MoneyGram 2008 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

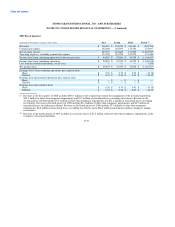

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

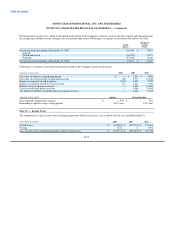

lease incentives received under certain leases are recorded as deferred rent when the incentive is received and amortized as a reduction to

rent over the term of the lease using the straight-line method. Incentives received relating to tenant improvements are capitalized as

leasehold improvements and depreciated over the remaining term of the lease. At December 31, 2008, the deferred rent liability relating

to these incentives was $2.9 million.

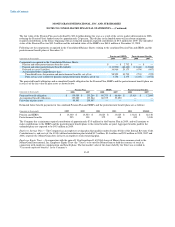

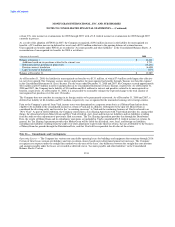

Rent expense under these operating leases totaled $12.7 million, $11.4 million and $7.8 million during 2008, 2007 and 2006,

respectively. Minimum future rental payments for all noncancelable operating leases with an initial term of more than one year are

(amounts in thousands):

2009 $ 10,536

2010 9,163

2011 8,212

2012 5,018

2013 4,007

Later 7,574

Total $ 44,510

Legal proceedings — We are party to a variety of legal proceedings, including those that arise in the normal course of our business. All

legal proceedings are subject to uncertainties and outcomes that are not predictable with assurance. We accrue for legal proceedings as

losses become probable and can be reasonably estimated. Significant legal proceedings arising outside the normal course of our business

are described below. While the results of these proceedings cannot be predicted with certainty, management believes that after final

disposition, any monetary liability will not be material to our financial position. Further, the Company maintains insurance coverage for

many of the claims alleged.

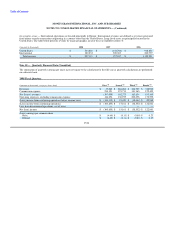

Federal Securities Class Actions — The Company and certain of its officers and directors are parties to four class action cases in the

United States District Court for the District of Minnesota. In July 2008, the four cases were consolidated into one case captioned In re

MoneyGram International, Inc. Securities Litigation. The Consolidated Complaint was filed on October 3, 2008, and alleges against each

defendant violations of Section 10(b) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and Rule 10b-5 under

the Exchange Act and alleges against Company officers violations of Section 20(a) of the Exchange Act. The Consolidated Complaint

alleges failure to adequately disclose, in a timely manner, the nature and risks of the Company's investments, as well as unrealized losses

and other-than-temporary impairments related to certain of the Company's investments. The complainant seeks recovery of losses

incurred by stockholder class members in connection with their purchases of the Company's securities.

ERISA Class Action — On April 22, 2008, Delilah Morrison, on behalf of herself and all other MoneyGram 401(k) Plan participants,

brought an action in the United States District Court for the District of Minnesota. The complaint alleges claims under the Employee

Retirement Income Security Act of 1974, as amended ("ERISA"), including claims that the defendants breached fiduciary duties by

failing to manage the plan's investment in Company stock, and by continuing to offer Company stock as an investment option when the

stock was no longer a prudent investment. The complaint also alleges that defendants failed to provide complete and accurate information

regarding Company stock sufficient to advise plan participants of the risks involved with investing in Company stock and breached

fiduciary duties by failing to avoid conflicts of interests and to properly monitor the performance of plan fiduciaries and fiduciary

appointees. Finally, the complaint alleges that to the extent that the Company is not a fiduciary, it is liable for knowingly participating in

the fiduciary breaches as alleged. On August 7, plaintiff amended the complaint to add an additional plaintiff, name additional defendants

and additional allegations. For relief, the complaint seeks damages based on what the most profitable alternatives to Company stock

would have yielded, unspecified equitable relief, costs and attorneys' fees.

F-52