Nokia 2010 Annual Report Download - page 119

Download and view the complete annual report

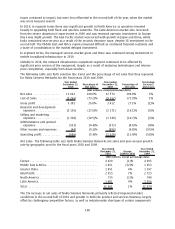

Please find page 119 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.effective tax rate increased to 73.0% in 2009 compared with 21.8% in 2008, primarily due to the

nontax deductible impairment of Nokia Siemens Networks goodwill and certain Nokia Siemens

Network’s tax deductible temporary differences for which no deferred tax assets were recognized due

to uncertainty of utilization in these items. These were offset by the positive effect from the

development and outcome of various prior year items impacting Nokia taxes. In 2008, taxes included

the positive impact of EUR 128 million due to recognition of certain tax benefits from prior years.

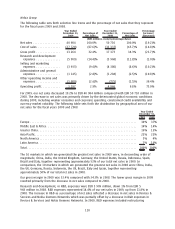

Noncontrolling Interests

Noncontrolling shareholders’ interest in our subsidiaries’ losses totaled EUR 631 million in 2009

compared with noncontrolling shareholders’ interest in our subsidiaries’ losses of EUR 99 million in

2008. The change was primarily due to an increase in Nokia Siemens Networks’ losses.

Profit Attributable to Equity Holders of the Parent and Earnings per Share

Profit attributable to equity holders of the parent in 2009 totaled EUR 891 million compared with

EUR 3 988 million in 2008, representing a yearonyear decrease of 78% in 2008. Earnings per share

in 2009 decreased to EUR 0.24 (basic) and EUR 0.24 (diluted) compared with EUR 1.07 (basic) and

EUR 1.05 (diluted) in 2008.

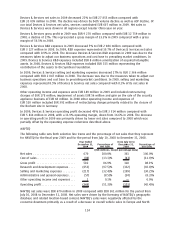

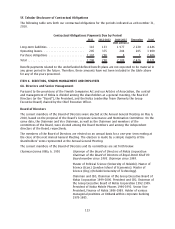

5B. Liquidity and Capital Resources

At December 31, 2010, our cash and other liquid assets (bank and cash; availableforsale

investments, cash equivalents; availableforsale investments, liquid assets; and investments at fair

value through profit and loss, liquid assets) increased to EUR 12 275 million, compared with

EUR 8 873 million at December 31, 2009, primarily as a result of an increase in cash generated from

operations. At December 31, 2008, cash and other liquid assets totaled EUR 6 820 million.

At December 31, 2010, cash and cash equivalents (bank and cash and availableforsale investments,

cash equivalent) increased to EUR 7 592 million, compared with EUR 5 926 million at December 31,

2009. We hold our cash and cash equivalents predominantly in euro. Cash and cash equivalents

totaled EUR 5 548 million at December 31, 2008.

Net cash from operating activities was EUR 4 774 million in 2010, compared with EUR 3 247 million in

2009 and EUR 3 197 million in 2008. In 2010, net cash from operating activities increased primarily

due to a decrease in net working capital partially offset by an increase in other financial income and

expenses, net. In 2009, net cash from operating activities increased primarily due to a decrease in net

working capital and a decrease in income taxes paid partially offset by decreased profitability.

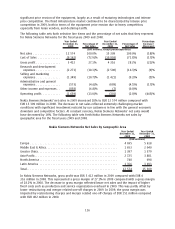

Net cash used in investing activities was EUR 2 421 million in 2010, compared with EUR 2 148 million

in 2009 and net cash from investing activities of EUR 2 905 million in 2008. Net cash used in

acquisitions of group companies, net of acquired cash, was EUR 110 million in 2010, compared with

EUR 29 million in 2009 and EUR 5 962 million in 2008 due to the acquisition of NAVTEQ. Cash flow

from investing activities in 2010 included purchases of current availableforsale investments, liquid

assets of EUR 8 573 million, compared with EUR 2 800 million in 2009 and EUR 669 million in 2008.

In 2010, net cash used in investing activities also included purchase of investments at fair value

through profit and loss, liquid assets of EUR 646 million, compared with EUR 695 million in 2009.

There were no additions to capitalized R&D expenses in 2010, compared with EUR 27 million addition

in 2009 and EUR 131 million addition in 2008.

Capital expenditures for 2010 were EUR 679 million, compared with EUR 531 million in 2009 and

EUR 889 million in 2008. Major items of capital expenditure included production lines, test equipment

and computer hardware used primarily in research and development, office and manufacturing

facilities as well as services and software related intangible assets.

118