MoneyGram 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Senior Facility also has certain financial covenants, including an interest coverage ratio and a senior secured debt ratio, with compliance

required beginning in the fiscal quarter ending March 31, 2009. Under the Senior Facility, we must maintain a minimum interest

coverage ratio of 1.5:1 from March 31, 2009 through September 30, 2010; 1.75:1 from December 31, 2010 through September 30, 2012;

and 2:1 from December 31, 2012 through maturity. We are not permitted to have a senior secured debt ratio in excess of 6.5:1 from

March 31, 2009 through September 30, 2009; 6:1 from December 31, 2009 through September 30, 2010; 5.5:1 from December 31, 2010

through September 30, 2011; 5:1 from December 31, 2011 through September 30, 2012; and 4.5:1 from December 31, 2012 through

maturity. The Senior Facility also contains a financial covenant requiring us to maintain at least a 1:1 ratio of certain assets to outstanding

payment service obligations. See Note 10 — Debt of the Notes to the Consolidated Financial Statements for further information

regarding the Senior Facility.

Second Lien Notes — As part of our Capital Transaction, our wholly-owned subsidiary Worldwide issued $500.0 million of senior

secured second lien notes (the "Notes") maturing in March 2018 to Goldman Sachs. The interest rate on the Notes is 13.25 percent per

year unless interest is capitalized, in which case the interest rate increases to 15.25 percent. Prior to March 25, 2011, we have the option

to capitalize interest of 14.75 percent, but must pay in cash 0.50 percent of the interest payable. We paid the interest through

December 31, 2008 and anticipate that we will continue to pay the interest under this option.

We can redeem the Notes after five years at specified premiums. Prior to the fifth anniversary, we may redeem some or all of the Notes at

a price equal to 100 percent of the outstanding principal at that date plus accrued and unpaid interest, if any, plus a premium equal to the

greater of one percent or an amount calculated by discounting the sum of (a) the redemption payment that would be due upon the fifth

anniversary plus (b) all required interest payments due through such fifth anniversary using the treasury rate plus 50 basis points. Upon a

change of control, we are required to make an offer to repurchase the Notes at a price equal to 101 percent of the principal amount plus

accrued and unpaid interest. We are also required to make an offer to repurchase the Notes with proceeds of certain asset sales that have

not been reinvested in accordance with the terms of the Note or have not been used to repay certain debt.

The Notes contain covenants that, among other things, limit our ability to: incur or guarantee additional indebtedness; pay dividends or

make other restricted payments; make certain investments; create or incur certain liens; sell assets or subsidiary stock; transfer all or

substantially all of their assets or enter into merger or consolidation transactions and enter into transactions with affiliates. The covenants

also substantially restrict our ability to incur additional debt, create or incur liens and invest assets that are subject to restrictions for the

payment of payment service obligations. We are also required to maintain at least a 1:1 ratio of certain assets to outstanding payment

service obligations. See Note 10 — Debt of the Notes to the Consolidated Financial Statements for further information regarding the

Notes.

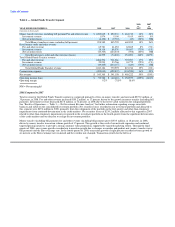

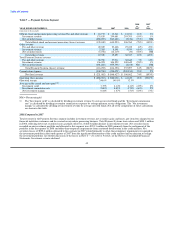

LIQUIDITY AND CAPITAL RESOURCES

We have various resources available to us for purposes of managing liquidity and capital needs, including our cash, cash equivalents,

investments, credit facilities and letters of credit. We refer to our cash equivalents, trading investments and available-for-sale investments

collectively as our "investment portfolio," with cash equivalents comprising our "short-term portfolio," and trading investments and

available-for-sale investments comprising our "long-term portfolio." The short-term portfolio is used in managing our daily operating

liquidity needs.

Liquidity

We utilize our cash and cash equivalents as the main tools to manage our daily operating liquidity needs. Our primary operating liquidity

need relates to the monies required to settle our payment instruments and related fees and commissions on a daily basis. Our second

primary operating liquidity need relates to the funding of the routine operating activities of the business. To meet these needs, we must

have sufficient highly liquid assets to meet our obligations at all times and be able to move funds on a global and timely basis. We also

have a primary objective to maintain excess liquidity beyond our operating needs to provide cushion through the normal fluctuations in,

and timing of, our payment service assets and liabilities, as well as to provide liquidity for the investment in the infrastructure and growth

of the business.

50