Nokia 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 20-F 2010

Copyright © 2011. Nokia Corporation. All rights reserved.

Nokia and Nokia Connecting People are registered trademarks of Nokia Corporation.

Nokia Form 20-F 2010

FORM_20-F_2011.indd 1 11.3.2011 6.09

Table of contents

-

Page 1

Form 20-F 2010 Nokia Form 20-F 2010 -

Page 2

...executive offices) Ëš hlberg, Vice President, Assistant General Counsel Kaarina Sta Telephone: +358 (0)7 1800Â8000, Facsimile: +358 (0) 7 1803Â8503 Keilalahdentie 4, P.O. Box 226, FIÂ00045 NOKIA GROUP, Espoo, Finland (Name, Telephone, EÂmail and/or Facsimile number and Address of Company Contact... -

Page 3

... ...Directors and Senior Management ...Compensation ...Board Practices ...Employees...Share Ownership ...MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS ...Major Shareholders ...Related Party Transactions ...Interests of Experts and Counsel ...FINANCIAL INFORMATION ...Consolidated Statements and... -

Page 4

... ...Share Capital ...Memorandum and Articles of Association ...Material Contracts ...Exchange Controls...Taxation ...Dividends and Paying Agents ...Statement by Experts ...Documents on Display ...Subsidiary Information ...QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK ...DESCRIPTION OF... -

Page 5

... a hard copy of this annual report by calling the tollÂfree number 1Â877ÂNOKIAÂADR (1Â877Â665Â4223), or by directing a written request to Citibank, N.A., Shareholder Services, PO Box 43124, Providence, RI 02940Â5140, or by calling Nokia Investor Relations US Main Office at 1Â914Â368Â0555... -

Page 6

... strategic partnership with Microsoft to combine complementary assets and expertise to form a global mobile ecosystem and to adopt Windows Phone as our primary smartphone platform, including the expected plans and benefits of such partnership; • the timing and expected benefits of our new strategy... -

Page 7

...intellectual property rights of these technologies; the impact of changes in government policies, trade policies, laws or regulations and economic or political turmoil in countries where our assets are located and we do business; any disruption to information technology systems and networks that our... -

Page 8

... and benefits of the planned acquisition; Nokia Siemens Networks' ability to timely introduce new products, services, upgrades and technologies; Nokia Siemens Networks' success in the telecommunications infrastructure services market and Nokia Siemens Networks' ability to effectively and profitably... -

Page 9

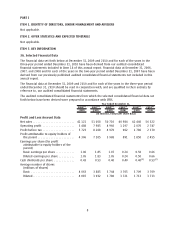

... OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS Not applicable. ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE Not applicable. ITEM 3. KEY INFORMATION 3A. Selected Financial Data The financial data set forth below at December 31, 2009 and 2010 and for each of the years in the threeÂyear period... -

Page 10

... basis. Nokia Siemens Networks, a company jointly owned by Nokia and Siemens, is comprised of our former Networks business group and Siemens' carrierÂrelated operations for fixed and mobile networks. Accordingly, our consolidated financial data for the year ended December 31, 2006 is not directly... -

Page 11

... tender offer made to all shareholders on equal terms, or through public trading from the stock market. The authorization would be effective until June 30, 2012 and terminate the current authorization for repurchasing of the Company's shares resolved at the Annual General Meeting on May 6, 2010. The... -

Page 12

...of New York (the "noon buying rate") on the respective dividend payment dates. EUR per share USD per ADS EUR millions (in total) 2006 2007 2008 2009 2010 (1) ... ... 0.43 0.53 0.40 0.40 0.40(1) 0.58 0.83 0.54 0.49 -(2) 1 1 1 1 1 685 992 481 483 498(3) The proposal of the Board of Directors for... -

Page 13

... under our control. We have also been working with Intel to develop a new smartphone platform, MeeGo, an openÂsourced platform focused on longerÂterm nextÂgeneration devices. Other smartphone platforms with their related ecosystems have gained significant momentum and market share, specifically... -

Page 14

... where we are weak. For example, our association with the Microsoft brand may impair our current strong market position in China and may not accelerate our access to a broader market in the United States. • New sources of revenue expected to be generated from the Microsoft partnership, such as 13 -

Page 15

...also decrease the value of our locationÂbased assets that might result in impairment charges. • We may not succeed in leveraging the Microsoft advertising assets to build and achieve the required scale for a NokiaÂbased online advertising platform on our smartphones that generates new sources of... -

Page 16

... be able to maintain the quality of our Symbian smartphones. • Under our new strategy, MeeGo becomes an openÂsource, mobile platform project. Our investment in MeeGo will emphasize longerÂterm market exploration of nextÂgeneration devices, platforms and user experiences. We plan to ship... -

Page 17

... to build a competitive and profitable global ecosystem of sufficient scale, attractiveness and value to all participants. The emergence of ecosystems in and around the mobile device market for smartphones represents the broad convergence of the mobility, computing, consumer electronics and services... -

Page 18

... type of ecosystem from that of smartphones is emerging around mobile phones involving very low cost components and manufacturing processes. Speed to market and attractive pricing are critical success factors in the mobile phones market. In particular, the availability of complete mobile solutions... -

Page 19

... to manufacture Nokia Windows Phone smartphones, source the right chipsets and generally integrate the hardware and software that both we and Microsoft will be contributing. Failures or delays in understanding or anticipating market trends or delays in innovation, product development and execution... -

Page 20

... new sources of revenues, such as advertising and subscriptions; or generally have been able to adjust their business models and operations in an effective and timely manner to the developing smartphone and related ecosystem market requirements. The availability and success of Google's free open... -

Page 21

... positively differentiate its digital map data and related locationÂbased content from similar offerings by our competitors and create competitive business models for our customers. In particular, the proposed Microsoft partnership business model to integrate our locationÂbased assets, including... -

Page 22

... and logistics, distribution and customer relations. The erosion of those strengths would impair our competitiveness in the mobile products market and our ability to execute successfully our new strategy and to realize fully the expected benefits of the proposed Microsoft partnership. Also, as... -

Page 23

... functional components, subÂassemblies and software on favorable terms and for their compliance with our supplier requirements could materially adversely affect our ability to deliver our mobile products profitably and on time. Our manufacturing operations depend on obtaining sufficient quantities... -

Page 24

... our manufacturing processes to accommodate the production of devices in smaller lot sizes to customize devices to the specifications of certain mobile networks operators or to comply with regional technical standards. Further, we may experience challenges in having our services and related software... -

Page 25

... sales, results of operations, reputation and the value of the Nokia brand. Our products are highly complex, and defects in their design, manufacture and associated hardware, software and content have occurred and may occur in the future. Due to the very high production volumes of many of our mobile... -

Page 26

... improve our market position and scale compared to our competitors across the range of our products, as well as leverage our scale to the fullest extent, or if we are unable to develop or otherwise acquire software, applications and content cost competitively in comparison to our competitors, or if... -

Page 27

... diverse markets in terms of the number of new mobile subscribers, the number of existing subscribers who upgrade or replace their existing mobile devices and the number of active users of applications and services on our devices. In certain low penetration markets, in order to support a continued... -

Page 28

... and related services. If we and the other market participants are not successful in our attempts to increase subscriber numbers, stimulate increased usage or drive upgrade and replacement sales of mobile devices and develop and increase demand for valueÂadded services, or if mobile network... -

Page 29

... our consolidated financial statements included in Item 18 of this annual report. Our products include increasingly complex technologies, some of which have been developed by us or licensed to us by certain third parties. As a consequence, evaluating the rights related to the technologies we use or... -

Page 30

... licensing terms may have a material adverse effect on the cost or timing of contentÂrelated services offered by us, mobile network operators or thirdÂparty service providers, and may also indirectly affect the sales of our mobile devices. Since all technology standards, including those used... -

Page 31

... to Nokia Siemens Networks' corporate structure, including a sale of Nokia Siemens Networks' shares by one or both of its current shareholders, Nokia Siemens Networks may be unable to rely on some of its existing licenses. There can be no assurance that such licenses could be replaced on terms that... -

