Nokia 2010 Annual Report Download - page 165

Download and view the complete annual report

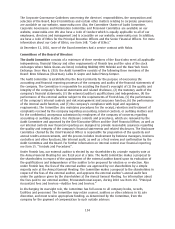

Please find page 165 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock Ownership Guidelines for Executive Management

One of the goals of our longterm equitybased incentive program is to focus executives on promoting

the longterm value sustainability of the company and on building value for shareholders on a longterm

basis. In addition to granting stock options, performance shares and restricted shares, we also encourage

stock ownership by our top executives and have stock ownership commitment guidelines with minimum

recommendations tied to annual base salaries. For the President and CEO, the recommended minimum

investment in Nokia shares corresponds to three times his annual base salary and for members of the

Nokia Leadership Team two times the member’s annual base salary, respectively. To meet this

requirement, all members of the Nokia Leadership Team are expected to retain 50% of any aftertax

gains from equity programs in shares until the minimum investment level is met. The Personnel

Committee regularly monitors the compliance by the executives with the stock ownership guidelines.

Insider Trading in Securities

The Board of Directors has established a policy in respect of insiders’ trading in Nokia securities. The

members of the Board and the Nokia Leadership Team are considered as primary insiders. Under the

policy, the holdings of Nokia securities by the primary insiders are public information, which is

available from Euroclear Finland Ltd. and available on our website. Both primary insiders and

secondary insiders (as defined in the policy) are subject to a number of trading restrictions and rules,

including, among other things, prohibitions on trading in Nokia securities during the threeweek

“closedwindow” period immediately preceding the release of our quarterly results including the day

of the release and the fourweek “closedwindow” period immediately preceding the release of our

annual results including the day of the release. In addition, Nokia may set trading restrictions based

on participation in projects. We update our insider trading policy from time to time and closely

monitor compliance with the policy. Nokia’s insider policy is in line with the NASDAQ OMX Helsinki

Guidelines for Insiders and also sets requirements beyond those guidelines.

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

7A. Major Shareholders

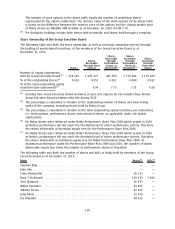

At December 31, 2010 a total of 536 225 792 ADSs (equivalent to the same number of shares or

approximately 14.32% of the total outstanding shares) were outstanding and held of record by

14 419 registered holders in the United States. We are aware that many ADSs are held of record by

brokers and other nominees, and accordingly the above number of holders is not necessarily

representative of the actual number of persons who are beneficial holders of ADSs or the number of

ADSs beneficially held by such persons. Based on information available from Automatic Data

Processing, Inc., the number of beneficial owners of ADSs as at December 31, 2010 was 500 266.

At December 31, 2010, there were 191 790 holders of record of our ordinary shares. Of these holders,

around 540 had a registered address in the United States and held a total of 1 777 738 of our shares,

approximately 0.05% of the total outstanding shares. In addition, certain accounts of record with a

registered address other than in the United States hold our shares, in whole or in part, beneficially for

United States persons.

As far as we know, Nokia is not directly or indirectly owned or controlled by any other corporation or

any government, and there are no arrangements that may result in a change of control of Nokia.

7B. Related Party Transactions

There have been no material transactions during the last three fiscal years to which any director,

executive officer or 5% shareholder, or any relative or spouse of any of them, was a party. There is no

significant outstanding indebtedness owed to Nokia by any director, executive officer or 5% shareholder.

There are no material transactions with enterprises controlling, controlled by or under common

control with Nokia or associates of Nokia.

164