MoneyGram 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

securities are diversified across U.S. and non-U.S. stocks, as well as growth, value and small and large capitalizations. Other assets such

as real estate and cash are used judiciously to enhance long-term returns while improving portfolio diversification. The Company strives

to maintain equity and fixed income securities allocation mix of approximately 60 percent and 40 percent, respectively. Investment risk is

measured and monitored on an ongoing basis through quarterly investment portfolio reviews and annual liability measurements.

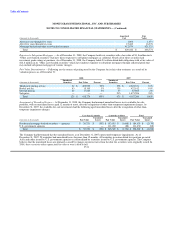

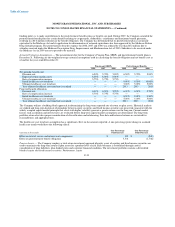

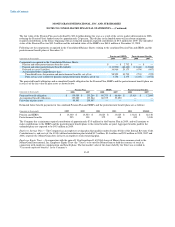

The Company's weighted average asset allocation for the Pension Plan by asset category at the measurement date of December 31 is as

follows:

2008 2007

Equity securities 57.5% 62.8%

Fixed income securities 34.0% 30.4%

Real estate 5.5% 3.8%

Other 3.0% 3.0%

Total 100.0% 100.0%

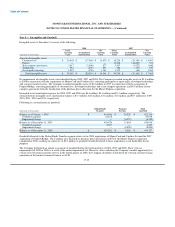

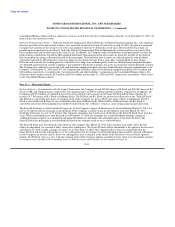

Plan Financial Information — Net periodic benefit expense for the combined Pension Plan and SERPs and postretirement benefit plans

includes the following components for the years ended December 31:

Pension and SERPs Postretirement Benefits

(Amounts in thousands) 2008 2007 2006 2008 2007 2006

Service cost $ 1,069 $ 2,298 $ 1,922 $ 543 $ 697 $ 637

Interest cost 12,678 11,900 11,698 822 837 715

Expected return on plan assets (10,275) (10,083) (9,082) — — —

Amortization of prior service cost 414 483 703 (352) (294) (294)

Recognized net actuarial loss 2,528 4,226 4,302 — 90 24

Curtailment 658 — — — — —

Net periodic benefit expense $ 7,072 $ 8,824 $ 9,543 $ 1,013 $ 1,330 $ 1,082

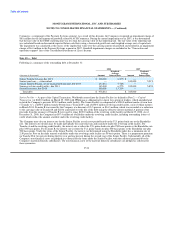

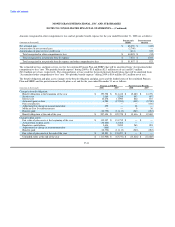

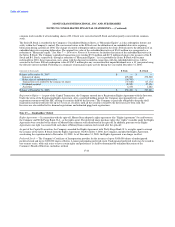

On January 1, 2008, the Company adopted a change in measurement date for its defined benefit pension plan and combined SERPs and

the defined benefit postretirement plans in accordance with SFAS No. 158, Employers' Accounting for Defined Benefit Pension and

Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106 and 132. The change in measurement date was adopted

using the transition method of measuring its plan assets and benefit obligations as of January 1, 2008. Net periodic costs of $0.4 million

for the period from the Company's current measurement date of November 30, 2007 through January 1, 2008 were recognized as a

separate adjustment to "Retained loss," net of tax. Changes in the fair value of the plan assets and benefit obligation for this period were

recognized as an adjustment of $1.5 million to the opening balance sheet of "Accumulated other comprehensive loss" in 2008.

During the third quarter of 2008, the Company recorded a curtailment loss of $0.7 million under the combined SERPs related to the

departure of the Company's Chief Executive Officer and another executive officer.

F-40