Page 32

... security clearance requirements in India which prevented the completion of product sales to customers, and could be similarly affected again in 2011, leading to ongoing uncertainty in that market. See Note 2 to our consolidated financial statements included in Item 18 of this annual report for more... -

Page 33

...of sources. We pursue various measures in order to manage our risks related to system and network malfunction and disruptions, including the use of multiple suppliers and available information technology security. However, despite precautions taken by us, any malfunction or disruption of our current... -

Page 34

... Networks announced in 2009 a plan designed to improve its financial performance and market position and increase profitability. The plan included a reorganization of Nokia Siemens Networks' business units to provide a more customerÂfocused structure, which came into effect on January 1, 2010... -

Page 35

... or governmental support, for example in the form of trade guarantees, allowing them to offer products and services at very low prices or with attractive financing terms. Nokia Siemens Networks also faces increasing competition from the entry into the market of low cost competitors from China... -

Page 36

... competitors or otherwise, our business, sales, results of operations, particularly profitability, and financial condition may be materially adversely affected. In addition, Nokia Siemens Networks has expanded its enterprise mobility infrastructure as well as its managed service, systems integration... -

Page 37

... loss of key employees of the acquired business. • The risk of diverting the attention of senior management from Nokia Siemens Networks' operations. • The risks associated with integrating financial reporting and internal control systems. • Difficulties in expanding information technology... -

Page 38

... successfully develop recognition as a software and services company and acceptance of its services offering in that market, an ability to maintain efficient and low cost operations, delays in implementing initiatives, further consolidation of Nokia Siemens Networks' customers, increased competition... -

Page 39

... also require extended payment terms. In some cases, the amounts and duration of these financings and trade credits, and the associated impact on Nokia Siemens Networks' working capital, may be significant. In response to the tightening of the credit markets in 2009 and 2010, requests for customer... -

Page 40

...one another with a Nokia, from our most affordable voiceÂoptimized mobile phones to advanced InternetÂconnected smartphones sold in virtually every market in the world. Through Ovi, people also enjoy access to maps and navigation on mobile, a rapidly expanding applications store, a growing catalog... -

Page 41

... than 160 countries; and a global network of sales, customer service and other operational units. History During our 146 year history, Nokia has evolved from its origins in the paper industry to become a world leader in mobile communications. Today, Nokia brings mobile products and services to more... -

Page 42

... our speed of execution in the intensely competitive mobile products market. The main elements of the new strategy include: plans for a broad strategic partnership with Microsoft to build a new global mobile ecosystem, with Windows Phone serving as Nokia's primary smartphone platform; a renewed... -

Page 43

... and Mobile Phones within Devices & Services, NAVTEQ and Nokia Siemens Networks. NAVTEQ is a leading provider of comprehensive digital map information and related locationÂbased content and services for mobile navigation devices, automotive navigation systems, InternetÂbased mapping applications... -

Page 44

... execution in an intensely competitive mobile products market. The main elements of our new strategy are as follows. Smartphones: We plan to form a broad strategic partnership with Microsoft that would combine our respective complementary assets and expertise to build a new global mobile ecosystem... -

Page 45

...our new strategy and changes in operational structure for our Devices & Services business, effective April 1, 2011, in order to align with the financial segment reporting and related operating and financial review discussion through December 31, 2010 contained in this annual report. Mobile Phones We... -

Page 46

... 2010, Nokia also offered a product built on the LinuxÂbased Maemo operating system. We make smartphones for a broad range of consumer groups, addressing the market for featureÂrich mobile devices offering Internet access, entertainment, locationÂbased and other services, applications and content... -

Page 47

...through the Nokia Ovi Suite software for desktop computers, as well as at www.ovi.com, giving Nokia users easy access to, for example, popular applications and games, in our view the world's best maps and navigation through a mobile device, a music store with millions of music tracks, free email and... -

Page 48

... email services providers directly to the user's device. By March 2011, Nokia Messaging was available in more than 200 countries and territories, covering more than 600 operator networks. Another area of focus is our strategic alliance with Microsoft to design and market a suite of productivity... -

Page 49

...In 2010, sales in North America and Latin America were predominantly to operator customers, sales in AsiaÂPacific, China and Middle East and Africa were predominantly to distributors, and sales in Europe were more evenly distributed between operators and distributors. Marketing: Devices & Services... -

Page 50

... of assets and competencies in technology areas that we believe will be vital to our future success. In recent years, the Nokia Research Center has been a contributor to almost half of Nokia's standard essential patents. The center works closely with Devices & Services and Nokia Siemens Networks and... -

Page 51

... into radio technologies. Another example of Nokia Research Center's research is High Accuracy Indoor Positioning (HAIP), which provides precise indoor location information on a handset without needing GPS, and could enable new services, such as precise routing and navigation inside a building, as... -

Page 52

...competing directly with one another, making for an intensely competitive market across all mobile products and services. At the same time, and particularly in the smartphone and tablets segments, success for hardware manufacturers is increasingly shaped by their ability to build, catalyze or be part... -

Page 53

... limited afterÂsales services, that take advantage of commerciallyÂavailable free software and other free or low cost components, software and content. In addition, we compete with nonÂbranded mobile phone manufacturers, including mobile network operators, which offer mobile devices under their... -

Page 54

...in 100 markets. Since introducing this offering, Nokia's Devices & Services has increased its use of data and its purchases of map licenses from NAVTEQ, boosting NAVTEQ's core business and revenues. Under our planned agreement with Microsoft, Nokia and Microsoft would combine complementary assets in... -

Page 55

...navigation systems, as well as through GPSÂenabled handheld navigation devices, and other mobile devices. • Route planning consists of driving directions, route optimization and map display through services provided by Internet portals and through computer software for personal and commercial use... -

Page 56

... media to automobile manufacturers and dealers or directly to endÂusers, as well as a complete range of services, including inventory management, order processing, onÂline credit card processing, multiÂcurrency processing, localized VAT handling and consumer call center support. NAVTEQ licenses... -

Page 57

... competitors have different business models. For example, Google uses an advertisingÂbased model allowing consumers and companies to use its map data and related services in their products free of change, TomTom licenses its map data, while Open Street Map is a community generated open source map... -

Page 58

... terms of the agreement, Nokia Siemens Networks will acquire assets related to the development, manufacture and sale of CDMA, WiMAX, WCDMA, LTE and GSM products and services, as well as approximately 7 500 employees and assets in 63 countries, including research and development sites in the United... -

Page 59

...Âvendor systems integration. Global Services consists of three businesses: • Managed Services offers network planning and optimization and the management of network operations, with the leading market share position in India, Latin America and the Middle East and Africa. • Care offers software... -

Page 60

...Customer Operation unit oversees and executes sales and product marketing at Nokia Siemens Networks. Prior to January 1, 2011, the Customer Operations unit was organized into eight regions: APAC, Greater China, India, Latin America, Middle East/Africa, North America, North East Europe and West South... -

Page 61

... management of all Nokia Siemens Networks' hardware, software and original equipment manufacturer (OEM) products. This includes supply planning, manufacturing, distribution, procurement, logistics, demand/supply network design and delivery capability creation in product programs. At the end of 2010... -

Page 62

... was preventing the completion of product sales to customers, further impacted the market. Based on preliminary estimates, Nokia and Nokia Siemens Networks believe the market for mobile and fixed infrastructure and related services was approximately flat in euro terms in 2010, compared to 2009. 61 -

Page 63

... to enable them to successfully address the challenges and opportunities of mobile broadband, smartphones, multiÂplay offerings, service innovation and new growth areas. In this area, Nokia Siemens Networks faces competition from information technology and software businesses like Accenture, Amdocs... -

Page 64

...a strategic market requirement, it primarily arranged and facilitated, and plans to continue to arrange and facilitate, financing to a number of customers, typically supported by Export Credit or Guarantee Agencies. Seasonality-Devices & Services, NAVTEQ and Nokia Siemens Networks For information on... -

