Nokia 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and require a discretionary assessment of performance by the Personnel Committee. Such strategic

objectives may include, but are not limited to, Nokia’s product portfolio, consumer relationships,

developer ecosystem, partnerships and other strategic assets.

When determining the final incentive payout, the Personnel Committee determines an overall score

for each executive based on the degree to which (a) Nokia’s financial objectives and key business

goals have been achieved together with (b) qualitative and quantitative scores assigned to the

individual strategic objectives. The final incentive payout is determined by multiplying each

executive’s eligible salary by: (i) his/her incentive target percentage; and (ii) the score resulting from

factors (a) and (b) above. The resulting score for each executive is then multiplied by an “affordability

factor”, which is determined based on overall net sales, profitability and cash flow management of

Nokia and which is applicable in a similar manner to all Nokia employees within the shortterm cash

incentive program. The Personnel Committee may apply discretion when evaluating actual results

against targets and the resulting incentive payouts. In certain exceptional situations, the actual short

term cash incentive awarded to the executive officer could be zero. The maximum payout is only

possible with maximum performance on all measures.

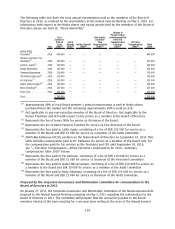

The portion of the shortterm cash incentive that is tied to (a) Nokia’s financial objectives and key

business goals and (b) individual strategic objectives and targets, is paid twice each year based on

the performance for each of Nokia’s shortterm plans that end on June 30 and December 31 of each

year. Another portion of the shortterm cash incentives is paid annually at the end of the year, based

on the Personnel Committee’s assessment of (c) Nokia’s total shareholder return compared to key

peer group companies that are selected by the Personnel Committee in the high technology, Internet

services and telecommunications industries and relevant market indices over one, three and five

year periods. In the case of the former President and CEO OlliPekka Kallasvuo, the annual incentive

award for 2010 was designed to also include his performance compared against (d) strategic

leadership objectives, including performance in key markets, development of strategic capabilities,

enhanced competitiveness of core businesses and executive development. As a result of the end of his

employment with Nokia prior to December 31, 2010, this incentive target, tied to strategic leadership

objectives, was not paid. For our current President and CEO, Stephen Elop, we did not designate

strategic leadership objectives for 2010 due to the inability to measure those objectives during the

shortterm performance period following his hire date.

For more information on the actual cash compensation paid in 2010 to our executive officers,

see “—Actual Executive Compensation for 2010—Summary Compensation Table 2010” below.

LongTerm EquityBased Incentives

Longterm equitybased incentive awards in the form of performance shares, stock options and

restricted shares are used to align executive officers’ interests with shareholders’ interests, reward for

longterm financial performance and encourage retention, while also considering evolving regulatory

requirements and recommendations and changing economic conditions. These awards are

determined on the basis of the factors discussed above in “—Executive Compensation Philosophy,

Programs and Decisionmaking Process”, including a comparison of an executive officer’s overall

compensation with that of other executives in the relevant market and the impact on the

competitiveness of the executive’s compensation package in that market. Performance shares are

Nokia’s main vehicle for longterm equitybased incentives and reward the achievement of both

Nokia’s longterm financial results and an increase in share price. Performance shares vest as shares,

if at least one of the predetermined threshold performance levels, tied to Nokia’s financial

performance, is achieved by the end of the performance period and the value that the executive

receives is dependent on Nokia’s share price. Stock options are granted with the purpose of creating

value for the executive officer, once vested, only if the Nokia share price at the time of vesting is

higher than the exercise price of the stock option established at grant. This is also intended to focus

executives on share price appreciation and thus aligning the interests of the executives with those of

the shareholders. Restricted shares are used primarily for longterm retention purposes and they vest

139