MoneyGram 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

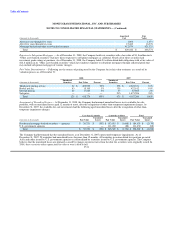

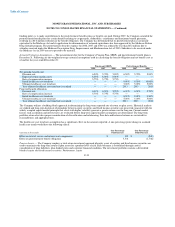

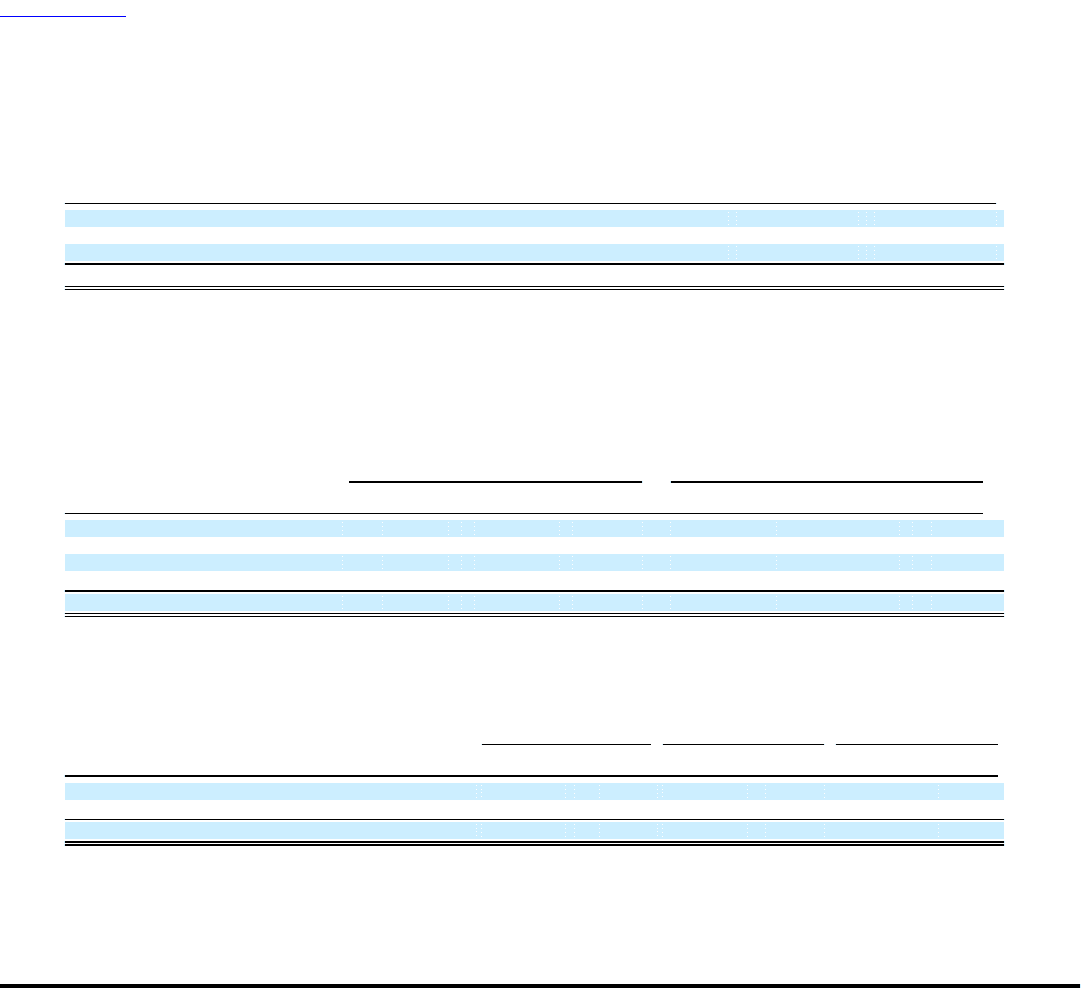

Amortized Fair

(Amounts in thousands) Cost Value

After one year through five years 1,003 1,073

After five years through ten years 15,460 16,376

Mortgage-backed and other asset-backed securities 412,979 421,325

Total $ 429,442 $ 438,774

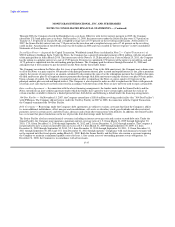

Exposure to Sub-prime Mortgages — As of December 31, 2008, the Company holds six securities with a fair value of $1.8 million in its

"Other asset-backed securities" that have direct exposure to sub-prime mortgages as collateral. Nearly all of these securities had

investment grade ratings at purchase. As of December 31, 2008, the Company holds 54 collateralized debt obligations with a fair value of

$12.8 million in its "Other asset-backed securities" which have indirect exposure to sub-prime mortgages through collateral pools that

may include sub-prime mortgages of various vintages.

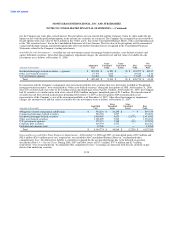

Fair Value Determination — Following are the sources of pricing used by the Company for its fair value estimates as a result of its

valuation process as of December 31:

2008 2007

Number of Number of

(Amounts in thousands) Securities Fair Value Percent Securities Fair Value Percent

Third party pricing service 52 $ 405,955 93% 278 $ 2,203,371 53%

Broker pricing 43 15,195 3% 138 422,612 10%

Internal pricing 25 17,624 4% 39 87,805 2%

Sale price — — — 215 1,473,596 35%

Total 120 $ 438,774 100% 670 $ 4,187,384 100%

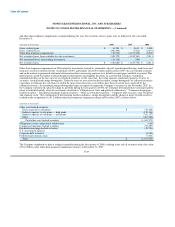

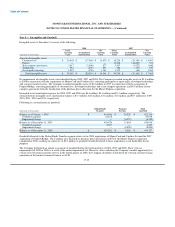

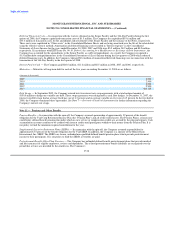

Assessment of Unrealized Losses — At December 31, 2008, the Company had nominal unrealized losses in its available-for-sale

portfolio, with no unrealized losses aged 12 months or more, after the recognition of other-than-temporary impairment charges. At

December 31, 2007, the available-for-sale investments had the following aged unrealized losses after the recognition of other-than-

temporary impairment charges:

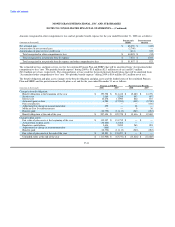

Less than 12 months 12 months or More Total

Unrealized Unrealized Unrealized

(Amounts in thousands) Fair Value Losses Fair Value Losses Fair Value Losses

Residential mortgage-backed securities — agencies $ 30,720 $ (502) $ 153,919 $ (1,668) $ 184,639 $ (2,170)

U.S. government agencies — — 111,430 (88) 111,430 (88)

Total $ 30,720 $ (502) $ 265,349 $ (1,756) $ 296,069 $ (2,258)

The Company had determined that the unrealized losses as of December 31, 2007 represented temporary impairments. As of

December 31, 2007, 20 securities had unrealized losses for more than 12 months. All securities in an unrealized loss position are rated

AAA and either issued by U.S. government agencies or collateralized by securities issued by U.S. government agencies. The Company

believes that the unrealized losses are primarily caused by changes in interest rates from the date the securities were originally issued. In

2008, these securities either appreciated in value or were called in full.

F-31