Page 65

..., voice dialing, textÂtoÂspeech processing and enhanced personalization options more accessible for more people. Nokia also supports the GSM Association's mWomen program, which seeks to narrow the gender gap in mobile device ownership in emerging markets. Health and Safety of Product Use Product... -

Page 66

... relating to the Nokia Code of Conduct and business ethics. The Ethics Office also supports NAVTEQ employees. There are various channels for reporting violations of the Code of Conduct. Employees may also report violations directly to the Board of Directors anonymously. Nokia Siemens Networks... -

Page 67

...webÂbased information management system to help companies collect, manage, and analyze social and environmental responsibility data from their supply chain. Nokia also uses this self assessment tool for its suppliers. At December 31, 2010, Nokia Siemens Networks had 2 081 employees working directly... -

Page 68

... also require suppliers to have Environmental Management Systems in place. In 2010, 91.7% of our direct hardware suppliers' sites serving Nokia were certified to ISO 14001. In 2010, to obtain a broader overview on working conditions at our suppliers, we introduced four new metrics related to health... -

Page 69

... standards in the information and communications technology (ICT) supply chain through groups such as the GeSI. By the end of 2010, 18 key suppliers representing 16% of Nokia Siemens Networks supplier spend had joined EÂTASC, a common industry supplier assessment and auditing tool developed by the... -

Page 70

... supply chains. Communication of the policy to suppliers started in 2010. Society-Corporate Responsibility Corporate Social Investment Strategy Used by the vast majority of the world's population, mobile phones have become recognized as a useful means by which to deliver critical social services... -

Page 71

... the availability of Nokia Data Gathering under an open source license. This software suite replaces traditional dataÂgathering methods (such as paper questionnaires) with mobile phones, improving results and saving time and money. The open source software has positively impacted adoption among... -

Page 72

... consumed through the entire product lifecycle-by up to 65%, while also introducing new features and capabilities that allow the mobile phone to be used in many other ways than just for calling. Our latest smartphone models-the Nokia C7, Nokia C6Â01, Nokia E7 and Nokia N8-represent an important... -

Page 73

... and resultant GHG emissions by exploiting more efficient technology and renewable energy. By the end of 2010 Nokia Siemens Networks had deployed more than 390 sites running on renewable energy in 25 countries encompassing AsiaÂPacific, China, Europe, Middle East, Africa and Latin America. 72 -

Page 74

... to approximately 2 million tons of CO2 annually compared to the 2007 level. During 2010 Nokia Siemens Networks has highlighted the positive environmental impact information technology solutions can have in other industry sectors. Nokia Siemens Networks is offering solutions for the utilities sector... -

Page 75

... key officers and the majority of the members of its Board of Directors and, accordingly, Nokia consolidates Nokia Siemens Networks. 4D. Property, Plants and Equipment At December 31, 2010, Nokia operated ten manufacturing facilities in nine countries for the production of mobile devices, and Nokia... -

Page 76

...full year 2008. As of April 1, 2011, we will have a new operational structure, which features two distinct business units in Devices & Services business: Smart Devices and Mobile Phones. They will focus on our key business areas: smartphones and massÂmarket mobile phones. Each unit will have profit... -

Page 77

... product development, product management and product marketing. Starting April 1, 2011, we will present our financial information in line with the new organizational structure and provide financial information for our three businesses: Devices & Services, NAVTEQ and Nokia Siemens Networks. Devices... -

Page 78

... position and longer term financial performance. We expect 2011 and 2012 to be transition years, as we transition to Windows Phone as our primary smartphone platform and we invest in building a new ecosystem with Microsoft. During this transition, we believe that our Devices & Services business... -

Page 79

... connected devices and related services has created new opportunities to capture value from the traditional mobile phone market as well as adjacent industries. As a result, in volume and value terms smartphones are capturing the major part of the growth and public focus in the mobile device market... -

Page 80

...combine our services assets to drive innovation and new sources of revenues. Nokia Maps, for example, would be at the heart of key Microsoft assets like Bing and AdCenter, and Nokia's application and content store would be integrated into Microsoft Marketplace for Nokia Windows Phone smartphones. We... -

Page 81

... specialists. For example, by making assets such as our locationÂbased services and a number of Microsoft's web assets available for other original equipment manufacturers and partners to use, we aim to bring further scale to our ecosystem, an important driver of future advertising based revenue... -

Page 82

...and market position. Nokia has the industry's largest distribution network with over 650 000 points of sale globally. Compared to our competitors, we have a substantially larger distribution and care network, particularly in China, India and Middle East and Africa. • Intellectual property: Success... -

Page 83

... limited afterÂsales services, that take advantage of commerciallyÂavailable free software and other free or low cost components, software and content. In addition, we compete with nonÂbranded mobile phone manufacturers, including mobile network operators, which offer mobile devices under their... -

Page 84

... payments to Microsoft to license Windows Phone as our primary smartphone platform; our current Symbian smartphone platform is royaltyÂfree to us. This will increase our cost of sales and lower the gross margin in our devices and services business. Accordingly, we plan to adjust our cost structure... -

Page 85

... of NAVTEQ's digital map data and related locationÂbased content and services for use in mobile devices, inÂvehicle navigation systems, Internet applications, geographical information system applications and other locationÂbased products and services. NAVTEQ's success depends upon the development... -

Page 86

... existing map data and add an increasing list of new locationÂbased content and services, as well as using innovative ways like crowd sourcing to collect data. The trends for such locationÂbased content and services include realÂtime updates to location information, more dynamic information, such... -

Page 87

..., such as text messaging, endÂusers are beginning to access a wealth of media services through communications networks, including email and other business data; entertainment services, including games and music; visual media, including films and television programming; and social media sites. End... -

Page 88

... and Brazil to support the move towards managed services in those regions. These new global operations centers are expected to open in the first half of 2011. Increasingly, Nokia Siemens Networks is addressing opportunities in multiÂvendor network management, where the customer network might 87 -

Page 89

... terms of the agreement, Nokia Siemens Networks will acquire assets related to the development, manufacture and sale of CDMA, WiMAX, WCDMA, LTE and GSM products and services, as well as approximately 7 500 employees and assets in 63 countries, including large development sites in the United States... -

Page 90

..., services, customer experience management, and addressing the competition from internet players. Nokia Siemens Networks will need to continue to leverage and, in some cases, improve its scale, technology and product portfolio to maintain or improve its position in the market. Nokia Siemens Networks... -

Page 91

... impact our competitive position and related price pressures through their impact on our competitors. For a discussion on the instruments used by Nokia in connection with our hedging activities, see Note 35 to our consolidated financial statements included in Item 18 of this annual report. See also... -

Page 92

... the company's speed of execution in the intensely competitive mobile product market. The main elements of our new strategy includes: plans for a broad strategic partnership with Microsoft to build a new global mobile ecosystem, with Windows Phones serving as Nokia's primary smartphone platform... -

Page 93

... the transaction closes, including large research and development sites in the United States, China and India. As part of the transaction, Nokia Siemens Networks expects to enhance its capabilities in key wireless technologies, including WiMAX and CDMA, and to strengthen its market position in key... -

Page 94

... customer financing. The financial impact of the customer financing related assumptions mainly affects the Nokia Siemens Networks segment. See also Note 35(b) to our consolidated financial statements included in Item 18 of this annual report for a further discussion of longÂterm loans to customers... -

Page 95

... inventory was EUR 301 million at the end of 2010 (EUR 361 million at the end of 2009). The financial impact of the assumptions regarding this allowance affects mainly the cost of sales of the Devices & Services and Nokia Siemens Networks segments. Warranty Provisions We provide for the estimated... -

Page 96

..., terminal values, the number of years on which to base the cash flow projections, as well as the assumptions and estimates used to determine the cash inflows and outflows. Management determines discount rates to be used based on the risk inherent in the related activity's current business model and... -

Page 97

..., terminal values, the number of years on which to base the cash flow projections, as well as the assumptions and estimates used to determine the cash inflows and outflows. Management determines discount rates to be used based on the risk inherent in the related activity's current business model and... -

