MoneyGram 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

common stock issuable if all outstanding shares of B-1 Stock were converted into B Stock and subsequently converted into common

stock.

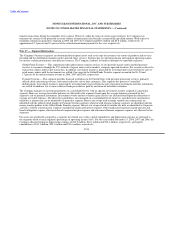

The Series B Stock is recorded in the Company's Consolidated Balance Sheets as "Mezzanine Equity" as it has redemption features not

solely within the Company's control. The conversion feature in the B Stock met the definition of an embedded derivative requiring

bifurcation during a portion of 2008. The change of control redemption option contained in the Series B Stock meets the definition of an

embedded derivative requiring bifurcation. The original fair value of the embedded derivatives of $54.8 million was recognized as a

reduction of "Mezzanine equity." See Note 7 — Derivative Financial Instruments for further discussion of the embedded derivatives in

the Series B Stock. The Company capitalized transaction costs totaling $37.6 million and $17.2 million relating to the issuance of the B

Stock and B-1 Stock, respectively, through a reduction of "Mezzanine Equity." As it is probable the Series B Stock will become

redeemable in 2018, these transaction costs, along with the discount recorded in connection with the embedded derivatives, will be

accreted to the Series B Stock redemption value of $767.5 million plus any accumulated but unpaid dividends over a 10 year period using

the effective interest method. Following is a summary of mezzanine equity activity during the year ended December 31, 2008:

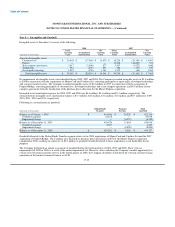

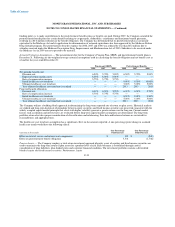

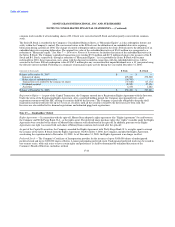

(Amounts in thousands) B Stock B-1 Stock

Balance at December 31, 2007 $ — $ —

Issuance of shares 495,000 272,500

Bifurcation of embedded derivative (54,797) —

Transaction costs related to the issuance of shares (37,648) (17,172)

Dividends accrued 49,399 27,194

Accretion 6,454 1,282

Balance at December 31, 2008 $ 458,408 $ 283,804

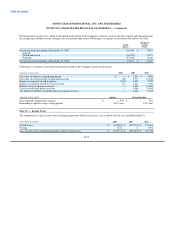

Registration Rights — As part of the Capital Transaction, the Company entered into a Registration Rights Agreement with the Investors.

Under the terms of the Registration Rights Agreement, after a specified holding period, the Company must promptly file a shelf

registration statement with the SEC relating to securities held by the Investors. The Company is generally obligated to keep the shelf

registration statement effective for up to 15 years or, if earlier, until all the securities owned by the Investors have been sold. The

Investors are also entitled to five demand registrations and unlimited piggyback registrations.

Note 13 — Stockholders' Deficit

Rights Agreement — In connection with the spin-off, MoneyGram adopted a rights agreement (the "Rights Agreement") by and between

the Company and Wells Fargo Bank, N.A., as the rights agent. The preferred share purchase rights (the "rights") issuable under the Rights

Agreement were attached to the shares of MoneyGram common stock distributed in the spin-off. In addition, pursuant to the Rights

Agreement, one right was issued with each share of MoneyGram common stock issued after the spin-off.

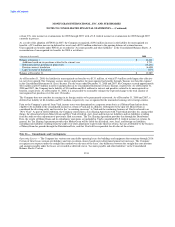

As part of the Capital Transaction, the Company amended the Rights Agreement with Wells Fargo Bank, N.A. as rights agent to exempt

the issuance of the Series B Stock from the Rights Agreement. On November 3, 2008, the Company amended the Rights Agreement,

accelerating the expiration date to November 10, 2008. As of December 31, 2008, the Rights Agreement is no longer in effect.

Preferred Stock — The Company's Certificate of Incorporation provides for the issuance of up to 5,000,000 shares of undesignated

preferred stock and up to 2,000,000 shares of Series A junior participating preferred stock. Undesignated preferred stock may be issued in

one or more series, with each series to have certain rights and preferences as shall be determined by unlimited discretion of the

Company's Board of Directors, including, without

F-44