MoneyGram 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

first quarter of 2008. These changes reduce the clearing banks' exposure if we were unable to settle our obligations with them. At no time

in the past or in 2008 have we failed to settle with our clearing banks in full. As the credit market disruption continued to deteriorate in

2008, financial institutions in general began to reduce their credit exposure to preserve their capital base. Three banks that clear official

checks gave us notice in 2008 that they will not renew their clearing agreements when those agreements expire in mid 2009. The loss of

our clearing arrangements with these three clearing banks has not had an adverse effect on our official check business as we are moving

the impacted clearing volume to the remaining clearing banks. In the second half of 2008, one clearing bank extended their agreement

with us for a five year period and another large bank extended their agreement with us for a three year period. After the exit of the three

banks in 2009, we will have five official check clearing banks, all of which have agreed to significantly increase their clearing activity for

us. We believe these relationships provide sufficient capacity for our official check business. We rely on two banks to clear our retail

money orders. We entered into a new five-year agreement with the smaller of our two money order clearing banks in early 2009 and are

in the process of negotiating a new agreement with our primary money order clearing bank.

We also maintain contractual relationships with a variety of domestic and international cash management banks for ACH and wire

transfer services for the movement of consumer funds and agent settlements. There are a limited number of international cash

management banks with a network large enough to manage cash settlements for our entire agent base. In the first half of 2008, our current

international cash management bank informed us of its intent to terminate our relationship. This bank has indicated its willingness to

continue the relationship while we convert to our new primary international cash management banking relationship. We currently

anticipate completing this process in the first half of 2009. Should we not be successful in completing this process, we would be required

to establish a network of numerous smaller cash management banks. While this would not impact the timing of settling money transfers

with the consumer, it could alter the pattern of settlement with our agents and increase our banking costs. Altering the pattern of

settlement could result in our agent receivables and agent payables being outstanding for one to two days longer than the current pattern.

For certain of our financial institution customers, we established individual special purpose entities ("SPEs") upon the origination of our

relationship. Along with operational processes and certain financial covenants, these SPEs provide the financial institutions with

additional assurance of our ability to clear their official checks. Under these relationships, the cash, cash equivalents, investments and

payment service obligations related to the financial institution customer are all held by the SPE. In most cases, the fair value of the cash,

cash equivalents and investments must be maintained in excess of the payment service obligations. As the financial institution customer

sells our payment service instruments, the face amount of the instrument and any fees are paid into the SPE. As payment service

instruments issued by the financial institution customer are presented for payment, the cash and cash equivalents within the SPE are used

to settle the instrument. As a result, cash and cash equivalents within SPEs are generally not available for use outside of the SPE. We

remain liable to satisfy the obligations, both contractually and under the Uniform Commercial Code, as the issuer and drawer of the

official checks regardless of the existence of the SPEs. Accordingly, we consolidate all of the assets and liabilities of these SPEs in our

Consolidated Balance Sheets, with the individual assets and liabilities of the SPEs classified in a manner similar to our other assets and

liabilities. The combined SPEs hold six percent of our $4.5 billion portfolio as of December 31, 2008 as compared to 32 percent at

December 31, 2007. As the SPEs relate to financial institution customers we terminated in connection with the restructuring of the

official check business, we expect the SPEs to continue to decline as a percent of our portfolio as the outstanding instruments related to

the financial institutions roll-off over the next nine to 15 months. For further information relating to the SPEs, see Note 3 — Summary of

Significant Accounting Policies of the Notes to Consolidated Financial Statements.

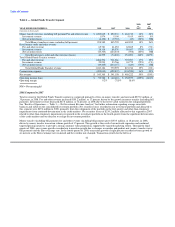

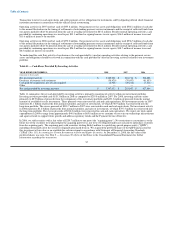

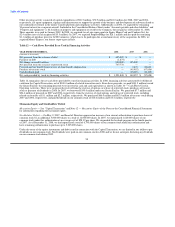

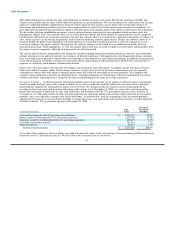

Contractual and Regulatory Capital

Our capital needs derive from our Senior Facility and Notes, certain clearing bank contracts, the SPEs and state regulatory requirements

as set forth below and are based on a requirement to maintain certain assets in a defined ratio to our payment service obligation. We

monitor our compliance with these capital needs by monitoring our unrestricted assets measure, which we define as cash, cash

equivalents, agent receivables, trading and available-for-sale investments and put options related to trading investments in excess of our

payment service obligations. As our cash, receivables and payment service obligations generally move in tandem, our unrestricted assets

serve as our

52