Nokia 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The 10 markets in which we generated the greatest net sales in 2010 were, in descending order of

magnitude, China, India, Germany, Russia, the United States, Brazil, the United Kingdom, Spain, Italy

and Indonesia, together representing approximately 52% of total net sales in 2010. In comparison,

the 10 markets in which we generated the greatest net sales in 2009 were China, India, the

United Kingdom, Germany, the United States, Russia, Indonesia, Spain, Brazil and Italy, together

representing approximately 52% of total net sales in 2009.

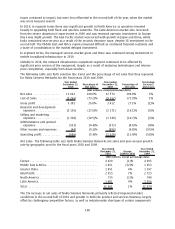

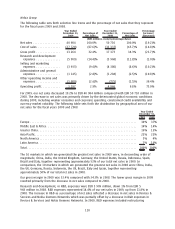

Profitability.

Our gross margin in 2010 was 30.2% compared with 32.4% in 2009. The lower gross

margin in 2010 resulted primarily from the decrease in gross margin in all three of our reportable

segments compared to 2009.

Research and development expenses were EUR 5 863 million in 2010, down 1% from EUR 5

909 million in 2009. Research and development costs represented 13.8% of our net sales in 2010,

down from 14.4% in 2009. The decrease in R&D expenses as a percentage of net sales reflected the

increase in net sales in 2010. Research and development expenses included purchase price accounting

items and other special items of EUR 575 million in 2010 (EUR 564 million in 2009). At December 31,

2010, we employed 35 869 people in research and development, representing approximately 27% of

the group’s total workforce, and had a strong research and development presence in 16 countries.

In 2010, our selling and marketing expenses were EUR 3 877 million, down 1% from EUR 3

933 million in 2009. Selling and marketing expenses represented 9.1% of our net sales in 2010,

compared with 9.6% in 2009. The decrease in selling and marketing expenses as a percentage of net

sales reflected the increase in net sales in 2010. Selling and marketing expenses included purchase

price accounting items and other special items of EUR 429 million in 2010 (EUR 413 million in 2009).

Administrative and general expenses were EUR 1 115 million in 2010, down 3% from EUR 1 145 in

2009. Administrative and general expenses represented 2.6% of our net sales in 2010, compared with

2.8% in 2009. The decrease in administrative and general expenses as a percentage of net sales

reflected the increase in net sales in 2010. Administrative and general expenses included special

items of EUR 77 million in 2010 (EUR 103 million in 2009).

In 2010, other income and expenses included restructuring charges of EUR 112 million, a prior

yearrelated refund of customs duties of EUR 61 million, a gain on sale of assets and businesses of

EUR 29 million and a gain on sale of the wireless modem business of EUR 147 million. In 2009, other

income and expenses included restructuring charges of EUR 192 million, purchase price accounting

related items of EUR 5 million, impairment of goodwill related to Nokia Siemens Networks of

EUR 908 million, impairment of assets of EUR 56 million, a gain on sale of the security appliance

business of EUR 68 million and a gain on sale real estate of EUR 22 million.

Our operating profit for 2010 increased 73% to EUR 2 070 million, compared with EUR 1 197 million

in 2009. The increased operating profit resulted from a decrease in the operating losses at Nokia

Siemens Networks and NAVTEQ somewhat offset by a lower operating profit in Devices & Services. Our

operating margin was 4.9% in 2010, compared with 2.9% in 2009. Our operating profit in 2010

included purchase price accounting items and other special items of net negative EUR 1.1 billion (net

negative EUR 2.3 billion in 2009).

Group Common Functions.

Group Common Functions’ expenses totaled EUR 114 million in 2010,

compared to EUR 134 million in 2009.

Net Financial Income and Expenses.

During 2010, our net financial expenses were EUR 285 million,

compared with EUR 265 million in 2009. In 2010, the group’s net funding costs, as well as the result

from foreign exchange gains and losses, were approximately at the same level as in 2009. Other

financial income and expenses were adversely impacted by a net loss from an investment in a private

fund in 2010.

101