Nokia 2010 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8. Impairment (Continued)

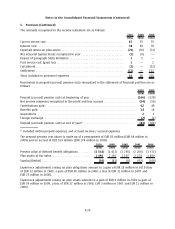

The Group has applied consistent valuation methodologies for each of the Group’s CGUs for the years

ended December 31, 2010, 2009 and 2008. The value in use is determined on a pretax value basis

using pretax valuation assumptions including pretax cash flows and pretax discount rate. As

marketbased rates of return for the Group’s cashgenerating units are available only on a posttax

basis, the pretax discount rates are derived by adjusting the posttax discount rates to reflect the

specific amount and timing of future tax cash flows. The discount rates applied in the impairment

testing for each CGU have been determined independently of capital structure reflecting current

assessments of the time value of money and relevant market risk premiums. Risk premiums included

in the determination of the discount rate reflect risks and uncertainties for which the future cash flow

estimates have not been adjusted. Overall, the discount rates applied in the 2010 impairment testing

have decreased in line with declining interest rates.

In 2009, the Group recorded an impairment loss of EUR 908 million to reduce the carrying amount of

the Nokia Siemens Networks CGU to its recoverable amount. The impairment loss was allocated in its

entirety to the carrying amount of goodwill arising from the formation of Nokia Siemens Networks

and from subsequent acquisitions completed by Nokia Siemens Networks. As a result of the

impairment loss, the amount of goodwill allocated to the Nokia Siemens Networks CGU has been

reduced to zero.

The goodwill impairment testing conducted for each of the Group’s CGUs for the year ended

December 31, 2008 did not result in any impairment charges.

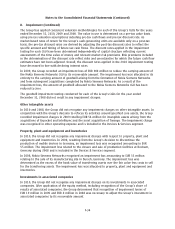

Other intangible assets

In 2010 and 2008, the Group did not recognise any impairment charges on other intangible assets. In

conjunction with the Group’s decision to refocus its activities around specified core assets, the Group

recorded impairment charges in 2009 totalling EUR 56 million for intangible assets arising from the

acquisitions of Enpocket and Intellisync and the asset acquisition of Twango. The impairment charge

was recognised in other operating expense and is included in the Devices & Services segment.

Property, plant and equipment and inventories

In 2010, the Group did not recognise any impairment charges with respect to property, plant and

equipment and inventories. In 2008, resulting from the Group’s decision to discontinue the

production of mobile devices in Germany, an impairment loss was recognised amounting to EUR

55 million. The impairment loss related to the closure and sale of production facilities at Bochum,

Germany during 2008 and is included in the Devices & Services segment.

In 2008, Nokia Siemens Networks recognised an impairment loss amounting to EUR 35 million

relating to the sale of its manufacturing site in Durach, Germany. The impairment loss was

determined as the excess of the book value of transferring assets over the fair value less costs to sell

for the transferring assets. The impairment loss was allocated to property, plant and equipment and

inventories.

Investments in associated companies

In 2010, the Group did not recognise any impairment charges on its investments in associated

companies. After application of the equity method, including recognition of the Group’s share of

results of associated companies, the Group determined that recognition of impairment losses of

EUR 19 million in 2009 and EUR 8 million in 2008 was necessary to adjust the Group’s investment in

associated companies to its recoverable amount.

F34

Notes to the Consolidated Financial Statements (Continued)