MoneyGram 2008 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

certain U.S. state income tax examinations for 2005 through 2007, with a U.S. federal income tax examination for 2005 through 2007

currently in process.

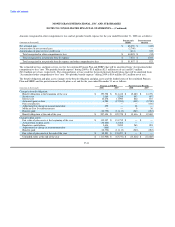

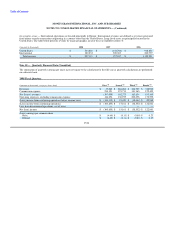

As a result of the adoption of FIN 48 in 2007, the Company recognized a $29.6 million increase in the liability for unrecognized tax

benefits, a $7.6 million increase in deferred tax assets and a $22.0 million reduction to the opening balance of retained income.

Unrecognized tax benefits under FIN 48 are recorded in "Accounts payable and other liabilities" in the Consolidated Balance Sheets. A

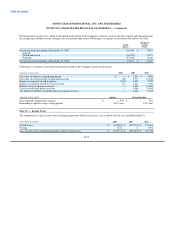

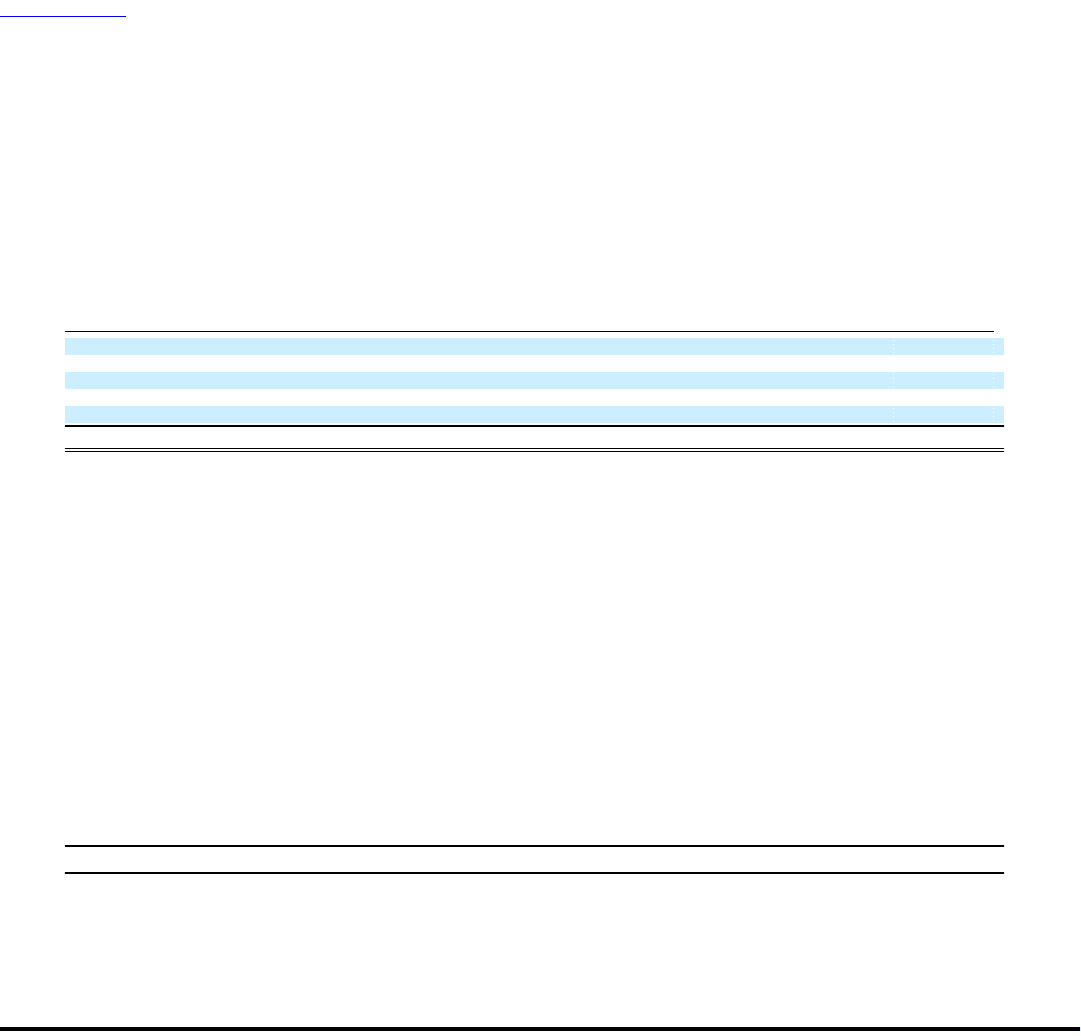

reconciliation of unrecognized tax benefits for 2008 is as follows:

(Amounts in thousands) 2008

Balance at January 1 $ 33,669

Additions based on tax positions related to the current year 5,711

Reductions for tax positions of prior years (19,204)

Foreign currency translation (6,608)

Lapse in statute of limitations (479)

Balance at December 31 $ 13,089

As of December 31, 2008, the liability for unrecognized tax benefits was $13.1 million, of which $7.4 million could impact the effective

tax rate if recognized. The Company accrues interest and penalties for unrecognized tax benefits through "Income tax (benefit) expense"

in the Consolidated Statements of (Loss) Income. For the years ended December 31, 2008 and 2007, the Company accrued approximately

$2.8 million and $3.5 million in interest and penalties in its Consolidated Statement of (Loss) Income, respectively. As of December 31,

2008 and 2007, the Company had a liability of $3.6 million and $6.4 million for interest and penalties related to its unrecognized tax

benefits, respectively. As of December 31, 2008, it is not possible to reasonably estimate the expected change to the total amount of

unrecognized tax positions over the next 12 months.

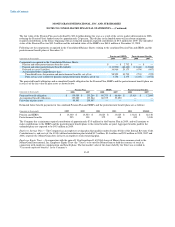

The Company does not consider its earnings in its foreign entities to be permanently reinvested. As of December 31, 2008 and 2007, a