Page 98

... for the Devices & Services CGU and NAVTEQ CGU are determined based on a value in use calculation. The cash flow projections employed in the value in use calculation are based on financial plans approved by management. These projections are consistent with external sources of information, whenever... -

Page 99

... CGU in the annual goodwill impairment testing for each year indicated are presented in the table below: CashÂgenerating Unit Devices & Services % 2010 2009 2008 2010 Nokia Siemens Networks % 2009 2008 2010 NAVTEQ % 2009 2008 Terminal growth rate ...2.0 PreÂtax discount rate ...11.1 (1) 2.0 11... -

Page 100

... and our future expense. The financial impact of the pension assumptions affects mainly the Devices & Services and Nokia Siemens Networks segments. ShareÂbased Compensation We have various types of equity settled shareÂbased compensation schemes for employees. Employee services received, and the... -

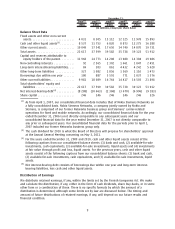

Page 101

...2010 had a positive effect on our net sales. The following table sets forth the distribution by geographical area of our net sales for the fiscal years 2010 and 2009. Year Ended December 31, 2010 2009 Europe ...Middle East & Africa ...Greater China ...AsiaÂPacific ...North America ...Latin America... -

Page 102

... resulted from a decrease in the operating losses at Nokia Siemens Networks and NAVTEQ somewhat offset by a lower operating profit in Devices & Services. Our operating margin was 4.9% in 2010, compared with 2.9% in 2009. Our operating profit in 2010 included purchase price accounting items and other... -

Page 103

... million in 2010, compared with loss attributable to nonÂcontrolling interests of EUR 631 million in 2009. This change was primarily due to a decrease in Nokia Siemens Networks' losses. Profit Attributable to Equity Holders of the Parent and Earnings per Share. Profit attributable to equity holders... -

Page 104

... for industry mobile device volumes and yearÂonÂyear growth rate by geographic area for the fiscal years 2010 and 2009. Year Ended Year Ended December 31, Change December 31, (1) 2010 2009 to 2010 2009 (Units in millions, except percentage data) Europe ...Middle East & Africa ...Greater China... -

Page 105

... table sets forth our mobile device volumes and yearÂonÂyear growth rate by geographic area for the fiscal years 2010 and 2009. Year Ended Year Ended December 31, December 31, Change 2010 2009 to 2010 2009 (Units in millions, except percentage data) Europe ...Middle East & Africa ...Greater China... -

Page 106

...United States offset to some extent by our market share increase in Canada. In Greater China, we continued to benefit from our brand, broad product portfolio and extensive distribution system during 2010. Average Selling Price. The following table sets forth our mobile device ASP and yearÂonÂyear... -

Page 107

... 7.9% of Devices & Services net sales, compared with 8.5% of its net sales in 2009. Other operating income and expenses were EUR 170 million in 2010 and included restructuring charges of EUR 85 million, a prior yearÂrelated refund of customs duties of EUR 61 million, a gain on sale of assets and... -

Page 108

... East & Africa 6% (4%), AsiaÂPacific 7% (3%), Latin America 2% (2%) and Greater China 9% (1%) in 2010 (2009). The yearÂonÂyear increase in net sales was primarily driven by growth in mobile device sales, particularly Nokia mobile devices, improved sales of map licenses to mobile device customers... -

Page 109

... sets forth Nokia Siemens Networks net sales and yearÂonÂyear growth rate by geographic area for the fiscal years 2010 and 2009. Year Ended Year Ended December 31, Change December 31, 2010 2009 to 2010 2009 (EUR millions, except percentage data) Europe ...Middle East & Africa ...Greater China... -

Page 110

... billion in 2009). Europe accounted for 37% (37%) of Nokia Siemens Network's net sales, AsiaÂPacific 23% (22%), Middle East & Africa 11% (13%), Latin America 12% (11%), Greater China 11% (11%) and North America 6% (6%) in 2010 (2009). Profitability. Nokia Siemens Networks gross profit decreased to... -

Page 111

... years 2009 and 2008. Year Ended December 31, 2009 2008 Europe ...Middle East & Africa ...Greater China ...AsiaÂPacific ...North America ...Latin America... ... 36% 14% 16% 22% 5% 7% 37% 14% 13% 22% 4% 10% Total ... 100% 100% The 10 markets in which we generated the greatest net sales in 2009... -

Page 112

...net sales in Devices & Services and Nokia Siemens Networks which was partially offset by a decrease in sales and marketing expenses in Devices & Services. In 2009, selling and marketing expenses included restructuring charges of EUR 12 million and EUR 401 million of purchase price accounting related... -

Page 113

... the industry mobile device market used in 2009 and 2008. Year Ended Year Ended December 31, December 31, Change (*) 2009 2008 2008 to 2009 (Units in millions, except percentage data) Europe ...Middle East & Africa ...Greater China ...AsiaÂPacific ...North America ...Latin America...Total ... 107... -

Page 114

... and Argentina. Our market share declined in North America in 2009 primarily due to a market share decline in the United States. In Greater China, Nokia continued to benefit from its brand, broad product portfolio and extensive distribution system during 2009. Nokia's device ASP in 2009 was EUR 63... -

Page 115

...on the sale of the security appliance business of EUR 68 million. In 2008 other operating income and expenses of EUR 520 million included EUR 392 million of restructuring charges primarily related to the closure of the Bochum site in Germany. In 2009, Devices & Services operating profit decreased 43... -

Page 116

... intangible assets recorded as part of Nokia's acquisition of NAVTEQ, which was partially offset by profits from NAVTEQ's ongoing business. Nokia Siemens Networks According to our estimates, the mobile infrastructure market declined by about 5% in euro terms in 2009 compared to 2008 with the trend... -

Page 117

... Siemens Networks net sales by geographic area for the fiscal years 2009 and 2008. Nokia Siemens Networks Net Sales by Geographic Area Year Ended Year Ended December 31, December 31, 2008 2009 (EUR millions) Europe ...Middle East & Africa...Greater China ...AsiaÂPacific...North America ...Latin... -

Page 118

...lower cost countries. In 2009, R&D expenses included restructuring charges and other items of EUR 30 million (EUR 46 million in 2008) and purchase price accounting related items of EUR 180 million (EUR 180 million in 2008). In 2009, Nokia Siemens Networks' selling and marketing expenses decreased to... -

Page 119

... in 2010 included purchases of current availableÂforÂsale investments, liquid assets of EUR 8 573 million, compared with EUR 2 800 million in 2009 and EUR 669 million in 2008. In 2010, net cash used in investing activities also included purchase of investments at fair value through profit and loss... -

Page 120

...liquid assets in 2010 reflected positive operational cash flow partially offset by the dividend payment and capital expenditures. For further information regarding our longÂterm liabilities, see Note 16 to our consolidated financial statements included in Item 18 of this annual report. Our ratio of... -

Page 121

...on commercially acceptable terms. We primarily invest in research and development, marketing and building the Nokia brand. However, over the past few years we have increased our investment in services and software by acquiring companies with specific technology assets and expertise. In 2010, capital... -

Page 122

.... In 2009, our total structured financing, outstanding and committed, decreased to EUR 159 million from EUR 327 million in 2008 and primarily consisted of committed financing to network operators. See Note 35(b) to our consolidated financial statements included in Item 18 of this annual report for... -

Page 123

... 2010, Devices & Services R&D expenses included EUR 10 million of purchase price accounting related items compared to EUR 8 million in 2009. In 2008, Devices & Services R&D expenses included EUR 153 million representing the contribution of the assets to the Symbian Foundation. In 2010, Nokia Siemens... -

Page 124

... Association, the control and management of Nokia is divided among the shareholders at a general meeting, the Board of Directors (or the "Board"), the President, and the Nokia Leadership Team (formerly the Group Executive Board) chaired by the Chief Executive Officer. Board of Directors The current... -

