Nokia 2010 Annual Report Download - page 146

Download and view the complete annual report

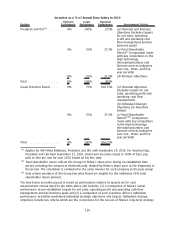

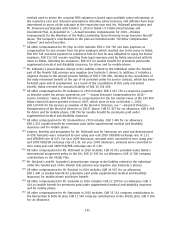

Please find page 146 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.method used to derive the actuarial IFRS valuation is based upon available salary information at

the respective year end. Actuarial assumptions including salary increases and inflation have been

determined to arrive at the valuation at the respective year end. Ms. McDowell participates and

Mr. Simonson participated until October 2, 2010 in Nokia’s U.S Retirement Savings and

Investment Plan, as described in “—Actual Executive Compensation for 2010—Pension

Arrangements for the Members of the Nokia Leadership Team (formerly Group Executive Board)”

above. The Company’s contributions to the plan are included under “All Other Compensation

Column” and noted hereafter.

(6)

All other compensation for Mr. Elop in 2010 includes: EUR 2 292 702 one time payment as

compensation for lost income from his prior employer which resulted due to his move to Nokia;

EUR 509 744 onetime payment to reimburse him for fees he was obligated to repay his former

employer; EUR 312 203 income resulting from legal expenses paid by Nokia associated with his

move to Nokia, including tax assistance; EUR 627 for taxable benefit for premiums paid under

supplemental medical and disability insurance, for driver and for mobile phone.

(7)

Mr. Kallasvuo’s proportionate change in the liability related to the individual under the funded

part of the Finnish TyEL pension was negative (see footnote 5 above). In addition, it includes a

negative change in the annual pension liability of EUR 9 590 000, relating to the cancellation of

the early retirement benefit at the age of 60 provided under his service contract, which has been

forfeited upon end of employment. As a result of the cancellation of this early retirement

benefit, Nokia reversed the actuarial liability of EUR 10 154 000.

(8)

All other compensation for Mr. Kallasvuo in 2010 includes: EUR 4 623 750 as severance payment

as describe under his service agreement, see ‘‘—Actual Executive Compensation for 2010—

Service Contracts ‘‘above; EUR 748 000 as compensation for the fair market value of the 100 000

Nokia restricted shares granted to him in 2007, which were to vest on October 1, 2010;

EUR 130 000 for his services as member of the Board or Directors, see ‘‘—Board of Directors—

Remuneration of the Board of Directors in 2010” above; EUR 15 427 for car allowance; EUR 6 088

for driver and for mobile phone; EUR 796 for taxable benefit for premiums paid under

supplemental medical and disability insurance.

(9)

All other compensation for Mr. Ihamuotila in 2010 includes: EUR 7 440 for car allowance;

EUR 1 453 taxable benefit for premiums paid under supplemental medical and disability

insurance and for mobile phone.

(10)

Salaries, benefits and perquisites for Ms. McDowell and Mr. Simonson are paid and denominated

in USD. Amounts were converted to euro using yearend 2010 USD/EUR exchange rate of 1.32

and GPB/EUR rate of 0.85. For year 2009 disclosure, amounts were converted to euro using year

end 2009 USD/EUR exchange rate of 1.43. For year 2008 disclosure, amounts were converted to

euro using yearend 2008 USD/EUR exchange rate of 1.40.

(11)

All other compensation for Ms. McDowell in 2010 includes: EUR 45 951 provided under Nokia’s

international assignment policy in the U.K; EUR 12 935 for car allowance, EUR 12 500 company

contributions to the 401(k) Plan.

(12)

Mr. O

¨ista

¨mo

¨’s and Mr. Savander’s proportionate change in the liability related to the individual

under the funded part of the Finnish TyEL pension was negative (see footnote 5 above).

(13)

All other compensation for Mr. O

¨ista

¨mo

¨in 2010 includes: EUR 16 925 for car allowance;

EUR 1 440 as taxable benefit for premiums paid under supplemental medical and disability

insurance, for mobile phone and driver benefit.

(14)

All other compensation for Mr. Savander in 2010 includes: EUR 22 200 for car allowance; EUR 1

434 as taxable benefit for premiums paid under supplemental medical and disability insurance

and for mobile phone.

(15)

All other compensation for Mr. Simonson in 2010 includes: EUR 55 514 company contributions to

the Restoration & Deferral plan; EUR 12 500 company contributions to the 401(k) plan; EUR 9 906

for car allowance.

145