Nokia 2010 Annual Report Download - page 170

Download and view the complete annual report

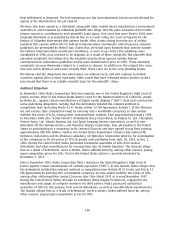

Please find page 170 of the 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We intend to pursue our CRT and LCD claims as appropriate in these matters in order to protect our

interests. However, the final outcome of the claims, including the ability to recover damages for any

overcharges paid, is uncertain due to the nature and inherent risks of such legal proceedings.

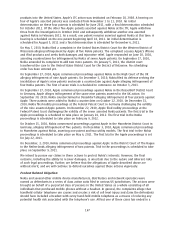

Agreement Related Litigation

We are also involved in arbitrations and several lawsuits with Basari Elektronik Sanayi ve Ticaret A.S.

(“Basari Elektronik”) and Basari Teknik Servis Hizmetleri Ticaret A.S. regarding claims associated with

the expiration of a product distribution agreement and the termination of a product service

agreement. Those matters have been before various courts and arbitral tribunals in Turkey and

Finland. Basari Elektronik claims that it is entitled to compensation for goodwill it generated on

behalf of Nokia during the term of the agreement and for Nokia’s alleged actions in connection with

the termination of the agreement. The compensation claim has been dismissed by the Turkish courts

and referred to arbitration. Basari Elektronik has filed for arbitration in Helsinki and Turkey. In October

2009, the arbitration in Helsinki was resolved in our favor while the arbitration in Turkey continues.

We believe that these claims are without merit, and will continue to defend ourselves against these

actions vigorously.

Securities Litigation

On February 5, 2010, a lawsuit was initiated by a municipal retirement fund in the United States

District Court for the Southern District of New York on behalf of itself, and seeking class action status

on behalf of purchasers of the American Depositary Shares, or ADSs, of Nokia between January 24,

2008 and September 5, 2008, inclusive (the “Class Period”), to pursue remedies under the Securities

Exchange Act of 1934 (the “Exchange Act”). An amended complaint was filed in the same lawsuit on

August 23, 2010 by a different municipal retirement fund that was appointed lead plaintiff. The

amended complaint names Nokia Corporation, and its former executives, OlliPekka Kallasvuo and

Richard Simonson as well as its current executive Kai O

¨ista

¨mo

¨, and claims violations of the Exchange

Act. In particular, the complaint alleges that throughout the Class Period, Nokia and the individual

defendants failed to disclose alleged material adverse facts about the Company’s business, including

specifically that: (i) Nokia was experiencing significant softwarerelated problems with the

development of its Symbian operating system, which were delaying scheduled product launch dates;

(ii) Nokia was allegedly losing market share because of intense price cuts by its competitors; and

(iii) the dynamics of the emerging Chinese market for mobile phones were changing. Plaintiff claims

that as a result of the above allegations, the price of Nokia ADSs dropped substantially. Plaintiff seeks

to recover damages on behalf of all purchasers of Nokia ADSs during the Class Period. A motion to

dismiss has been filed and is pending before the Court.

In addition, on April 19, 2010 and April 21, 2010 two individuals filed separate putative class action

lawsuits against Nokia Inc. and the directors and officers of Nokia Inc., and certain other employees

and representatives of the company, claiming to represent all persons who were participants in or

beneficiaries of the Nokia Retirement Savings and Investment Plan (the “Plan”) who participated in

the Plan between January 1, 2008 and the present and whose accounts included investments in Nokia

stock. The plaintiffs allege that the defendants failed to comply with their statutory and fiduciary

duties when they failed to remove Nokia stock as a plan investment option. The cases were

consolidated and an amended consolidated complaint was filed on September 15, 2010. The

amended complaint alleges that the named individuals knew of the matters alleged in the securities

case referenced above, that the matters significantly increased the risk of Nokia stock ownership, and

as a result of that knowledge, the named defendants should have removed Nokia stock as a Plan

investment option. A motion to dismiss has been filed and is pending before the Court.

We believe that the allegations described above are without merit, and we will continue to defend

ourselves against these actions vigorously.

169