Nokia 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.European Investment Bank. The proceeds of the loan are being used to finance the investments in

research and development in radio access network technology for mobile communication systems.

The loan from the European Investment Bank includes similar financial covenants as the EUR 2

000 million revolving credit facility. As of December 31, 2010, all financial covenants were satisfied.

At February 28, 2011, the total amount available to us under our committed credit facilities was

EUR 3 475 million. See Note 35(c) to our consolidated financial statements included in Item 18 of this

annual report for further information relating to our funding programs and committed credit

facilities.

We have historically maintained a high level of liquid assets. Management estimates that the cash

and other liquid assets level of EUR 12 275 million at the end of 2010, together with our available

credit facilities, cash flow from operations, funds available from longterm and shortterm debt

financings, as well as the proceeds of future equity or convertible bond offerings, will be sufficient to

satisfy our future working capital needs, capital expenditure, research and development, acquisitions

and debt service requirements at least through 2011.

We believe that we will continue to be able to access the capital markets on terms and in amounts

that will be satisfactory to us, and that we will be able to obtain bid and performance bonds, to

arrange or provide customer financing as necessary to support our business and to engage in

hedging transactions on commercially acceptable terms.

We primarily invest in research and development, marketing and building the Nokia brand. However,

over the past few years we have increased our investment in services and software by acquiring

companies with specific technology assets and expertise. In 2010, capital expenditures totaled

EUR 679 million, compared with EUR 531 million in 2009 and EUR 889 million in 2008. The increase in

2010 resulted primarily from increased capital expenditures in machinery and equipment. Principal

capital expenditures during the three years included production lines, test equipment and computer

hardware used primarily in research and development, office and manufacturing facilities as well as

services and software related intangible assets. In accordance with our current estimate, we expect

the amount of capital expenditures (excluding acquisitions) during 2011 to be approximately

EUR 800 million, and to be funded from cash flow from operating activities.

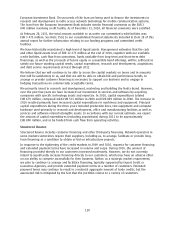

Structured Finance

Structured finance includes customer financing and other thirdparty financing. Network operators in

some markets sometimes require their suppliers, including us, to arrange, facilitate or provide long

term financing as a condition to obtain or bid on infrastructure projects.

In response to the tightening of the credit markets in 2009 and 2010, requests for customer financing

and extended payment terms have increased in volume and scope. During 2010, the amount of

financing provided directly to our customers increased moderately. However, we do not currently

intend to significantly increase financing directly to our customers, which may have an adverse effect

on our ability to compete successfully for their business. Rather, as a strategic market requirement,

we plan to continue to arrange and facilitate financing, typically supported by Export Credit or

Guarantee Agencies, and provide extended payment terms to a number of customers. Extended

payment terms may continue to result in a material aggregate amount of trade credits, but the

associated risk is mitigated by the fact that the portfolio relates to a variety of customers.

120