Nokia 2010 Annual Report Download - page 254

Download and view the complete annual report

Please find page 254 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275

|

|

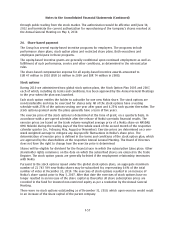

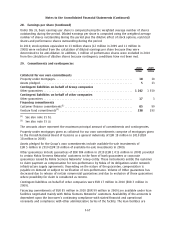

27. Provisions (Continued)

The restructuring provision is mainly related to restructuring activities in Devices & Services and Nokia

Siemens Networks segments. The majority of outflows related to the restructuring is expected to

occur during 2011.

In 2010, Devices & Services recognized restructuring provisions of EUR 85 million mainly related to

changes in Symbian Smartphones and Services organizations as well as certain corporate functions

that are expected to result in a reduction of up to 1 800 employees globally. In 2009, Devices &

Services recognized restructuring provisions of EUR 208 million mainly related to measures taken to

adjust our business operations and cost base according to market conditions.

Restructuring and other associated expenses incurred in Nokia Siemens Networks in 2010 totaled

EUR 316 million (EUR 310 million in 2009) including mainly personnel related expenses as well as

expenses arising from the elimination of overlapping functions, and the realignment of product

portfolio and related replacement of discontinued products in customer sites. These expenses

included EUR 173 million (EUR 151 million in 2009) impacting gross profit, EUR 19 million (EUR

30 million in 2009) research and development expenses, EUR 21 million reversal of provision (EUR

12 million in 2009) in selling and marketing expenses, EUR 76 million (EUR 103 million in

2009) administrative expenses and EUR 27 million (EUR 14 million in 2009) other operating expenses.

EUR 510 million was paid during 2010 (EUR 514 million during 2009).

Provisions for losses on projects in progress are related to Nokia Siemens Networks’ onerous

contracts. Utilization of provisions for project losses is generally expected to occur in the next

18 months.

The IPR provision is based on estimated future settlements for asserted and unasserted past IPR

infringements. Final resolution of IPR claims generally occurs over several periods.

Other provisions include provisions for noncancelable purchase commitments, product portfolio

provisions for the alignment of the product portfolio and related replacement of discontinued

products in customer sites and provision for pension and other social security costs on sharebased

awards. In 2010, usage of other provisions mainly relates to product portfolio provisions. Most of

those contracts were signed in 2008 and contract fullfillment occurred primarily in 2009 and 2010.

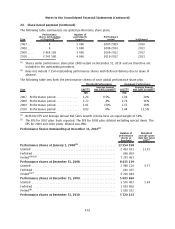

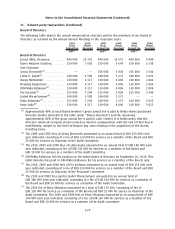

28. Earnings per share

2010 2009 2008

Numerator/EURm

Basic/Diluted:

Profit attributable to equity holders of the parent ....... 1 850 891 3 988

Denominator/1000 shares

Basic:

Weighted average shares ........................... 3 708 816 3 705 116 3 743 622

Effect of dilutive securities:

Performance shares ............................. 324 9 614 25 997

Restricted shares................................ 4 110 6 341 6 543

Stock options .................................. —1 4 201

4 434 15 956 36 741

Diluted:

Adjusted weighted average and assumed conversions . . . . 3 713 250 3 721 072 3 780 363

F66

Notes to the Consolidated Financial Statements (Continued)