Nokia 2010 Annual Report Download - page 151

Download and view the complete annual report

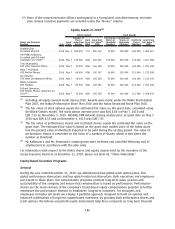

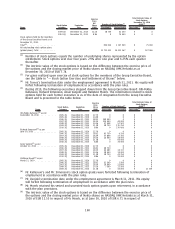

Please find page 151 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Averaged Annual EPS criteria are equally weighted and performance under each of the two

performance criteria is calculated independent of each other.

We believe the performance criteria set above are challenging. The awards at the threshold are

significantly reduced from grant level and achievement of maximum award would serve as an

indication that Nokia’s performance significantly exceeded current market expectations of our

longterm execution.

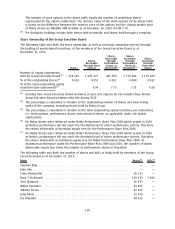

Achievement of the maximum performance for both criteria would result in the vesting of a

maximum of 28 million Nokia shares. Performance exceeding the maximum criteria does not increase

the number of performance shares that will vest. Achievement of the threshold performance for both

criteria will result in the vesting of approximately 7 million shares. If only one of the threshold levels

of performance is achieved, only approximately 3.5 million of the performance shares will vest. If

none of the threshold levels is achieved, then none of the performance shares will vest. The vesting

of shares follows a linear scale for actual financial performance achieved. If the required performance

level is achieved, the vesting will occur December 31, 2013. Until the Nokia shares are delivered, the

participants will not have any shareholder rights, such as voting or dividend rights associated with

these performance shares.

Stock Options

The Board of Directors will make a proposal for Stock Option Plan 2011 to the Annual General Meeting

convening on May 3, 2011. The Board will propose to the Annual General Meeting that selected

personnel of Nokia Group be granted a maximum of 35 million stock options until the end of 2013.

The proposed Stock Option Plan 2011 will succeed the previous Stock Option Plan 2007, approved by

the Annual General Meeting 2007, which has not been available for further grants of stock options

since the end of 2010.

The grants of stock options in 2011 will be made out of this new plan subject to its approval by the

Annual General Meeting. The planned maximum annual grant for the year 2011 under the Stock

Option Plan 2011 is approximately 12 million stock options, with the remaining stock options

available through the end of 2013.

The stock options under the Stock Option Plan 2011 entitle to subscribe for a maximum of 35 million

Nokia shares. The subcategories of stock options to be granted under the plan will have a term of

approximately six years. The vesting periods of the stock options are as follows: 50% of stock options

granted under each subcategory vesting three years after grant date and the remaining 50% vesting

four years from grant. The exercise period for the first subcategory will commence on July 1, 2014

and the exercise period for the last subcategories will expire on December 27, 2019.

The exercise price for each subcategory of stock options will be determined on a quarterly basis. The

exercise price for each subcategory of stock options will be equal to the trade volume weighted

average price of the Nokia share on NASDAQ OMX Helsinki during the trading days of the first whole

week of the second month (i.e. February, May, August or November) of the respective calendar

quarter, on which the subcategory has been denominated. Should an exdividend date take place

during that week, the exercise price shall be determined based on the following week’s trade volume

weighted average price of the Nokia share on NASDAQ OMX Helsinki. The determination of exercise

price is defined in the terms and conditions of the stock option plan, which are subject to the

approval of the shareholders at the respective Annual General Meeting. The Board of Directors does

not have the right to change how the exercise price is determined.

Restricted Shares

Restricted shares under the Restricted Share Plan 2011 approved by the Board of Directors are used,

on a very selective basis, to attract and retain high potential and critical talent, vital to the future

success of Nokia. The restricted shares under the Restricted Share Plan 2011 will have a threeyear

restriction period. The restricted shares will vest and the resulting Nokia shares be delivered in 2014

150