deferred tax liability of $4.4 million and $5.3 million, respectively, was recognized for the unremitted earnings of its foreign entities.

Prior to the Company's spin-off from Viad, income taxes were determined on a separate return basis as if MoneyGram had not been

eligible to be included in the consolidated income tax return of Viad and its affiliates. Subsequent to the spin-off, MoneyGram is

considered the divesting entity and treated as the "accounting successor" to Viad and the continuing business of Viad is referred to as

"New Viad." As part of the Distribution, the Company entered into a Tax Sharing Agreement with Viad which provides for, among other

things, the allocation between MoneyGram and New Viad of federal, state, local and foreign tax liabilities and tax liabilities resulting

from the audit or other adjustment to previously filed tax returns. The Tax Sharing Agreement provides that through the Distribution

Date, the results of MoneyGram and its subsidiaries' operations are included in Viad's consolidated U.S. federal income tax returns. In

general, the Tax Sharing Agreement provides that MoneyGram will be liable for all federal, state, local, and foreign tax liabilities,

including such liabilities resulting from the audit of or other adjustment to previously filed tax returns, that are attributable to the business

of MoneyGram for periods through the Distribution Date, and that Viad will be responsible for all other of these taxes.

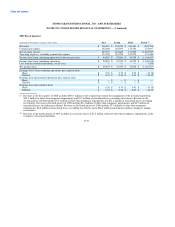

Note 16 — Commitments and Contingencies

Operating Leases — The Company has various non-cancelable operating leases for buildings and equipment that terminate through 2016.

Certain of these leases contain rent holidays and rent escalation clauses based on pre-determined annual rate increases. The Company

recognizes rent expense under the straight-line method over the term of the lease. Any difference between the straight-line rent amounts

and amounts payable under the leases are recorded as deferred rent in "Accounts payable and other liabilities" in the Consolidated

Balance Sheets. Cash or

F-51