Nokia 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.fully after the close of a predetermined restriction period. Any shares granted are subject to the

share ownership guidelines as explained below. All of these equitybased incentive awards are

generally forfeited if the executive leaves Nokia prior to their vesting.

Recoupment of certain equity gains

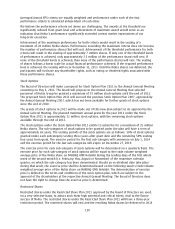

The Board of Directors has approved a policy allowing for the recoupment of equity gains realized by

Nokia Leadership Team members under Nokia equity plans in case of a financial restatement caused

by an act of fraud or intentional misconduct. This policy applies to equity grants made to Nokia

Leadership Team members after January 1, 2010.

Information on the actual equitybased incentives granted to the members of our Group Executive

Board in 2010 is included in Item 6E. “Share Ownership.”

Actual Executive Compensation for 2010

Service Contracts

Stephen Elop’s service contract covers his position as President and CEO as from September 21, 2010.

As at December 31, 2010, Mr. Elop’s annual total gross base salary, which is subject to an annual

review by the Board of Directors and confirmation by the independent members of the Board, is

EUR 1 050 000. His incentive targets under the Nokia shortterm cash incentive plan are 150% of

annual gross base salary as at December 31, 2010. Mr. Elop is entitled to the customary benefits in

line with our policies applicable to the top management, however, some of them are being provided

on a tax assisted basis. Mr. Elop is also eligible to participate in Nokia’s longterm equitybased

compensation programs according to Nokia policies and guidelines and as determined by the Board

of Directors. Upon joining Nokia, Mr. Elop received 500 000 stock options, 75 000 performance shares

at threshold performance level and 100 000 restricted shares out of Nokia Equity Program 2010.

As compensation for lost income from his prior employer, which resulted due to his move to Nokia,

Mr. Elop received a onetime payment of EUR 2 292 702 in October 2010 and is entitled to a second

payment of USD 3 000 000 in October 2011. In addition, relating to his move to Nokia, Mr. Elop

received a onetime payment of EUR 509 744 to reimburse him for fees he was obligated to repay his

former employer. He also received income of EUR 312 203, including tax assistance, resulting from

legal expenses paid by Nokia associated with his move to Nokia. In case of early termination of

employment, Mr. Elop is obliged to return to Nokia all or part of these payments related to his move

to Nokia.

In case of termination by Nokia for reasons other than cause, Mr. Elop is entitled to a severance

payment of up to 18 months of compensation (both annual total gross base salary and target

incentive) and his equity will be forfeited as determined in the applicable equity plan rules, with the

exception of the equity out of the Nokia Equity Program 2010 which will vest in an accelerated

manner. In case of termination by Mr. Elop, the notice period is six months and he is entitled to a

payment for such notice period (both annual total gross base salary and target incentive for six

months) but all his equity will be forfeited. In the event of a change of control of Nokia, Mr. Elop may

terminate his employment upon a material reduction of his duties and responsibilities, upon which

he will be entitled to a compensation of 18 months (both annual total gross base salary and target

incentive), and his unvested equity will vest in an accelerated manner. In case of termination by

Nokia for cause, Mr. Elop is entitled to no additional compensation and all his equity will be forfeited.

In case of termination by Mr. Elop for cause, he is entitled to a severance payment equivalent to

18 months of notice (both annual total gross base salary and target incentive), and his unvested

equity will vest in an accelerated manner. Mr. Elop is subject to a 12month noncompetition

obligation after termination of the contract. Unless the contract is terminated for cause, Mr. Elop may

be entitled to compensation during the noncompetition period or a part of it. Such compensation

amounts to the annual total gross base salary and target incentive for the respective period during

which no severance payment is paid.

140