MoneyGram 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

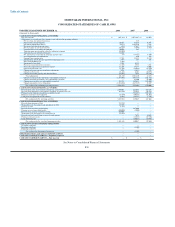

Table of Contents

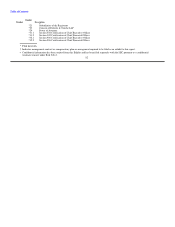

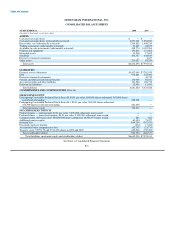

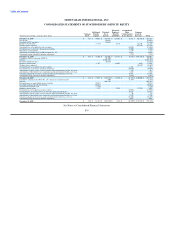

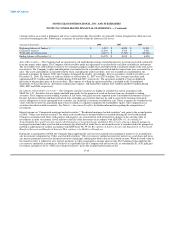

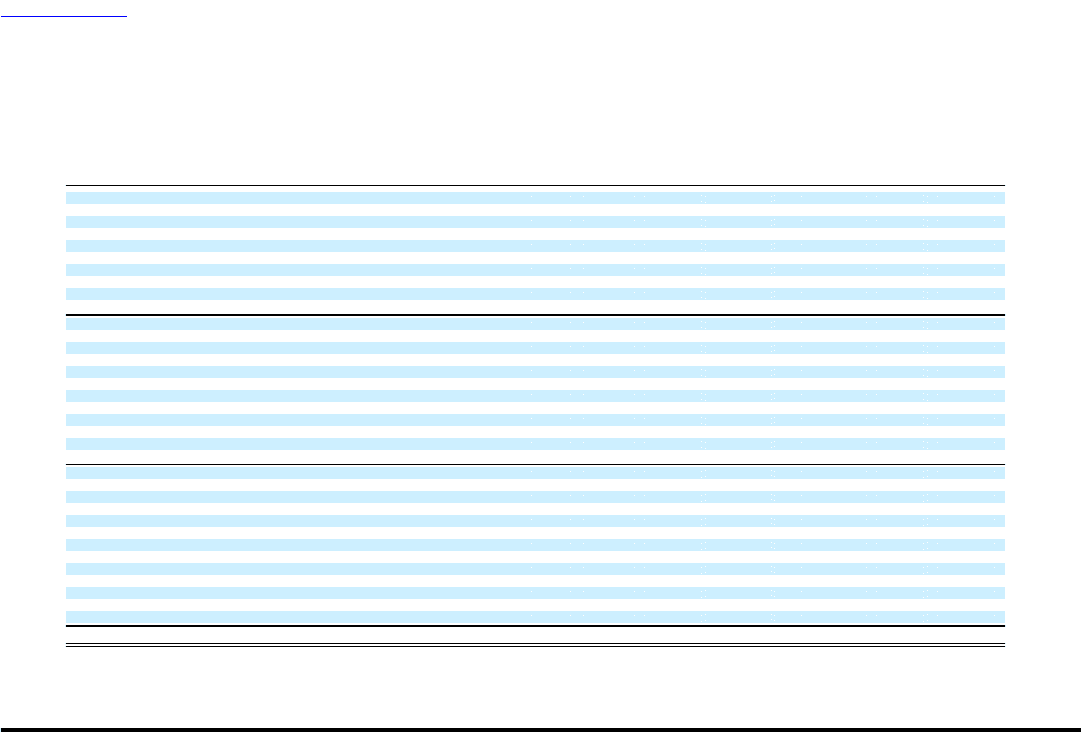

MONEYGRAM INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' (DEFICIT) EQUITY

Unearned Accumulated

Additional Retained Employee Other Common

Common Paid-In (Loss) Benefits Comprehensive Stock in

(Amounts in thousands, except per share data) Stock Capital Income and Other (Loss) Income Treasury Total

December 31, 2005 $ 886 $ 80,038 $ 613,497 $ (25,401) $ 11,825 $ (56,716) $ 624,129

Net income 124,054 124,054

Dividends ($0.17 per share) (14,445) (14,445)

Employee benefit plans (8,138) 8,216 21,220 21,298

Treasury shares acquired (67,856) (67,856)

Unrealized loss on available-for-sale securities (13,681) (13,681)

Unrealized loss on derivative financial instruments (2,306) (2,306)

Minimum pension liability 3,297 3,297

Adjustment to initially apply FASB Statement No. 158 (9,221) (9,221)

Unrealized foreign currency translation adjustment 3,794 3,794

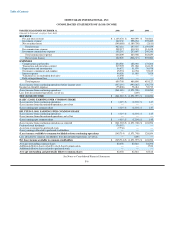

December 31, 2006 $ 886 $ 71,900 $ 723,106 $ (17,185) $ (6,292) $ (103,352) $ 669,063

Cumulative effect of adoption of FIN 48 (21,963) (21,963)

Net loss (1,071,997) (1,071,997)

Dividends ($0.20 per share) (16,625) (16,625)

Employee benefit plans 1,177 13,905 (662) 14,420

Treasury shares acquired (45,992) (45,992)

Unrealized gain on available-for-sale securities 1,811 1,811

Unrealized loss on derivative financial instruments (30,690) (30,690)

Amortization of prior service cost for pension and postretirement benefits, net of tax 117 117

Amortization of unrealized losses on pension and postretirement benefits, net of tax 2,649 2,649

Valuation adjustment for pension and postretirement benefit plans, net of tax 14,372 14,372

Unrealized foreign currency translation adjustment (3,682) (3,682)

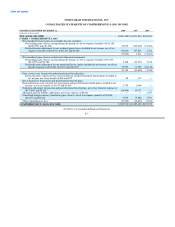

December 31, 2007 $ 886 $ 73,077 $ (387,479) $ (3,280) $ (21,715) $ (150,006) $ (488,517)

Cumulative adjustment for SFAS No. 158- change of measurement date (390) (1,467) (1,857)

Net loss (261,385) (261,385)

Reclassification of embedded derivative liability 70,827 70,827

Dividends on B and B-1 Preferred Stock (76,593) (76,593)

Accretion of preferred stock (7,736) (7,736)

Employee benefit plans 2,749 2,856 (2,555) 3,050

Unrealized loss on available-for-sale securities (17,086) (17,086)

Reclassification of unrealized loss on derivative financial instruments 20,125 20,125

Amortization of prior service cost for pension and postretirement benefits, net of tax 62 62

Amortization of unrealized losses on pension and postretirement benefits, net of tax 2,740 2,740

Valuation adjustment for pension and postretirement benefit plans, net of tax (28,405) (28,405)

Unrealized foreign currency translation adjustment 3,039 3,039

December 31, 2008 $ 886 $ 62,324 $ (649,254) $ (424) $ (42,707) $ (152,561) $ (781,736)

See Notes to Consolidated Financial Statements

F-9