Page 125

... merged with ICICI Bank Ltd in 2002). Deputy Managing Director of ICICI Limited 1996Â1999. Executive Director on the Board of Directors of ICICI Limited 1994Â1996. Various leadership positions in Corporate and Retail Banking, Strategy and Resources, and International Banking in ICICI Limited since... -

Page 126

... since 2007. Member of the Personnel Committee. Ph.D. (Theoretical Physics) (Technical University of Brunswick). CoÂCEO and Chairman of the Executive Board of SAP AG 2008Â2009. CEO of SAP 2003Â2008. CoÂchairman of the Executive Board of SAP AG 1998Â2003. A number of leadership positions in... -

Page 127

..., Paris). Director of Shared Services of L'Oréal Group 2010Â2011. Chief Financial Officer, Executive Vice President in charge of strategy of PSA Peugeot Citroën 2007Â2009. COO, Intellectual Property and Licensing Business Unit of Thomson 2006Â2007. Vice President Corporate Planning at Saint... -

Page 128

... of the Nokia Board of Directors for the same oneÂyear term ending at the close of the Annual General Meeting in 2012. The Committee will also propose the election of Stephen Elop, President and CEO of Nokia Corporation, to the Nokia Board of Directors for the same oneÂyear term. The Committee... -

Page 129

...COO, Juniper Networks, Inc. 2007Â2008. President, Worldwide Field Operations, Adobe Systems Inc. 2005Â2006. President and CEO (last position), Macromedia Inc. 1998Â2005. Chairman of the Board of Directors of NAVTEQ Corporation. Esko Aho, b. 1954 Executive Vice President, Corporate Relations and... -

Page 130

... Marketing, Asia Pacific, Nokia 1994Â1997. Management positions in several telecommunications companies in Australia and the United Kingdom. Richard Green, b. 1955 Executive Vice President, Chief Technology Officer. Nokia Leadership Team member since February 11, 2011. Joined Nokia on May 3, 2010... -

Page 131

... 2010. Senior Vice President, Smartphones Product Management, Nokia 2009. Vice President, Live Category, Nokia 2008Â2009. Senior Vice President, Marketing, Mobile Phones, Nokia 2006Â2007. Vice President, Marketing, North America, Mobile Phones, Nokia 2003Â2005. Marketing, sales and management... -

Page 132

...). Executive Vice President, Services, Nokia 2007Â2010. Executive Vice President, Technology Platforms, Nokia 2006Â2007. Senior Vice President and General Manager of Nokia Enterprise Solutions, Mobile Devices Business Unit 2003Â2006. Senior Vice President, Nokia Mobile Software, Market Operations... -

Page 133

...Technology). Executive Vice President, Devices, Nokia 2007Â2010. Executive Vice President and General Manager of Mobile Phones, Nokia 2005Â2007. Senior Vice President, Business Line Management, Mobile Phones, Nokia 2004Â2005. Senior Vice President, Mobile Phones Business Unit, Nokia Mobile Phones... -

Page 134

... Nokia's policy that nonÂexecutive members of the Board do not participate in any of Nokia's equity programs and do not receive stock options, performance shares, restricted shares or any other equityÂbased or otherwise variable compensation for their duties as Board members. The former President... -

Page 135

... paid in Nokia shares purchased from the market and the remaining approximately 60% is paid in cash. Not applicable to any nonÂexecutive member of the Board of Directors. Not applicable to the former President and CEO with respect to his service as a member of the Board of Directors. Represents the... -

Page 136

... success and industry leadership worldwide. Our compensation programs are designed to promote sustainability and longÂterm value creation of the company and to ensure that remuneration is based on performance. Our compensation program for executive officers includes: • competitive base pay rates... -

Page 137

... of Nokia's executive officers or recommending the compensation of the President and CEO to the Board: • the compensation levels for similar positions (in terms of scope of position, revenues, number of employees, global responsibility and reporting relationships) in relevant comparison companies... -

Page 138

... market levels. The Personnel Committee evaluates and weighs as a whole the appropriate salary levels based on both our US and European peer companies. ShortÂterm cash incentives are an important element of our variable pay programs and are tied directly to Nokia's and the individual executives... -

Page 139

... and CEO until September 20, 2010. For Stephen Elop, President and CEO from September 21, 2010, shortÂterm incentive target is 150% of base pay, paid to him pro rata for year 2010, based on his hire date. Total shareholder return reflects the change in Nokia's share price during an established time... -

Page 140

...impact on the competitiveness of the executive's compensation package in that market. Performance shares are Nokia's main vehicle for longÂterm equityÂbased incentives and reward the achievement of both Nokia's longÂterm financial results and an increase in share price. Performance shares vest as... -

Page 141

... January 1, 2010. Information on the actual equityÂbased incentives granted to the members of our Group Executive Board in 2010 is included in Item 6E. "Share Ownership." Actual Executive Compensation for 2010 Service Contracts Stephen Elop's service contract covers his position as President and... -

Page 142

... Mr. Elop's compensation to increased shareholder value and will link a meaningful portion of his compensation directly to the performance of Nokia's share price over the next two years. To participate in this new program, Mr. Elop will invest during 2011 and 2012 a portion of his shortÂterm cash... -

Page 143

...Nokia Leadership Team participate in the local retirement programs applicable to employees in the country where they reside. Executives in Finland, including Mr. Elop, President and CEO, participate in the Finnish TyEL pension system, which provides for a retirement benefit based on years of service... -

Page 144

... terminates with Nokia prior to vesting. The settlement is conditional upon performance and/or service conditions, as determined in the relevant plan rules. For a description of our equity plans, see Note 24 to our consolidated financial statements included in Item 18 of this annual report. At... -

Page 145

... as Executive Vice President, Mobile Phones until June 30, 2010. Bonus payments are part of Nokia's shortÂterm cash incentives. The amount consists of the bonus earned and paid or payable by Nokia for the respective fiscal year. Amounts shown represent the grant date fair value of equity grants... -

Page 146

...: EUR 4 623 750 as severance payment as describe under his service agreement, see ''-Actual Executive Compensation for 2010- Service Contracts ''above; EUR 748 000 as compensation for the fair market value of the 100 000 Nokia restricted shares granted to him in 2007, which were to vest on October... -

Page 147

... executives and employees participate in these plans. Our compensation programs promote longÂterm value creation and sustainability of the company and ensure that remuneration is based on performance. Performance shares are the main element of the company's broadÂbased equity compensation program... -

Page 148

... promoting the longÂterm financial success of the company. The equityÂbased compensation programs are intended to align the potential value received by participants directly with the performance of Nokia. We also have granted restricted shares to a small selected number of key employees each year... -

Page 149

... in the terms and conditions of the stock option plan, which are approved by the shareholders at the respective Annual General Meeting. The Board of Directors does not have the right to change how the exercise price is determined. Shares will be eligible for dividend for the financial year in which... -

Page 150

... 24 to our consolidated financial statements included in Item 18 of this annual report. Nokia EquityÂBased Incentive Program 2011 On January 27, 2011, the Board of Directors approved the scope and design of the Nokia Equity Program 2011, subject to the approval of the Stock Option Plan 2011 by the... -

Page 151

... 31, 2013. Until the Nokia shares are delivered, the participants will not have any shareholder rights, such as voting or dividend rights associated with these performance shares. Stock Options The Board of Directors will make a proposal for Stock Option Plan 2011 to the Annual General Meeting... -

Page 152

... or dividend rights associated with these restricted shares. Maximum Planned Grants under the Nokia EquityÂBased Incentive Program 2011 in Year 2011 The maximum number of planned grants under the Nokia Equity Program 2011 (i.e. performance shares, stock options and restricted shares) in 2011 are... -

Page 153

... of the Board Chairman was evaluated in a process led by the Vice Chairman. Pursuant to the Articles of Association, Nokia Corporation has a Board of Directors composed of a minimum of seven and a maximum of 12 members. The members of the Board are elected for a oneÂyear term at each Annual General... -

