Nokia 2010 Annual Report Download - page 256

Download and view the complete annual report

Please find page 256 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275

|

|

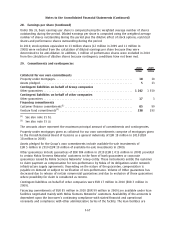

29. Commitments and contingencies (Continued)

primarily available to fund capital expenditure relating to purchases of network infrastructure

equipment and services.

Venture fund commitments of EUR 238 million in 2010 (EUR 293 million in 2009) are financing

commitments to a number of funds making technology related investments. As a limited partner in

these funds, Nokia is committed to capital contributions and also entitled to cash distributions

according to respective partnership agreements.

The Group is party to routine litigation incidental to the normal conduct of business, including, but

not limited to, several claims, suits and actions both initiated by third parties and initiated by Nokia

relating to infringements of patents, violations of licensing arrangements and other intellectual

property related matters, as well as actions with respect to products, contracts and securities. Based

on the information currently available, in the opinion of the management outcome of and liabilities

in excess of what has been provided for related to these or other proceedings, in the aggregate, are

not likely to be material to the financial condition or result of operations.

At December 31, 2010, the Group had purchase commitments of EUR 2 606 million (EUR 2 765 million

in 2009) relating to inventory purchase obligations, service agreements and outsourcing

arrangements, primarily for purchases in 2011.

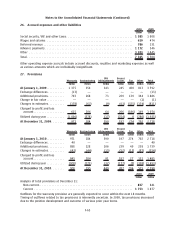

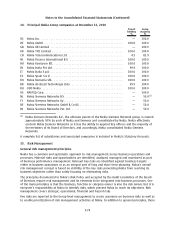

30. Leasing contracts

The Group leases office, manufacturing and warehouse space under various noncancellable operating

leases. Certain contracts contain renewal options for various periods of time

The future costs for noncancellable leasing contracts are as follows:

Operating

leases

Leasing payments, EURm

2011 .................................................................... 285

2012 .................................................................... 215

2013 .................................................................... 160

2014 .................................................................... 122

2015 .................................................................... 82

Thereafter ................................................................ 205

Total .................................................................... 1 069

Rental expense amounted to EUR 429 million in 2010 (EUR 436 million in 2009 and EUR 418 million in

2008).

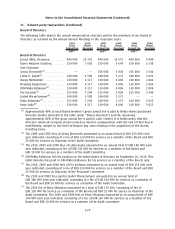

31. Related party transactions

At December 31, 2010, the Group had borrowings amounting to EUR 69 million (EUR 69 million in

2009 and EUR 69 million in 2008) from Nokia Unterstu

¨tzungskasse GmbH, the Group’s German

pension fund, which is a separate legal entity. The loan bears interest at 6% annum and its duration

is pending until further notice by the loan counterparts who have the right to terminate the loan

with a 90 day notice period.

There were no loans made to the members of the Group Executive Board and Board of Directors at

December 31, 2010, 2009 or 2008, respectively.

F68

Notes to the Consolidated Financial Statements (Continued)