Nokia 2010 Annual Report Download - page 251

Download and view the complete annual report

Please find page 251 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275

|

|

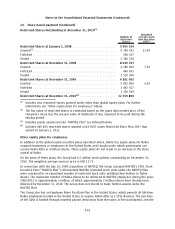

24. Sharebased payment (Continued)

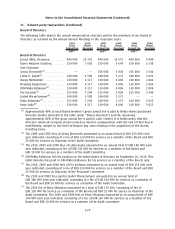

Restricted Shares Outstanding at December 31, 2010

(1)

Number of

Restricted

Shares

Weighted

average grant

date fair value

EUR

(2)

Restricted Shares at January 1, 2008 ........................... 5 995 329

Granted

(3)

................................................... 4799543 13.89

Forfeited ................................................... 358747

Vested ..................................................... 2386728

Restricted Shares at December 31, 2008 ........................ 8 049 397

Granted .................................................... 4288600 7.59

Forfeited ................................................... 446695

Vested ..................................................... 2510300

Restricted Shares at December 31, 2009 ........................ 9 381 002

Granted .................................................... 5801800 6.85

Forfeited ................................................... 1492357

Vested ..................................................... 1330549

Restricted Shares at December 31, 2010

(4)

...................... 12 359 896

(1)

Includes also restricted shares granted under other than global equity plans. For further

information see “Other equity plans for employees” below.

(2)

The fair value of restricted shares is estimated based on the grant date market price of the

Company’s share less the present value of dividends, if any, expected to be paid during the

vesting period.

(3)

Includes grants assumed under “NAVTEQ Plan” (as defined below).

(4)

Includes 849 800 restricted shares granted in Q4 2007 under Restricted Share Plan 2007 that

vested on January 1, 2011.

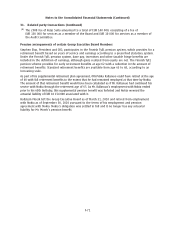

Other equity plans for employees

In addition to the global equity incentive plans described above, Nokia has equity plans for Nokia

acquired businesses or employees in the United States and Canada under which participants can

receive Nokia ADSs or ordinary shares. These equity plans do not result in an increase in the share

capital of Nokia.

On the basis of these plans, the Group had 0.2 million stock options outstanding on December 31,

2010. The weighted average exercise price is USD 13.72.

In connection with the July 10, 2008 acquisition of NAVTEQ, the Group assumed NAVTEQ’s 2001 Stock

Incentive Plan (“NAVTEQ Plan”). All unvested NAVTEQ restricted stock units under the NAVTEQ Plan

were converted to an equivalent number of restricted stock units entitling their holders to Nokia

shares. The maximum number of Nokia shares to be delivered to NAVTEQ employees during the years

20082012 is approximately 3 million, of which approximately 2 million shares have already been

delivered by December 31, 2010. The Group does not intend to make further awards under the

NAVTEQ Plan.

The Group also has an Employee Share Purchase Plan in the United States, which permits all fulltime

Nokia employees located in the United States to acquire Nokia ADSs at a 15% discount. The purchase

of the ADSs is funded through monthly payroll deductions from the salary of the participants, and the

F63

Notes to the Consolidated Financial Statements (Continued)