MoneyGram 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

straight-line method. See Note 14 — Stock-Based Compensation for further discussion of the Company's stock-based compensation.

Earnings Per Share — In accordance with SFAS No. 128, Earnings Per Share, and related pronouncements, the Company utilizes the

two-class method for computing basic earnings per common share, which reflects the amount of undistributed earnings allocated to the

common stockholders using the participation percentage of each class of stock. Undistributed earnings is determined as the Company's

net (loss) income less dividends declared or accumulated on preferred stock less any preferred stock accretion. The undistributed earnings

allocated to the common stockholders are divided by the weighted-average number of common shares outstanding during the period to

compute basic earnings per common share. Diluted earnings per common share reflects the potential dilution that could result if securities

or incremental shares arising out of the Company's stock-based compensation plans and the outstanding shares of Series B Stock were

exercised or converted into common stock. Diluted earnings per common share assumes the exercise of stock options using the treasury

stock method and the conversion of the Series B Stock using the if-converted method.

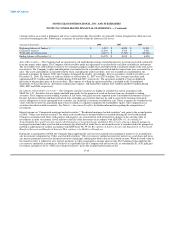

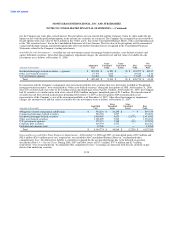

Potential common shares are excluded from the computation of diluted earnings per common share when the effect would be anti-

dilutive. All potential common shares are anti-dilutive in periods of net loss available to common stockholders. Stock options are anti-

dilutive when the exercise price of these instruments is greater than the average market price of the Company's common stock for the

period. The Series B Stock is anti-dilutive when the incremental earnings per share of Series B Stock on an if-converted basis is greater

than the basic earnings per common share. Following are the potential common shares excluded from diluted earnings per common share

as their effect would be anti-dilutive:

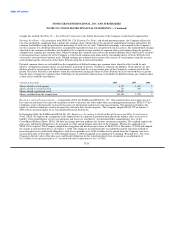

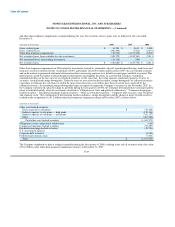

(Amounts in thousands) 2008 2007 2006

Shares related to stock options 3,577 1,495 2

Shares related to restricted stock 127 249 —

Shares related to preferred stock 337,637 — —

Shares excluded from the computation 341,341 1,744 2

Recent Accounting Pronouncements — In September 2006, the FASB issued SFAS No. 157. This statement does not require any new

fair value measurement, but it provides guidance on how to measure fair value under other accounting pronouncements. SFAS 157 also

establishes a fair value hierarchy to classify the source of information used in fair value measurements. The hierarchy prioritizes the

inputs to valuation techniques used to measure fair value into three broad categories. The Company adopted SFAS 157 on January 1,

2008 with no material impact on its Consolidated Financial Statements.

In September 2006, the FASB issued SFAS No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement

Plans. SFAS 158 requires the recognition of the funded status of a pension or postretirement plan in the balance sheet as an asset or

liability. Unrecognized prior service cost and gains and losses are recorded to "Accumulated other comprehensive loss" in the

Consolidated Balance Sheets. SFAS 158 does not change previous guidance for income statement recognition. The standard requires the

plan assets and benefit obligations to be measured as of the annual balance sheet date of the Company. Prospective application of

SFAS 158 is required. The Company adopted the recognition and disclosure provisions of SFAS 158 at December 31, 2006 and adopted

the change in measurement date as of January 1, 2008. The change in measurement date was adopted using the transition method of

measuring plan assets and benefit obligations, with the net periodic costs of $0.4 million for the period from the Company's previous

measurement date of November 30, 2007 through January 1, 2008 recognized as an adjustment to opening "Retained loss," net of tax.

Changes in the fair value of the plan assets and benefit obligation for the transition period were recognized as an adjustment of

$1.5 million to the opening balance of "Accumulated other comprehensive loss" in 2008.

F-20