MoneyGram 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

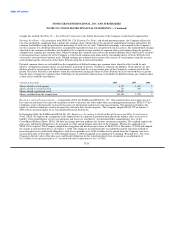

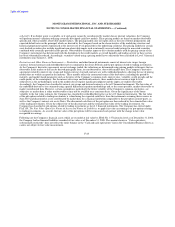

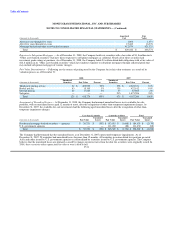

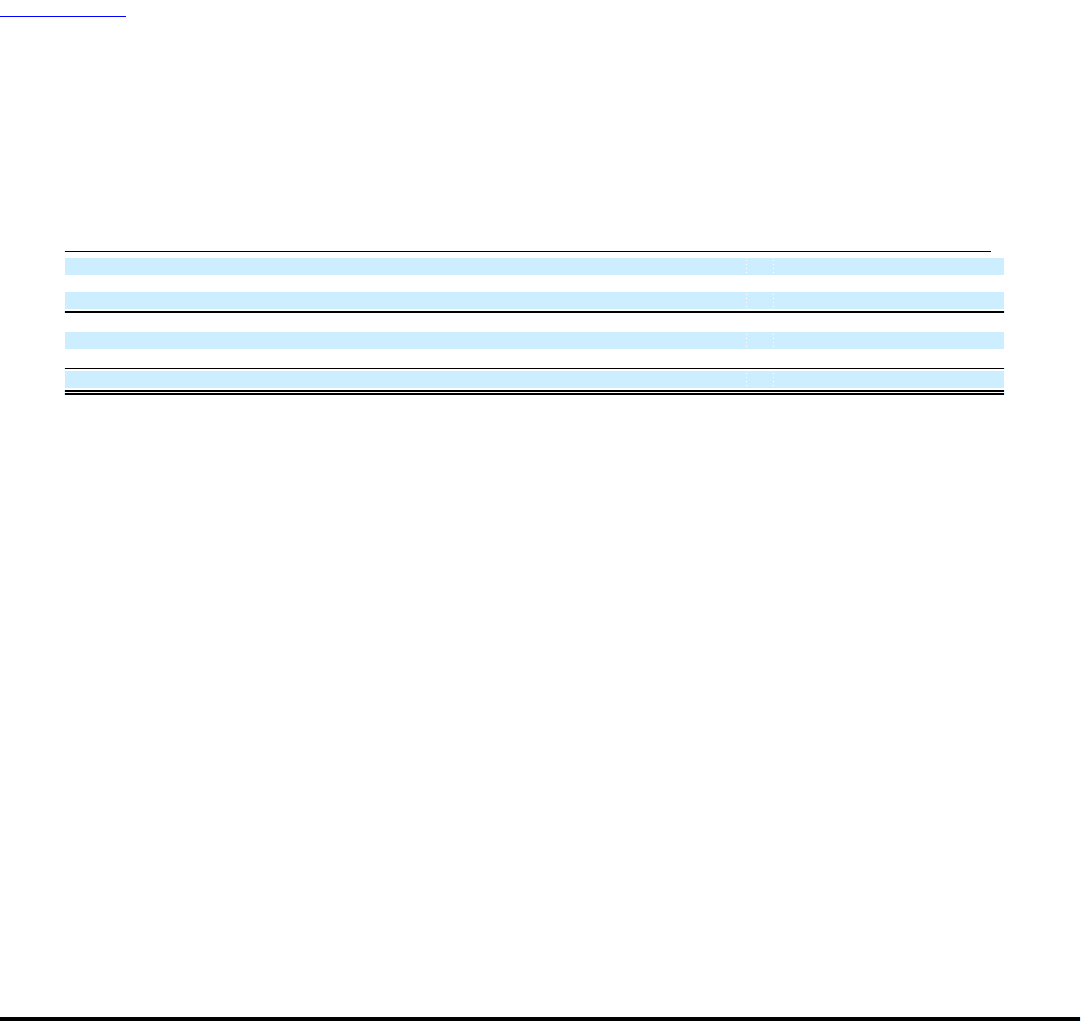

result of this realignment, substantially all of the portfolio is invested in cash and cash equivalents as of December 31, 2008. Components

of our investment portfolio as of December 31, 2008 are as follows:

Fair

(Amounts in thousands) Value

Cash $ 1,575,601

Money Markets 1,626,788

Time Deposits 874,992

Cash and cash equivalents 4,077,381

Trading investments 21,485

Available-for-sale investments 438,774

Total Investment Portfolio $ 4,537,640

Cash and Cash Equivalents — Cash and cash equivalents consist of cash, money-market securities and time deposits. Cash primarily

consists of interest-bearing deposit accounts and clearing accounts. The Company's money-market securities are invested in nine funds,

all of which are AAA rated and are comprised of U.S. Treasury bills, notes or other obligations issued or guaranteed by the

U.S. government and its agencies, as well as repurchase agreements secured by such instruments. The time deposits have maturities no

longer than six weeks and are issued from well-established financial institutions that are rated AA as of the date of this filing.

Trading Investments — Trading investments have historically consisted of auction rate securities, which are publicly issued securities

with long-term stated maturities for which the interest rates are reset periodically through an auction process. At the end of each reset

period, investors can sell or continue to hold the securities at par. The Company's auction rate securities were insured by monolines and

collateralized by commercial paper with a rating of A-1/P-1 and original maturities of less than 28 days. The auction rate securities also

had contractual maturities in the year 2049 and auction dates typically every 28 days.

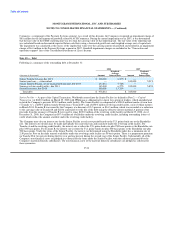

All of the Company's auction rate securities have had failed auctions during 2008 due to sell orders exceeding buy orders. Under the

contractual terms, the issuer of the auction rate security is obligated to pay penalty rates should an auction fail. In addition, the monoline

insurer has the right to replace the auction rate security with the insurer's preferred stock (the "preferred put option"), which would

effectively convert the Company's security into a long-term, less liquid investment. During 2008, the credit rating agencies downgraded

and/or placed several monoline insurers on negative credit watch due to concerns over their capital position. A rating downgrade is

viewed by the market as an indicator that it is more likely the insurer would exercise its preferred put option, and negatively impacts the

fair value of an auction rate security. In December 2008, two of the monoline insurers of the auction rate securities held by the Company

exercised their preferred put options. As a result of the exercise of the preferred put options, the Company now holds one auction rate

security collateralized by commercial paper with a rating of A-1/P-1 and original maturities of less than 28 days; one auction rate security

collateralized by perpetual preferred stock issued by the monoline insurer and paying a discretionary dividend; and perpetual preferred

stock of a monoline insurer with a discretionary dividend. The combined fair value of the trading investments is $21.5 million on a par

value of $62.3 million. Due to the failed auctions, general disruption of the credit markets and concerns regarding the capital position of

the monoline insurers and their intent to pay dividends on their preferred stock, the Company recorded an unrealized loss on its trading

investments of $40.6 million in "Net securities losses" in the Consolidated Statements of (Loss) Income for 2008 as compared to

$0.2 million in 2007. The Company has received all contractual interest payments, including the penalty rate payments, as of the date of

this filing.

During the fourth quarter 2008, the Company opted in to a buy-back program sponsored by the trading firm that sold the Company all

three of its original auction rate securities. Under this program, the Company received the right to require the trading firm to redeem the

securities at full par value beginning June 30, 2010 through June 30, 2012 (the "put options"). The trading firm maintains the right to

purchase the securities at any time through June 30, 2012 and

F-27