Nokia 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275

|

|

Under the Finnish Companies Act, we may distribute retained earnings on our shares only upon a

shareholders’ resolution and subject to limited exceptions in the amount proposed by our Board of

Directors. The amount of any distribution is limited to the amount of distributable earnings of the

parent company pursuant to the last accounts approved by our shareholders, taking into account the

material changes in the financial situation of the company after the end of the last financial period

and a statutory requirement that the distribution of earnings must not result in insolvency of the

company. Subject to exceptions relating to the right of minority shareholders to request for a certain

minimum distribution, the distribution may not exceed the amount proposed by the Board of

Directors.

Share Buybacks

Under the Finnish Companies Act, Nokia Corporation may repurchase its own shares pursuant to

either a shareholders’ resolution or an authorization to the Board of Directors approved by the

company’s shareholders. The authorization may amount to a maximum of 10% of all the shares of

the company and its maximum duration is 18 months. Our Board of Directors has been regularly

authorized by our shareholders at the Annual General Meetings to repurchase Nokia’s own shares, and

during the past three years the authorization covered 370 million shares in 2008, 360 million shares

in 2009 and 360 million shares in 2010. The amount authorized each year has been at or slightly

under the maximum limit provided by the Finnish Companies Act. Nokia has not repurchased any of

its own shares since September 2008.

On January 27, 2011, we announced that the Board of Directors will propose that the Annual General

Meeting convening on May 3, 2011 authorize the Board to resolve to repurchase a maximum of

360 million Nokia shares. The proposed maximum number of shares that may be repurchased is the

same as the Board’s current share repurchase authorization and it corresponds to less than 10% of all

the shares of the company. The shares may be repurchased in order to develop the capital structure

of the Company, finance or carry out acquisitions or other arrangements, settle the company’s

equitybased incentive plans, be transferred for other purposes, or be cancelled. The shares may be

repurchased either through a tender offer made to all shareholders on equal terms, or through public

trading from the stock market. The authorization would be effective until June 30, 2012 and

terminate the current authorization for repurchasing of the Company’s shares resolved at the Annual

General Meeting on May 6, 2010.

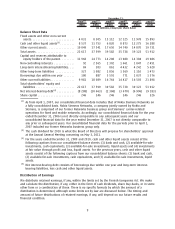

The table below sets forth actual share buybacks by the Group in respect of each fiscal year

indicated.

Number of shares

EUR millions

(in total)

2006 ..................................................... 212340000 3412

2007 ..................................................... 180590000 3884

2008 ..................................................... 157390000 3123

2009 ..................................................... — —

2010 ..................................................... — —

Cash Dividends

On January 27, 2011, we announced that the Board of Directors will propose for shareholders’

approval at the Annual General Meeting convening on May 3, 2011 a dividend of EUR 0.40 per share in

respect of 2010.

10