on 14 August 2014. On 1 April 2015, it changed its name to Vodafone Automotive S.P.A. 172 Vodafone Group Plc Annual Report 2015 -

Page 175

... have non-controlling interests that are material to the Group. Vodacom Group Limited 2015 £m 2014 £m Vodafone Egypt Telecommunications S.A.E. 2015 £m 2014 £m Vodafone Qatar Q.S.C. 2015 £m 2014 £m Overview Summary comprehensive income information Revenue Profit/(loss) for the financial year... -

Page 176

... set out within section 479A of the Companies Act 2006 for the year ended 31 March 2015. Name Registration number Cable & Wireless Worldwide plc Cable & Wireless UK Holdings Limited Cable & Wireless Waterside Holdings Limited The Eastern Leasing Company Limited Vodafone 2 Vodafone 4 UK Vodafone... -

Page 177

... 2014 £m 2013 £m % change £ Organic Overview Strategy review Performance Revenue 24,222 13,473 Service revenue 22,592 12,130 Other revenue 1,630 1,343 EBITDA 6,821 4,145 Adjusted operating profit 2,333 1,947 Adjustments for: Impairment loss Restructuring costs Amortisation of acquired customer... -

Page 178

... traditionally high ARPU. In a more competitive environment we launched both a more aggressive 3G price plan ("Smart") and pushed otelo in the entry-level contract segment. Mobile in-bundle revenue increased 2.7%* as a result of growth in integrated Vodafone Red offers, which was more than offset by... -

Page 179

... market. EBITDA declined 14.0%*, with a 2.1* percentage point reduction in the EBITDA margin, driven by lower service revenue, partly offset by operating cost efficiencies. Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2015... -

Page 180

... exchange rate movements. On an organic basis, EBITDA grew 11.2%*, driven primarily by strong growth in India, Turkey, Qatar and Ghana as well as improved contributions from Egypt and Vodacom. Organic change* % Foreign exchange pps Reported change % Revenue - AMAP Service revenue India Vodacom... -

Page 181

... cost discipline. Our associate in Kenya, Safaricom, increased local currency service revenue by 17.2% driven by a higher customer base and continued growth in M-Pesa. Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2015 179 -

Page 182

...were approved by the Board of Directors and authorised for issue on 19 May 2015 and were signed on its behalf by: Vittorio Colao Chief Executive Nick Read Chief Financial Officer The accompanying notes are an integral part of these financial statements. 180 Vodafone Group Plc Annual Report 2015 -

Page 183

... in the Vodafone Group Plc consolidated financial statements for the year ended 31 March 2015. Governance Overview Strategy review Performance Significant accounting policies applied in the current reporting period that relate to the financial statements as a whole Accounting convention The Company... -

Page 184

... 31 March 2015 and 31 March 2014. 2. Fixed assets Accounting policies Shares in Group undertakings are stated at cost less any provision for impairment. The Company assesses investments for impairment whenever events or changes in circumstances indicate that the carrying value of an investment may... -

Page 185

... in the net profit or loss for the period. 2015 £m 2014 £m Overview Investments1 Note: 1 Investments includes collateral paid on derivative financial instruments of £37 million (2014: £130 million). 37 130 Strategy review 5. Creditors Accounting policies Capital market and bank... -

Page 186

... £m Own shares held2 £m Profit and loss account3 £m Total equity shareholders' funds £m 1 April 2014 Allotment of shares Loss for the financial year Dividends Capital contribution given relating to share-based payments Contribution received relating to share-based payments Other... -

Page 187

... of its joint venture, Vodafone Hutchison Australia Pty Limited. The Company will guarantee the debts and liabilities of certain of its UK subsidiaries at the balance sheet date in accordance with section 479C of the Companies Act 2006. The Company has assessed the probability of loss under these... -

Page 188

...mandate bank instructions and review dividend payment history; a update member details and address changes; and a register to receive Company communications electronically. Computershare also offers an internet and telephone share dealing service to existing shareholders. The service can be obtained... -

Page 189

... middle market quotations of ordinary shares on the London Stock Exchange, and (ii) the reported high and low sales prices of ADSs on NASDAQ. Additional information London Stock Exchange Pounds per ordinary share Year ended 31 March High Low High NASDAQ Dollars per ADS Low 2011 2012 2013 2014 2015... -

Page 190

... share capital of the Company. The Company is not directly or indirectly owned or controlled by any foreign government or any other legal entity. There are no arrangements known to the Company that could result in a change of control of the Company. 188 Vodafone Group Plc Annual Report 2015 -

Page 191

...pages 75 to 91). The report is also subject to a shareholder vote. Overview Strategy review Performance Governance Financials Rights attaching to the Company's shares At 31 March 2015 the issued share capital of the Company was comprised of 50,000 7% cumulative fixed rate shares of £1.00 each, 26... -

Page 192

... the Company may give notices to shareholders by publication on the Company's website and advertisement in newspapers in the UK. Holders of the Company's ADSs are entitled to receive notices under the terms of the deposit agreement relating to the ADSs. 190 Vodafone Group Plc Annual Report 2015 -

Page 193

...for members of certain classes of holders subject to special rules including, for example, US expatriates and former long-term residents of the US and officers of the Company; employees and holders that, directly, indirectly or by attribution, hold 5% or more of the Company's voting stock; financial... -

Page 194

... amount of any dividend we pay out of our current or accumulated earnings and profits (as determined for US federal income tax purposes). Dividends paid to a non-corporate US holder will be taxable to the holder at the reduced rate normally applicable to long-term capital gains provided that certain... -

