Nokia 2010 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

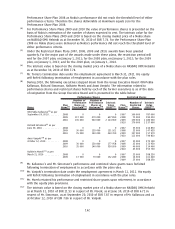

Performance Share Plan 2008 as Nokia’s performance did not reach the threshold level of either

performance criteria. Therefore the shares deliverable at maximum equals zero for the

Performance Share Plan 2008.

(4)

For Performance Share Plans 2009 and 2010 the value of performance shares is presented on the

basis of Nokia’s estimation of the number of shares expected to vest. The intrinsic value for the

Performance Share Plans 2009 and 2010 is based on the closing market price of a Nokia share

on NASDAQ OMX Helsinki as at December 30, 2010 of EUR 7.74. For the Performance Share Plan

2008 no Nokia shares were delivered as Nokia’s performance did not reach the threshold level of

either performance criteria.

(5)

Under the Restricted Share Plans 2007, 2008, 2009 and 2010, awards have been granted

quarterly. For the major part of the awards made under these plans, the restriction period will

end for the 2007 plan, on January 1, 2011; for the 2008 plan, on January 1, 2012; for the 2009

plan, on January 1, 2013; and for the 2010 plan, on January 1, 2014.

(6)

The intrinsic value is based on the closing market price of a Nokia share on NASDAQ OMX Helsinki

as at December 30, 2010 of EUR 7.74.

(7)

Mr. Torres’s termination date under the employment agreement is March 31, 2011. His equity

will forfeit following termination of employment in accordance with the plan rules.

(8)

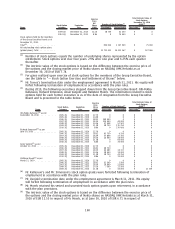

During 2010, the following executives stepped down from the Group Executive Board: OlliPekka

Kallasvuo, Richard Simonson, Hallstein Moerk and Anssi Vanjoki. The information related to

performance shares and restricted shares held by each of the former executives is as of the date

of resignation from the Group Executive Board and is presented in the table below.

Name

Plan

Name

(1)

Number of

Performance

Shares at

Threshold

(13)

Number of

Performance

Shares at

Maximum

(14)

Intrinsic

Value

(EUR)

(12)

Plan

Name

(5)

Number of

Restricted

Shares

Intrinsic

Value

(EUR)

(12)

Performance Shares Restricted Shares

OlliPekka Kallasvuo

(9)

as per

September 20, 2010 ....... 2008 0 0 0 2007 100 000 787 000

2009 117 500 470 000 697 890 2008 75 000 590 250

2010 135 000 540 000 2 124 900 2009 150 000 1 180 500

2010 170 000 1 337 900

Richard Simonson

(9)

as per

June 30, 2010 ........... 2008 0 0 0 2007 35 000 234 850

2009 30 000 120 000 151 921 2008 22 000 147 620

2010 35 000 140 000 469 700 2009 107 000 717 970

2010 111 000 744 810

Anssi Vanjoki

(10)

as per

October 12, 2010 . . ....... 2008 0 0 0 2007 35 000 275 100

2009 30 000 120 000 177 958 2008 22 000 172 920

2010 35 000 140 000 550 200 2009 40 000 314 400

2010 45 000 353 700

Hallstein Moerk

(11)

as per

March 31, 2010 . . . ....... 2008 0 0 0 2007 25 000 288 250

2009 17 500 70 000 152 280 2008 14 000 161 420

2009 25 000 288 250

(9)

Mr. Kallasvuo’s and Mr. Simonson’s performance and restricted share grants were forfeited

following termination of employment in accordance with the plan rules.

(10)

Mr. Vanjoki’s termination date under the employment agreement is March 11, 2011. His equity

will forfeit following termination of employment in accordance with the plan rules.

(11)

Mr. Moerk retained his performance and restricted share grants upon retirement, in accordance

with the equity plan provisions.

(12)

The intrinsic value is based on the closing market price of a Nokia share on NASDAQ OMX Helsinki

as at March 31, 2010 of EUR 11.53 in respect of Mr. Moerk, as at June 30, 2010 of EUR 6.71 in

respect of Mr. Simonson, as at September 20, 2010 of EUR 7.87 in respect of Mr. Kallasvuo and as

at October 12, 2010 of EUR 7.86 in respect of Mr. Vanjoki.

162