MoneyGram 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

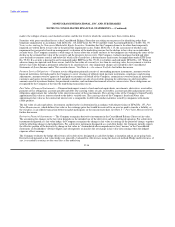

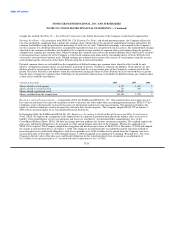

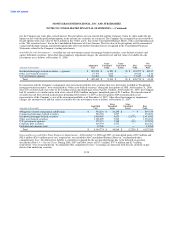

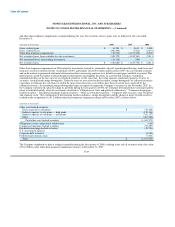

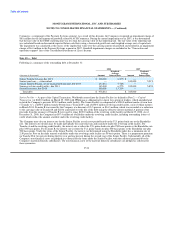

(Amounts in thousands) Level 1 Level 2 Level 3 Total

Cash equivalents (substantially restricted) $ 2,501,780 $ — $ — $ 2,501,780

Trading investments (substantially restricted) — — 21,485 21,485

Put options related to trading investments — — 26,505 26,505

Available-for-sale investments (substantially restricted) U.S. government agencies — 17,449 — 17,449

Residential mortgage-backed securities — agencies — 391,798 — 391,798

Other asset-backed securities — — 29,528 29,528

Total Financial Assets $ 2,501,780 $ 409,247 $ 77,518 $ 2,988,545

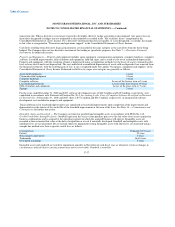

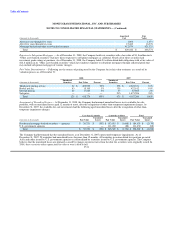

The tables below provide a roll-forward of the financial assets and liabilities classified in Level 3 which are measured at fair value on a

recurring basis.

Put Options Total

Related to Level 3

Trading Trading Available-for- Financial

(Amounts in thousands) Investments Investments Sale Investments Assets

Balance at January 1, 2008 $ 62,105 $ — $ 2,478,832 $ 2,540,937

Issuance of put options — 24,114 — 24,114

Sales and settlements — — (2,355,014) (2,355,014)

Realized losses — — (13,760) (13,760)

Principal paydowns — — (16,073) (16,073)

Other-than-temporary impairments — — (70,274) (70,274)

Unrealized gains — instruments still held at the reporting date — 2,391 5,817 8,208

Unrealized losses — instruments still held at the reporting date (40,620) — — (40,620)

Balance at December 31, 2008 $ 21,485 $ 26,505 $ 29,528 $ 77,518

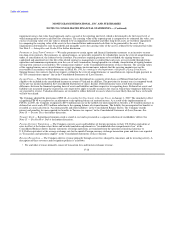

Total

Embedded Derivative Level 3

Derivatives in Financial Financial

(Amounts in thousands) Preferred Stock Instruments Liabilities

Balance at January 1, 2008 $ — $ 28,723 $ 28,723

Issuance of preferred stock 54,797 — 54,797

Valuation adjustment 16,030 973 17,003

Cash settlement of derivatives upon termination — (29,696) (29,696)

Reversal of liability to Additional paid-in capital (see Note 7) (70,827) — (70,827)

Balance at December 31, 2008 $ — $ — $ —

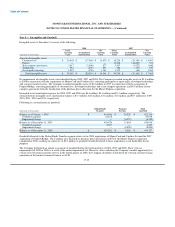

Note 6 — Investment Portfolio

The Company's portfolio is invested in cash and cash equivalents, trading investments and available-for-sale investments, all of which are

substantially restricted as described in Note 3 — Summary of Significant Accounting Policies. During the first quarter of 2008, the

Company realigned its investment portfolio away from asset-backed securities into highly liquid assets through the sale of a substantial

portion of its available-for-sale portfolio. As a F-26