Page 195

... rules and any other reporting obligations that may apply to the ownership or disposition of shares or ADSs, including requirements related to the holding of certain foreign financial assets. Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual... -

Page 196

History and development Unaudited information The Company was incorporated under English law in 1984 as Racal Strategic Radio Limited (registered number 1833679). After various name changes, 20% of Racal Telecom Plc share capital was offered to the public in October 1988. The Company was fully ... -

Page 197

...infrastructure of telecoms operators. It has to be transposed in each member state no later than 1 July 2016. This regulation applies to all owners of infrastructure whether they are dominant or not. Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2015 195 -

Page 198

... ensuring interference free use of the E-GSM 900MHz band at the border. Although the agreement entered into force on 1 January 2014, there is still E-GSM spectrum interference on Vodafone Romania's network, especially on the south-east side of the country. 196 Vodafone Group Plc Annual Report 2015 -

Page 199

... litigation in India, see note 30 "Contingent liabilities" to the consolidated financial statements. Vodafone Group Plc Annual Report 2015 Financials Additional information Vodacom: South Africa In October 2013, the Ministry of Trade and Industry published revised generic Codes of Good Practice on... -

Page 200

...market dominance in contravention of Section 8 of the Competition Act. In May 2014, Vodacom entered into a sale agreement in terms of which it would acquire 100% of the issued share capital and shareholders loan and claims against Neotel. The transaction remains subject to the fulfilment of a number... -

Page 201

...includes requesting reference offers for passive infrastructure from Ooredoo and QNBN. Vodafone and Ooredoo are also required to prepare reference offers for interconnection. Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2015 199 -

Page 202

... the consolidated financial statements. 11 Vodacom's South African spectrum licences are renewed annually. As part of the migration to a new licensing regime the national regulator has issued Vodacom a service licence and a network licence which will permit Vodacom to offer mobile and fixed services... -

Page 203

...of financial year values. 2 MTRs established from 1 April 2015 are included where a glide path or a final decision has been determined by the regulatory authority. 3 The MTR is under appeal. 4 Please see Vodacom: South Africa on page 197. Additional information Vodafone Group Plc Annual Report 2015... -

Page 204

... exchange rate differences, together with related tax effects. We believe that it is both useful and necessary to report these measures for the following reasons: a these measures are used for internal performance reporting; a these measures are used in setting director and management remuneration... -

Page 205

... growth to reported growth is shown where used, or in the table below: Period Organic change % Other activity1 pps Foreign exchange pps Reported change % Financials Additional information 31 March 2015 Group Revenue Service revenue Fixed line revenue Vodafone Global Enterprise service revenue... -

Page 206

... margin Vodacom - service revenue India - service revenue 31 March 2014 Group Revenue Service revenue EBITDA Percentage point change in EBITDA margin Adjusted operating profit Europe Germany - mobile in-bundle revenue Germany - mobile out-of-bundle revenue UK - mobile in-bundle revenue UK - mobile... -

Page 207

... exchange pps Reported change % Overview AMAP South Africa - service revenue South Africa - data revenue Vodacom's international operations - service revenue Turkey - service revenue Turkey - mobile in-bundle revenue Egypt - service revenue Ghana - service revenue India - percentage point change... -

Page 208

... 3C Reasons for the offer and use of proceeds 3D Risk factors Information on the Company 4A History and development of the Company 4B Business overview 4C Organisational structure 4D Property, plant and equipment 206 Vodafone Group Plc Annual Report 2015 4A Unresolved staff comments -

Page 209

... statements Board of Directors Executive Committee Directors' remuneration Note 24 "Directors and key management compensation" Compliance with the 2012 UK Corporate Governance Code Shareholder information: Articles of association and applicable English law Directors' remuneration Board of Directors... -

Page 210

... listing 9A Offer and listing details 9B Plan of distribution 9C Markets 9D Selling shareholders 9E Dilution 9F Expenses of the issue Additional information 10A Share capital 10B Memorandum and articles of association 10C Material contracts 10D Exchange controls 10E Taxation 10F Dividends and paying... -

Page 211

...increased pricing pressure; a the Group's ability to expand its spectrum position, win 3G and 4G allocations and realise expected synergies and benefits associated with 3G and 4G; Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2015... -

Page 212

...partnerships, joint ventures, franchises, brand licences, platform sharing or other arrangements with third parties, particularly those related to the development of data and internet services; a acquisitions and divestments of Group businesses and assets and the pursuit of new, unexpected strategic... -

Page 213

...access to their organisation's network. M2M Machine-to-machine. M2M communications, or telemetry, enable devices to communicate with one another via built-in mobile SIM cards. 2G Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2015... -

Page 214

... Tablets Telemetrics Vodafone Group Plc Annual Report 2015 VZW Mark-to-market or fair value accounting refers to accounting for the value of an asset or liability based on the current market price of the asset or liability. Also known as mobile internet (see below). A mobile customer is defined as... -

Page 215

... and company names mentioned herein may be the trade marks of their respective owners. The content of our website (vodafone.com) should not be considered to form part of this annual report or our annual report on Form 20-F. © Vodafone Group 2015 Vodafone Group Plc Annual Report 2015 Text printed... -

Page 216

... Group Plc Annual Report 2015 vodafone.com Contact details: Shareholder helpline Telephone: +44 (0)870 702 0198 (In Ireland): +353 (0)818 300 999 Investor Relations [email protected] vodafone.com/investor Media Relations vodafone.com/media/contact Sustainability vodafone.com/sustainability Access...