Nokia 2010 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275

|

|

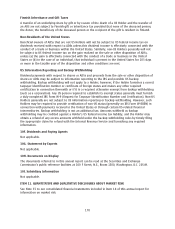

Finnish Inheritance and Gift Taxes

A transfer of an underlying share by gift or by reason of the death of a US Holder and the transfer of

an ADS are not subject to Finnish gift or inheritance tax provided that none of the deceased person,

the donor, the beneficiary of the deceased person or the recipient of the gift is resident in Finland.

NonResidents of the United States

Beneficial owners of ADSs that are not US Holders will not be subject to US federal income tax on

dividends received with respect to ADSs unless this dividend income is effectively connected with the

conduct of a trade or business within the United States. Similarly, nonUS Holders generally will not

be subject to US federal income tax on the gain realized on the sale or other disposition of ADSs,

unless (a) the gain is effectively connected with the conduct of a trade or business in the United

States or (b) in the case of an individual, that individual is present in the United States for 183 days

or more in the taxable year of the disposition and other conditions are met.

US Information Reporting and Backup Withholding

Dividend payments with respect to shares or ADSs and proceeds from the sale or other disposition of

shares or ADSs may be subject to information reporting to the IRS and possible US backup

withholding. Backup withholding will not apply to a Holder; however, if the Holder furnishes a correct

taxpayer identification number or certificate of foreign status and makes any other required

certification in connection therewith or if it is a recipient otherwise exempt from backup withholding

(such as a corporation). Any US person required to establish its exempt status generally must furnish

a duly completed IRS Form W9 (Request for Taxpayer Identification Number and Certification). NonUS

Holders generally are not subject to US information reporting or backup withholding. However, such

Holders may be required to provide certification of nonUS status (generally on IRS Form W8BEN) in

connection with payments received in the United States or through certain USrelated financial

intermediaries. Backup withholding is not an additional tax. Amounts withheld as backup

withholding may be credited against a Holder’s US federal income tax liability, and the Holder may

obtain a refund of any excess amounts withheld under the backup withholding rules by timely filing

the appropriate claim for refund with the Internal Revenue Service and furnishing any required

information.

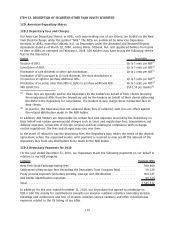

10F. Dividends and Paying Agents

Not applicable.

10G. Statement by Experts

Not applicable.

10H. Documents on Display

The documents referred to in this annual report can be read at the Securities and Exchange

Commission’s public reference facilities at 100 F Street, N.E., Room 1580, Washington, D.C. 20549.

10I. Subsidiary Information

Not applicable.

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

See Note 35 to our consolidated financial statements included in Item 18 of this annual report for

information on market risk.

178