Nokia 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

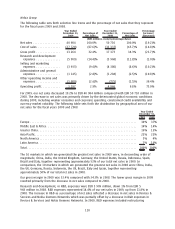

Our mobile device volumes declined 8% in 2009 compared with 2008, to 432 million units. Of those

volumes, our converged mobile device volumes were 67.8 million units in 2009, compared with

60.6 million units in 2008. The yearonyear volume decline in our mobile device volumes was

primarily due to difficult global economic conditions, including weaker consumer and corporate

spending, constrained credit availability and currency market volatility. Based on the industry mobile

device market definition we used in 2009 and 2008, our mobile device volume market share

decreased to 38% in 2009, compared with 39% in 2008. The decrease in our device volume market

share was primarily due to intense competition. In 2009, we estimate that Nokia was the market

leader in Europe, AsiaPacific, China and Latin America. We further estimate that we were also the

market leader in the fastest growing markets of the world, including Middle East & Africa, South East

AsiaPacific and India. We continued to be the market share leader in the entrylevel market with an

estimated market share of approximately 45%. We also continued to be the market share leader in

converged mobile devices. Our estimated converged mobile device market share remained unchanged

at 38% in 2009, compared with 2008, despite strong competition.

During 2009, based on the industry mobile device market definition we used in 2009, we estimate

that Nokia gained mobile device market share in Europe and Middle East & Africa. Our device market

share decreased in AsiaPacific, Latin America and North America. Our device market share was flat in

Greater China.

In Europe, we estimate that our market share increased. Nokia’s share increased in, for example,

Germany, the United Kingdom, Russia and Spain, but was partly offset by market share declines in

Italy, Finland, Ireland and some other countries. In Middle East & Africa our market share increased

driven by share gains for instance in Nigeria.

In AsiaPacific, Nokia’s market share declined in 2009 as a result of market share losses in several

markets, including Singapore and Thailand. In Latin America, Nokia’s market share declined in 2009

as a result of market share losses in several markets, including Brazil, Mexico and Argentina. Our

market share declined in North America in 2009 primarily due to a market share decline in the United

States. In Greater China, Nokia continued to benefit from its brand, broad product portfolio and

extensive distribution system during 2009.

Nokia’s device ASP in 2009 was EUR 63, a decline of 15% from EUR 74 in 2008. Industry ASPs also

declined in 2009. Nokia’s lower ASP in 2009 compared to 2008 was primarily the result of a higher

proportion of lowerpriced entry level device sales as well as general price pressure.

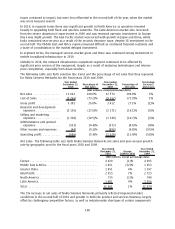

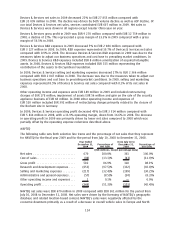

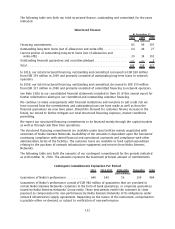

The following table sets forth selective line items and the percentage of net sales that they represent

for the Devices & Services group for the fiscal years 2009 and 2008.

Year Ended

December 31,

2009

Percentage of

Net Sales

Year Ended

December 31,

2008

Percentage of

Net Sales

Percentage

Increase/

(Decrease)

(EUR millions, except percentage data)

Net sales ................. 27853 100.0% 35 099 100.0% (21)%

Cost of sales .............. (18583) (66.7)% (22 360) (63.7)% (17)%

Gross profit ............... 9270 33.3% 12 739 36.3% (27)%

Research and development

expenses ............... (2984) (10.7)% (3 127) (8.9)% (5)%

Selling and marketing

expenses ............... (2366) (8.5)% (2 847) (8.1)% (17)%

Administrative and general

expenses ............... (417) (1.5)% (429) (1.2)% (3)%

Other operating income and

expenses ............... (189) (0.7)% (520) (1.5)% (64)%

Operating profit............ 3314 11.9% 5 816 16.6% (43)%

113