Nokia 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

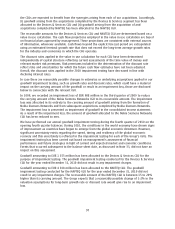

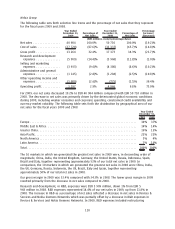

Latin America. Our device market share decreased in AsiaPacific, Middle East & Africa, Europe and

North America. Our device market share was flat in Greater China.

In Latin America, our market share increased. Our share increased in, for example, Chile, Colombia,

Paraguay and Peru, but was partly offset by market share declines in Argentina, Brazil, Mexico and

some other countries.

In AsiaPacific, our market share declined in 2010 as a result of market share losses in several

markets, including India, Indonesia, Singapore, Vietnam and some other countries, but this was partly

offset by market share increases in, for example, Australia, Thailand and Philippines. In Middle East &

Africa, our market share decline was driven by share losses in markets such as Egypt, Nigeria and UAE,

which was offset to some extent by share gains in some markets such as South Africa and Pakistan.

In Europe, our market share declined in markets including the UK and Spain, but was partly offset by

share gains in markets such as Italy and France. Our market share declined in North America in 2010

primarily due to a market share decline in the United States offset to some extent by our market

share increase in Canada. In Greater China, we continued to benefit from our brand, broad product

portfolio and extensive distribution system during 2010.

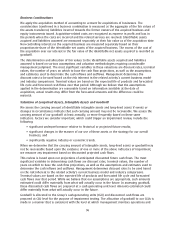

Average Selling Price.

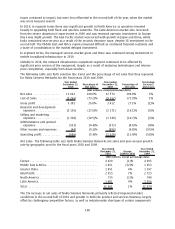

The following table sets forth our mobile device ASP and yearonyear growth

rate by category for the fiscal years 2010 and 2009.

Year Ended

December 31,

2010

Change

2009 to 2010

Year Ended

December 31,

2009

(EUR millions, except percentage data)

Mobile phones

1

................................... 41 (2)% 42

Converged mobile devices

2

.......................... 147 (21)% 187

Total ............................................ 64 0% 64

(1)

Series 30 and Series 40based devices ranging from basic mobile phones focused on voice

capability to devices with a number of additional functionalities, such as Internet connectivity,

including the services and accessories sold with them.

(2)

Smartphones and mobile computers, including the services and accessories sold with them.

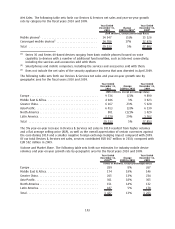

Our mobile device ASP (including services revenue) in 2010 was EUR 64, unchanged from 2009. During

the first half of 2010, our device ASP decreased primarily as a result of general price erosion across

our mobile device portfolio and a higher proportion of lowerpriced converged mobile device sales,

offset to some extent by the positive impact of converged mobile devices representing a higher

proportion of our overall mobile device sales compared to 2009. However, the decrease in our ASP

during the first half of 2010 was offset by an increase in our ASP during the second half of 2010. The

increase in our ASP during the second half of 2010 was due primarily to converged mobile devices

representing a higher proportion of our overall mobile device sales and the appreciation of certain

currencies against the euro. This increase was offset to some extent by general price erosion driven

by the intense competitive environment and a higher proportion of lowerpriced converged mobile

device sales, which is reflected in the 21% decline in our converged mobile devices ASP in 2010

compared to 2009.

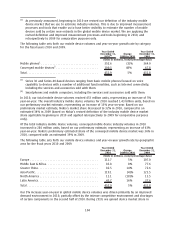

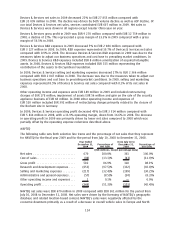

Profitability.

Devices & Services gross profit decreased 5% to EUR 8.8 billion, compared with

EUR 9.3 billion in 2009, with a gross margin of 30.1% (33.3% in 2009). The gross margin decline was

primarily due to general price pressure and product material cost erosion being less than general

product price erosion, offset to some extent by converged mobile device volumes representing a

higher proportion of overall mobile device volumes. Additionally, the gross margin was negatively

impacted in 2010 by the overall appreciation of certain currencies against the euro and unfavorable

foreign exchange hedging compared with 2009. During the first half of 2010, the gross margin was

positively impacted by the depreciation of certain currencies against the euro. However, this positive

105