Page 154

... of the New York Stock Exchange due to a family relationship with an executive officer of a Nokia supplier of whose consolidated gross revenue from Nokia accounts for an amount that exceeds the limit provided in the New York Stock Exchange rules, but that is less than 5%. The Board has determined... -

Page 155

... our employees, directors and management and is accessible on our website, www.nokia.com. In addition, we have a Code of Ethics for the Principal Executive Officers and the Senior Financial Officers. For more information about our Code of Ethics, see Item 16B. "Code of Ethics." At December 31, 2010... -

Page 156

... three to five members of the Board who meet all applicable independence requirements of Finnish law and the rules of the stock exchanges where Nokia shares are listed, including NASDAQ OMX Helsinki and the New York Stock Exchange. Since May 6, 2010, the Corporate Governance and Nomination Committee... -

Page 157

... 099 359 427 614 Nokia Group ...129 355 Finland ...Other European countries ...MiddleÂEast & Africa ...China ...AsiaÂPacific ...North America ...Latin America ...20 35 4 18 26 8 14 956 175 628 923 976 128 569 Nokia Group ...129 355 (1) 123 171 121 723 Nokia completed the acquisition of NAVTEQ... -

Page 158

...performance shares, stock options and restricted shares. For a description of our equityÂbased compensation programs for employees and executives, see Item 6B. "Compensation-EquityÂBased Compensation Programs." The following report discusses executive compensation in 2010 when the Nokia Leadership... -

Page 159

... former Group Executive Board members who left during 2010. The percentage is calculated in relation to the outstanding number of shares and total voting rights of the company, excluding shares held by Nokia Group. The percentage is calculated in relation to the total outstanding equity incentives... -

Page 160

... Group Executive Board as of December 31, 2010. These stock options were issued pursuant to Nokia Stock Option Plans 2005 and 2007. For a description of our stock option plans, please see Note 24 to our consolidated financial statements in Item 18 of this annual report. Exercise Price per Share (EUR... -

Page 161

... value of the stock options is based on the difference between the exercise price of the options and the closing market price of Nokia shares on NASDAQ OMX Helsinki as at December 30, 2010 of EUR 7.74. For gains realized upon exercise of stock options for the members of the Group Executive Board... -

Page 162

... Share Plans 2008, 2009 and 2010 and Restricted Share Plans 2007, 2008, 2009 and 2010. For a description of our performance share and restricted share plans, please see Note 24 to the consolidated financial statements in Item 18 of this annual report. Performance Shares Number of Performance Shares... -

Page 163

... restriction period will end for the 2007 plan, on January 1, 2011; for the 2008 plan, on January 1, 2012; for the 2009 plan, on January 1, 2013; and for the 2010 plan, on January 1, 2014. The intrinsic value is based on the closing market price of a Nokia share on NASDAQ OMX Helsinki as at December... -

Page 164

...reach the threshold level of either performance criteria. Delivery of Nokia shares vested from the Restricted Share Plan 2007. Value is based on the closing market price of the Nokia share on NASDAQ OMX Helsinki on October 27, 2010 of EUR 7.86. During 2010, the following executives stepped down from... -

Page 165

... for Executive Management One of the goals of our longÂterm equityÂbased incentive program is to focus executives on promoting the longÂterm value sustainability of the company and on building value for shareholders on a longÂterm basis. In addition to granting stock options, performance shares... -

Page 166

... did not address any prospective 3G license terms; however, our sale of 3G products was fully released through the date of the settlement agreements. Nokia Corporation and Nokia Inc. (referred collectively as "Nokia") and IDT currently have pending legal disputes in the United States regarding IDT... -

Page 167

... suit. Three separate trial dates are currently scheduled: a patent trial in May 2012; a breach of contract trial in June 2012; and an antitrust trial in October 2012. On December 29, 2009, Nokia filed a complaint with the ITC in Washington, DC alleging that various Apple products infringe... -

Page 168

.... Product Related Litigation Nokia and several other mobile device manufacturers, distributors and network operators were named as defendants in a series of class action suits filed in various US jurisdictions. The actions were brought on behalf of a purported class of persons in the United States... -

Page 169

... its mobile handsets. The lawsuits allege that as a result of defendants' cartel activities, Nokia suffered harm by, among other reasons, paying supraÂcompetitive prices for LCDs. Trial in the United States action is currently scheduled for November 1, 2012. Also in November 2009, Nokia Corporation... -

Page 170

... softwareÂrelated problems with the development of its Symbian operating system, which were delaying scheduled product launch dates; (ii) Nokia was allegedly losing market share because of intense price cuts by its competitors; and (iii) the dynamics of the emerging Chinese market for mobile phones... -

Page 171

...of our consolidated financial statements included in this annual report. See Item 5A. "Operating Results- Principal Factors and Trends Affecting our Results of Operations" for information on material trends affecting our business and results of operations. ITEM 9. THE OFFER AND LISTING 9A. Offer and... -

Page 172

... 9.98 9.08 9.49 10.20 8.44 The principal trading markets for the shares are the New York Stock Exchange, in the form of ADSs, and NASDAQ OMX Helsinki, in the form of shares. In addition, the shares are listed on the Frankfurt Stock Exchange. 9D. Selling Shareholders Not applicable. 9E. Dilution Not... -

Page 173

..., manufacture, marketing and sales of mobile devices, other electronic products and telecommunications systems and equipment as well as related mobile, internet and network infrastructure services and other consumer and enterprise services. Nokia may also create, acquire and license intellectual... -

Page 174

..., the company shall disclose it by a stock exchange release without undue delay. Purchase Obligation Our Articles of Association require a shareholder that holds oneÂthird or oneÂhalf of all of our shares to purchase the shares of all other shareholders that so request, at a price generally based... -

Page 175

...a descriptive summary and does not purport to be a complete analysis or listing of all potential tax effects relevant to ownership of our shares represented by ADSs. The statements of United States and Finnish tax laws set out below are based on the laws in force as of the date of this annual report... -

Page 176

... abode in the United States. For purposes of this discussion, it is assumed that the Depositary and its custodian will perform all actions as required by the deposit agreement with the Depositary and other related agreements between the Depositary and Nokia. If a partnership holds ADSs (including... -

Page 177

... dividend income" and are not eligible for reduced rates of taxation. In addition, as a result of a change in law effective in 2010, US persons that are shareholders in a PFIC generally will be required to file an annual report disclosing the ownership of such shares and certain other information... -

Page 178

... to the payer prior to the dividend payment: name, date of birth or business ID (if applicable) and address in the country of residence. US and Finnish Tax on Sale or Other Disposition A US Holder generally will recognize taxable capital gain or loss on the sale or other disposition of ADSs in... -

Page 179

... not subject to US information reporting or backup withholding. However, such Holders may be required to provide certification of nonÂUS status (generally on IRS Form WÂ8BEN) in connection with payments received in the United States or through certain USÂrelated financial intermediaries. Backup... -

Page 180

... on our behalf in relation to our ADR program. Category Payment (USD) New York Stock Exchange listing fees ...Settlement infrastructure fees (including the Depositary Trust Company fees) ...Proxy process expenses (including printing, postage and distribution) ...ADS holder identification expenses... -

Page 181

... our consolidated financial statements for the year ended December 31, 2010, has issued an attestation report on the effectiveness of the company's internal control over financial reporting under Auditing Standard No. 5 of the Public Company Accounting Oversight Board (United States of America... -

Page 182

...; advice and assistance in connection with local statutory accounting requirements; due diligence related to acquisitions; financial due diligence in connection with provision of funding to customers, reports in relation to covenants in loan agreements; employee benefit plan audits and reviews; and... -

Page 183

...cost of those services. ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES Not applicable. ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS There were no purchases of Nokia shares and ADSs by Nokia Corporation and its affiliates during 2010. ITEM 16F... -

Page 184

... share and stock option plans. PART III ITEM 17. FINANCIAL STATEMENTS Not applicable. ITEM 18. FINANCIAL STATEMENTS The following financial statements are filed as part of this annual report: Consolidated Financial Statements Report of Independent Registered Public Accounting Firm ...Consolidated... -

