Nokia 2010 Annual Report Download - page 120

Download and view the complete annual report

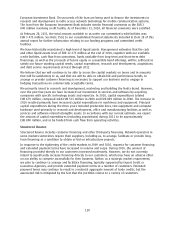

Please find page 120 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Proceeds from maturities and sale of current availableforsale investments, liquid assets, increased to

EUR 7 181 million, compared with EUR 1 730 million in 2009 and EUR 4 664 million in 2008. Net cash

used in financing activities increased to EUR 911 million in 2010, compared with EUR 696 million in

2009, primarily as a result of a change in the proceeds and payments of shortterm borrowings partly

offset by a decrease of proceeds from longterm borrowings. Net cash used in financing activities

increased to EUR 696 million in 2009, compared with EUR 1 545 million in 2008, primarily as a result

of a decrease in the share buybacks, an increase in longterm borrowings, and a decrease in

dividends paid partly offset by a decrease of shortterm borrowings. Dividends paid decreased to

EUR 1 519 million in 2010, compared with EUR 1 546 million in 2009 and EUR 2 048 million in 2008.

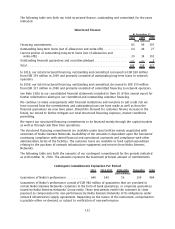

At December 31, 2010, we had EUR 4 242 million in longterm interestbearing liabilities and

EUR 1 037 million in shortterm borrowings, offset by EUR 12 275 million in cash and other liquid

assets, resulting in a net liquid assets balance of EUR 6 996 million, compared with EUR 3 670 million

at the end of 2009 and EUR 2 368 million at the end of 2008. The increase in net liquid assets in

2010 reflected positive operational cash flow partially offset by the dividend payment and capital

expenditures. For further information regarding our longterm liabilities, see Note 16 to our

consolidated financial statements included in Item 18 of this annual report. Our ratio of net interest

bearing debt, defined as shortterm and longterm debt less cash and other liquid assets, to equity,

defined as capital and reserves attributable to equity holders of the parent and noncontrolling

interests, was negative 43%, negative 25% and negative 14% at December 31, 2010, 2009 and 2008,

respectively.

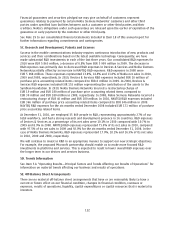

Our Board of Directors has proposed a dividend of EUR 0.40 per share for the year ended

December 31, 2010, subject to the shareholders’ approval, compared with EUR 0.40 and EUR 0.40 per

share paid for the years ended December 31, 2009 and 2008, respectively. See Item 3A “Selected

Financial Data—Distribution of Earnings.”

We have no significant refinancing requirements in 2011. We may incur additional indebtedness from

time to time as required to finance acquisitions and working capital needs. In 2010, we did not raise

material new longterm debt. In February 2009, we issued EUR 1 750 million of Eurobonds

(EUR 1 250 million bonds due 2014 with a coupon of 5.50% and issue price of 99.855%; and

EUR 500 million bonds due 2019 with a coupon of 6.75% and issue price of 99.702%) under our Euro

MediumTerm Note, or EMTN, program to repay part of our shortterm borrowings. In February 2009,

we also signed and fully drew a EUR 500 million loan from the European Investment Bank. The

proceeds of the loan are being used to finance part of our smartphone research and development

expenses. In May 2009, we issued USD 1 500 million of US bonds (USD 1 000 million due in 2019 with

a coupon of 5.375% and issue price of 99.075%; and USD 500 million due in 2039 with a coupon of

6.625% and issue price of 99.494%) under our shelf registration statement on file with the US

Securities and Exchange Commission for general corporate purposes.

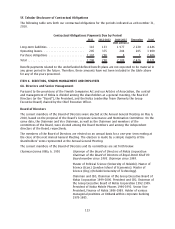

At December 31, 2010, we had a USD 4 000 million US Commercial Paper, or USCP, program,

USD 4 000 million Euro Commercial Paper, or ECP, program, domestic Finnish commercial paper

program totaling EUR 750 million and a shelf registration statement for an indeterminate amount of

debt securities on file with the US Securities and Exchange Commission. At December 31, 2010, we

also had committed credit facilities of USD 1 923 million maturing in 2012, and a number of short

term uncommitted facilities.

At December 31, 2010, Nokia Siemens Networks had a domestic Finnish commercial paper program

totaling EUR 500 million. Nokia Siemens Networks also had a committed revolving credit facility of

EUR 2 000 million maturing in 2012, which includes financial covenants related to gearing test,

leverage test and interest coverage test of Nokia Siemens Networks. As of December 31, 2010, all

financial covenants were satisfied. In 2010, the committed and drawn credit facility of

EUR 750 million maturing in 2013 was converted into equity.

In 2010, Nokia Siemens Networks drew a EUR 220 million Finnish pensions loan that will mature in

2015. In June 2009, Nokia Siemens Networks signed and fully drew a EUR 250 million loan from the

119