MoneyGram 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

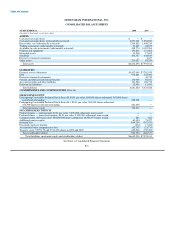

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

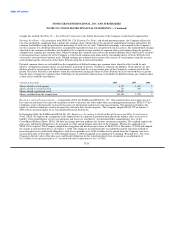

Second Lien Notes — As part of the Capital Transaction, Worldwide issued $500.0 million of senior secured second lien notes to

Goldman Sachs (the "Notes"), which will mature in March 2018. See Note 10 — Debt for further information regarding the Notes.

Registration Rights — As part of the Capital Transaction, the Company entered into a Registration Rights Agreement with the Investors.

Under the terms of the Registration Rights Agreement, after a specified holding period, the Company must promptly file a shelf

registration statement with the SEC relating to securities held by the Investors. The Company is generally obligated to keep the shelf

registration statement effective for up to 15 years or, if earlier, until all the securities owned by the Investors have been sold. The

Investors are also entitled to five demand registrations and unlimited piggyback registrations.

Participation Agreement between the Investors and Walmart Stores, Inc. — On February 11, 2008, the Investors entered into a

Participation Agreement (as amended on March 17, 2008) with Walmart Stores, Inc. ("Walmart") in connection with the Capital

Transaction. The Company is not a direct party to the Participation Agreement, which was negotiated solely between the Investors and

Walmart. Under the terms of the Participation Agreement, the Investors are obligated to pay Walmart certain percentages of accumulated

cash payments received by the Investors in excess of the Investors' original investment in the Company. Cash payments include dividends

paid by the Company to the Investors and any cash payments received by the Investors in connection with the sale of any shares of the

Company's stock to an unaffiliated third party or upon redemption by the Company. Walmart, in its sole discretion, may elect to receive

payments in cash or equivalent shares of stock held by the Investors. In addition, through March 17, 2010, the Investors must receive

Walmart's consent prior to voting in favor of, consenting to, or selling shares in a transaction that would cause a change in control of the

Company, as defined by the Participation Agreement.

The Company has no obligation to Walmart or additional obligations to the Investors under the terms of the Participation Agreement.

However, in accordance with Staff Accounting Bulletin ("SAB") Topic 5-T, Accounting for Expenses or Liabilities Paid by Principal

Stockholders, the Company will recognize the Participation Agreement in its consolidated financial statements as if the Company itself

entered into the agreement with Walmart. As Walmart may elect to receive any payments under the Participation Agreement in cash, the

agreement is accounted for as a liability award under Statement of Financial Accounting Standards ("SFAS") No. 123 (revised 2004),

Share-Based Payment ("SFAS No. 123(R)"). Under SFAS No. 123(R), the Company will recognize a liability equal to the fair value of

the Participation Agreement through a charge to the Consolidated Statements of (Loss) Income based upon the probability that certain

performance conditions will be met. The liability will be remeasured each period until settlement, with changes in fair value recognized

in the Consolidated Statements of (Loss) Income. Walmart's ability to earn the award under the Participation Agreement is conditioned

upon the Investors receiving cash payments related to its Series B Stock in excess of the Investors' original investment in the Company.

While it is probable that the performance conditions will be met at December 31, 2008, the fair value of the liability is zero at this time as

the Company's discount rate, based on its debt interest rates and credit rating, exceeds the dividend rate on the preferred stock.

Note 3 — Summary of Significant Accounting Policies

Basis of Presentation — The consolidated financial statements of MoneyGram are prepared in conformity with accounting principles

generally accepted in the United States of America ("GAAP"). The Consolidated Balance Sheets are unclassified due to the short-term

nature of the settlement obligations, contrasted with the ability to invest cash awaiting settlement in long-term investment securities.

Principles of Consolidation — The consolidated financial statements include the accounts of MoneyGram International, Inc. and its

subsidiaries. Inter-company profits, transactions and account balances have been eliminated in consolidation. The Company participates

in various trust arrangements (special purpose entities or "SPEs") related to official check processing agreements with financial

institutions and structured investments within the investment

F-11