Page 185

... bring their offerings to market. The nexus of the major ecosystems in the mobile devices and related services industry is the operating system and the development platform upon which services built. EDGE (Enhanced Data Rates for Global Evolution): A technology to boost cellular network capacity and... -

Page 186

...required for a telecommunications product. Feature phone: Mobile devices which support a wide range of functionalities and applications, such as Internet connectivity and access to our services, but whose software capabilities are generally less powerful than those of smartphones. Our feature phones... -

Page 187

... 40, which supports a wider range of different functionalities and applications, such as Internet connectivity. Mobile products: A term capturing our broader offering, including mobile phones and smartphones as well as the services that can be accessed with them. Multiradio: Able to support several... -

Page 188

... voice communications. WCDMA (Wideband Code Division Multiple Access): A thirdÂgeneration mobile wireless technology that offers high data speeds to mobile and portable wireless devices. Windows Phone: A software platform developed by Microsoft that Nokia plans to deploy as its principal smartphone... -

Page 189

Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Nokia Corporation In our opinion, the accompanying consolidated statements of financial position and the related consolidated income statements, consolidated statements of comprehensive income, ... -

Page 190

Nokia Corporation and Subsidiaries Consolidated Income Statements Notes Financial Year Ended December 31 2010 2009 2008 EURm EURm EURm Net sales ...Cost of sales ...Gross profit ...Research and development expenses ...Selling and marketing expenses ...Administrative and general expenses ...... -

Page 191

...Consolidated Statements of Comprehensive Income Notes Financial Year Ended December 31 2010 2009 2008 EURm EURm EURm Profit ...Other comprehensive income Translation differences...Net investment hedge gains (losses) ...Cash flow hedges ...AvailableÂforÂsale investments ...Other increase (decrease... -

Page 192

... Subsidiaries Consolidated Statements of Financial Position Notes December 31 2010 2009 EURm EURm ASSETS NonÂcurrent assets Capitalized development costs ...Goodwill...Other intangible assets ...Property, plant and equipment ...Investments in associated companies AvailableÂforÂsale investments... -

Page 193

... fair value through profit and loss, liquid assets ...Purchase of nonÂcurrent availableÂforÂsale investments ...Purchase of shares in associated companies ...Additions to capitalized development costs...Proceeds from repayment and sale of longÂterm loans receivable ...Proceeds from (+) / payment... -

Page 194

Nokia Corporation and Subsidiaries Consolidated Statements of Cash Flows (Continued) Financial Year Ended December 31 2010 2009 2008 EURm EURm EURm Notes Cash flow from financing activities Proceeds from stock option exercises ...Purchase of treasury shares ...Proceeds from longÂterm borrowings ... -

Page 195

Nokia Corporation and Subsidiaries Consolidated Statements of Changes in Shareholders' Equity Fair value Reserve for Before Share and invested non Non Number of Share issue Treasury Translation other nonÂrestrict. Retained controlling controlling shares (000's) capital premium shares ... -

Page 196

Nokia Corporation and Subsidiaries Consolidated Statements of Changes in Shareholders' Equity (Continued) Fair value Reserve for Before and invested Non non Share issue Treasury Translation other nonÂrestrict. Retained controlling controlling Number of Share equity earnings interests interests ... -

Page 197

... notes to the consolidated financial statements also conform to Finnish Accounting legislation. On March 11, 2011, Nokia's Board of Directors authorized the financial statements for 2010 for issuance and filing. The Group completed the acquisition of all of the outstanding equity of NAVTEQ on July... -

Page 198

... entity through agreement or the Group has the power to appoint or remove the majority of the members of the board of the entity. The Group's share of profits and losses of associates is included in the consolidated income statement in accordance with the equity method of accounting. An associate is... -

Page 199

... the average rate and assets and liabilities at the closing rate are recognized in other comprehensive income as translation differences within consolidated shareholder's equity. On the disposal of all or part of a foreign Group company by sale, liquidation, repayment of share capital or abandonment... -

Page 200

...expensed immediately. Other intangible assets Acquired patents, trademarks, licenses, software licenses for internal use, customer relationships and developed technology are capitalized and amortized using the straightÂline method over their useful lives, generally 3 to 6 years. Where an indication... -

Page 201

...or asset) recognized in the statement of financial position is pension obligation at the closing date less the fair value of plan assets, the share of unrecognized actuarial gains and losses, and past service costs. Any net pension asset is limited to unrecognized actuarial losses, past service cost... -

Page 202

... to the Consolidated Financial Statements (Continued) 1. Accounting principles (Continued) depreciated over the remaining useful life of the related asset. Leasehold improvements are depreciated over the shorter of the lease term or useful life. Gains and losses on the disposal of fixed assets are... -

Page 203

...on monetary assets, which are recognized directly in profit and loss. Dividends on availableÂforÂsale equity instruments are recognized in profit and loss when the Group's right to receive payment is established. When the investment is disposed of, the related accumulated changes in fair value are... -

Page 204

... of the position being hedged. Derivatives not designated in hedge accounting relationships carried at fair value through profit and loss Fair values of forward rate agreements, interest rate options, futures contracts and exchange traded options are calculated based on quoted market rates at each... -

Page 205

... pricing models and discounted cash flow analysis using assumptions that are based on market conditions existing at each balance sheet date. Changes in fair value are recognized in the income statement. Hedge accounting Cash flow hedges: Hedging of anticipated foreign currency denominated sales... -

Page 206

... deferred in shareholders' equity. The gain or loss relating to the ineffective portion is recognized immediately in the income statement as financial income and expenses. For hedging instruments closed before the maturity date of the related liability, hedge accounting will immediately discontinue... -

Page 207

... the Consolidated Financial Statements (Continued) 1. Accounting principles (Continued) within financial income and expenses. For qualifying foreign exchange options, the change in intrinsic value is deferred in shareholders' equity. Changes in the time value are at all times recognized directly in... -

Page 208

... ShareÂbased compensation The Group offers three types of global equity settled shareÂbased compensation schemes for employees: stock options, performance shares and restricted shares. Employee services received, and the corresponding increase in equity, are measured by reference to the fair value... -

Page 209

... limited number of customer financing arrangements and agreed extended payment terms with selected customers. Should the actual financial position of the customers or general economic conditions differ from assumptions, the ultimate collectability of such financings and trade credits may be required... -

Page 210

... Consolidated Financial Statements (Continued) 1. Accounting principles (Continued) Allowances for doubtful accounts The Group maintains allowances for doubtful accounts for estimated losses resulting from the subsequent inability of customers to make required payments. If the financial conditions... -

Page 211

... include, among others, the discount rate, expected longÂterm rate of return on plan assets and annual rate of increase in future compensation levels. A portion of plan assets is invested in equity securities, which are subject to equity market volatility. Changes in assumptions and actuarial... -

Page 212

... manages our supply chains, sales channels, brand and marketing activities, and explores corporate strategic and future growth opportunities for Nokia. NAVTEQ is a leading provider of comprehensive digital map information and related locationÂbased content and services for mobile navigation devices... -

Page 213

... to the Consolidated Financial Statements (Continued) 2. Segment information (Continued) Nokia Siemens Networks provides mobile and fixed network solutions and services to operators and service providers. Corporate Common Functions consists of company wide functions. The accounting policies of the... -

Page 214

... income except those related to interest and taxes for Devices & Services and Corporate Common Functions. In addition, NAVTEQ's and Nokia Siemens Networks' assets include cash and other liquid assets, availableÂforÂsale investments, longÂterm loans receivable and other financial assets as well as... -

Page 215

...assets and property, plant and equipment. 3. Percentage of completion Contract sales recognized under percentage of completion accounting were EUR 5 094 million in 2010 (EUR 6 868 million in 2009 and EUR 9 220 million in 2008). Services revenue for managed services and network maintenance contracts... -

Page 216

... contribution plans were EUR 377 million in 2010 (EUR 377 million in 2009 and EUR 394 million in 2008). Expenses related to defined benefit plans comprise the remainder. 2010 2009 2008 Average personnel Devices & Services ...NAVTEQ...Nokia Siemens Networks ...Group Common Functions ...Nokia Group... -

Page 217

...significant defined benefit pension plans showing the amounts that are recognized in the Group's consolidated statement of financial position at December 31: 2010 EURm 2009 EURm Present value of defined benefit obligations at beginning of year ...(1 411) Foreign exchange...(49) Current service cost... -

Page 218

...the Consolidated Financial Statements (Continued) 5. Pensions (Continued) The amounts recognized in the income statement are as follows: 2010 EURm 2009 EURm 2008 EURm Current service cost ...Interest cost ...Expected return on plan assets ...Net actuarial (gains) losses recognized in year ...Impact... -

Page 219

Notes to the Consolidated Financial Statements (Continued) 5. Pensions (Continued) The principal actuarial weighted average assumptions used were as follows: 2010 % 2009 % Discount rate for determining present values ...Expected longÂterm rate of return on plan assets ...Annual rate of increase in... -

Page 220

... of whom are located in Finland, India, the UK and Denmark. The sale was closed on November 30, 2010. Other expenses included restructuring charges of EUR 112 million, of which EUR 85 million is related to Devices & Services and EUR 27 million to Nokia Siemens Networks. The restructuring charges... -

Page 221

Notes to the Consolidated Financial Statements (Continued) 8. Impairment 2010 EURm 2009 EURm 2008 EURm Goodwill ...Other intangible assets ...Property, plant and equipment ...Inventories ...Investments in associated companies ...AvailableÂforÂsale investments ...Other nonÂcurrent assets ...Total... -

Page 222

... included in the Devices & Services segment. In 2008, Nokia Siemens Networks recognised an impairment loss amounting to EUR 35 million relating to the sale of its manufacturing site in Durach, Germany. The impairment loss was determined as the excess of the book value of transferring assets over the... -

Page 223

... provides mobile analytics services offering inÂapplication tracking and reporting. The Group acquired a 100% ownership interest in Motally on August 31, 2010. • PixelActive Inc, based in California, USA, specialises in tools and techniques for 3D modeling of detailed road networks, buildings and... -

Page 224

... digital map information for automotive systems, mobile navigation devices, InternetÂbased mapping applications, and government and business solutions. The Group will use NAVTEQ's industry leading maps data to add context - time, place, people - to web services optimized for mobility. The... -

Page 225

...: Map database ...Customer relationships ...Developed technology...License to use trade name and trademark ...Capitalized development costs ...Other intangible assets Property, plant & equipment ...Deferred tax assets ...AvailableÂforÂsale investments ...Other nonÂcurrent assets ... 114... -

Page 226

... interest increased from 47.9% to 100% of the outstanding common stock of Symbian. A UKÂbased software licensing company, Symbian developed and licensed Symbian OS, the marketÂleading open operating system for mobile phones. The acquisition of Symbian was a fundamental step in the establishment of... -

Page 227

... Amount EURm Fair Value EURm Goodwill ...Intangible assets subject to amortization: Developed technology ...Customer relationships ...License to use trade name and trademark ...Property, plant & equipment ...Deferred tax assets ...NonÂcurrent assets ...Accounts receivable ...Prepaid expenses... -

Page 228

... 1, 2008, Nokia Siemens Networks assumed control of Vivento Technical Services from Deutsche Telekom. 10. Depreciation and amortization 2010 EURm 2009 EURm 2008 EURm Depreciation and amortization by function Cost of sales ...Research and development(1) ...Selling and marketing(2) ...Administrative... -

Page 229

...an impairment loss of EUR 94 million (2009 EUR 9 million) for the fund included in other financial expenses. Additional information can be found in Note 8 Impairments and Note 16 Fair Value of Financial Instruments. During 2009, interest income decreased significantly due to lower interest rates and... -

Page 230

... of deferred tax assets in Nokia Siemens Networks. The change in deferred tax liability on undistributed earnings mainly relates to changes to tax rates applicable to profit distributions. (3) Certain of the Group companies' income tax returns for periods ranging from 2004 through 2010 are under... -

Page 231

...Consolidated Financial Statements (Continued) 13. Intangible assets 2010 EURm 2009 EURm Capitalized development costs Acquisition cost January 1 ...Additions during the period ...Impairment losses......Net book value January 1 ...Net book value December 31 ...Other intangible assets Acquisition cost ... -

Page 232

Notes to the Consolidated Financial Statements (Continued) 13. Intangible assets (Continued) 2010 EURm 2009 EURm Accumulated ...for the period ...(1 069) Accumulated amortization December 31 ...(3 509) Net book value January 1 ...Net book value December 31 ...2 762 1 928 (1 585) 56 17 38 2 (1... -

Page 233

... to the Consolidated Financial Statements (Continued) 14. Property, plant and equipment 2010 EURm 2009 EURm Land and water areas Acquisition cost January 1 ...Additions during the period ...Disposals during the period ...Accumulated acquisition cost December 31 ...Net book value January 1 ...Net... -

Page 234

... ...Transfers to: Other intangible assets ...Buildings and constructions ...Machinery and equipment ...Other tangible assets ...Net carrying amount December 31 ...Total property, plant and equipment ...15. Investments in associated companies 2010 EURm 2009 EURm Net carrying amount January... -

Page 235

... 31, 2010 AvailableÂforÂsale investments in publicly quoted equity shares...Other availableÂforÂsale investments carried at fair value ...Other availableÂforÂsale investments carried at cost less impairment ...LongÂterm loans receivable ...Other nonÂcurrent assets ...Accounts receivable... -

Page 236

..., 2009 Fair value EURm AvailableÂforÂsale investments in publicly quoted equity shares ...Other availableÂforÂsale investments carried at fair value ...Other availableÂforÂsale investments carried at cost less impairment ...LongÂterm loans receivable ...Other nonÂcurrent assets ...Accounts... -

Page 237

... category includes listed bonds and other securities, listed shares and exchange traded derivatives. Level 2 category includes financial assets and liabilities measured using a valuation technique based on assumptions that are supported by prices from observable current market transactions. These... -

Page 238

...following table shows a reconciliation of the opening and closing recorded amount of Level 3 financial assets, which are measured at fair value: Other availableÂforÂsale investments carried at fair value EURm Balance at December 31, 2008 ...Total gains (losses) in income statement ...Total gains... -

Page 239

... swaps ...Derivatives not designated in hedge accounting relationships carried at fair value through profit and loss: Forward foreign exchange contracts ...Currency options bought ...Currency options sold ...Interest rate swaps ...Cash settled equity options bought(4) ... 12 25 - 117 - 1 128 8 062... -

Page 240

... in 2009). In 2008, Nokia and Qualcomm entered into a new 15 year agreement, under the terms of which Nokia has been granted a license to all Qualcomm's patents for the use in Nokia mobile devices and Nokia Siemens Networks infrastructure equipment. The financial structure of the agreement included... -

Page 241

Notes to the Consolidated Financial Statements (Continued) 20. Valuation and qualifying accounts Allowances on assets to which they apply: Balance at beginning of year EURm Charged to cost and expenses EURm Deductions EURm (1) Acquisitions EURm Balance at end of year EURm 2010 Allowance for ... -

Page 242

... thereto, to ensure that the amounts transferred to the fair value reserves during the years ended December 31, 2010 and 2009 do not include gains/losses on forward exchange contracts that have been designated to hedge forecasted sales or purchases that are no longer expected to occur. All of the... -

Page 243

...Transfer to profit and loss (financial income and expense)...Movements attributable to nonÂcontrolling interests ... Balance at December 31, 2010 ... 23. The shares of the Parent Company Nokia shares and shareholders Shares and share capital Nokia has one class of shares. Each Nokia share entitles... -

Page 244

... to issue shares, convertible bonds, warrants or stock options. Other authorizations At the Annual General Meeting held on April 23, 2009, Nokia shareholders authorized the Board of Directors to repurchase a maximum of 360 million Nokia shares by using funds in the unrestricted equity. Nokia did not... -

Page 245