MoneyGram 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

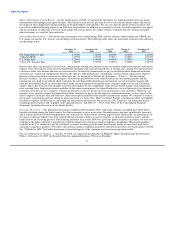

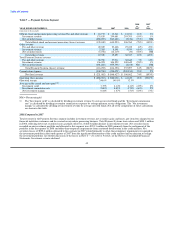

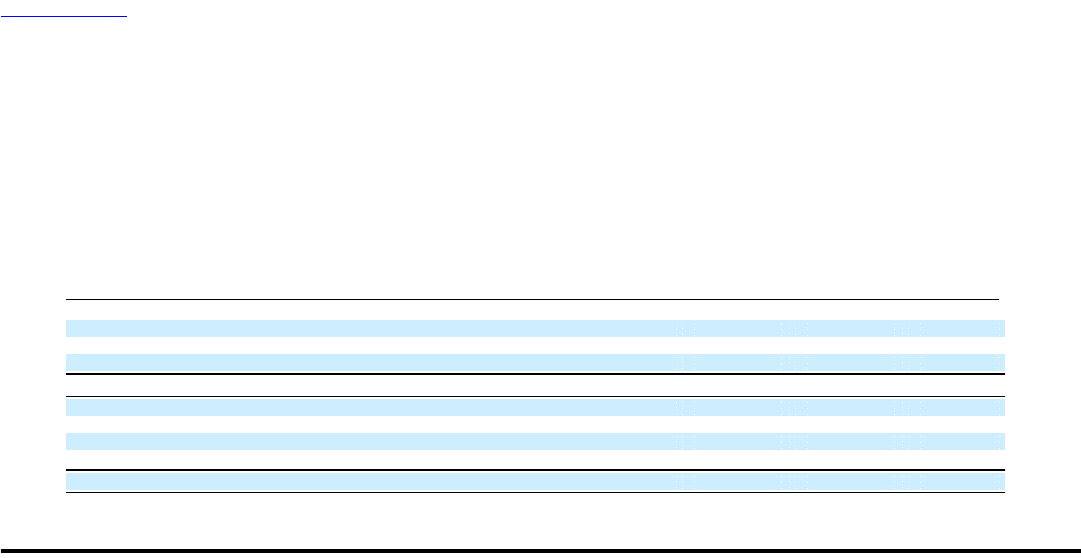

(losses) are allocated based upon the allocation of average investable balances. Our derivatives portfolio is also managed on a

consolidated level; however, each derivative instrument is utilized in a manner that can be identified to a particular segment. Our interest

rate swaps used to hedge variable rate commissions are identified with the official check product in Payment Systems segment, while our

forward foreign exchange contracts are identified with our money transfer product in the Global Funds Transfer segment. Our interest

rate swaps related to variable rate debt are identified to our Corporate activities, with the related income (expense) included in

unallocated interest expense. Other unallocated expenses include pension and benefit obligation expense, director deferred compensation

plan expense and other miscellaneous corporate expenses not allocated to the segments. Table 5 reconciles "Total segment operating

(loss) income" to "(Loss) income from continuing operations before income taxes" as reported in the Consolidated Statements of (Loss)

Income.

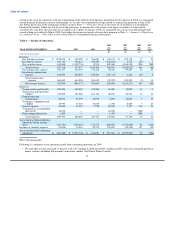

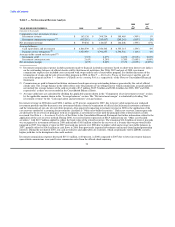

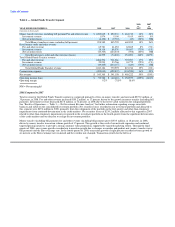

Table 5 — Segment Information

YEAR ENDED DECEMBER 31, 2008 2007 2006

(Amounts in thousands)

Operating (loss) income:

Global Funds Transfer $ 95,788 $ (60,410) $ 152,579

Payment Systems (286,763) (920,130) 41,619

Total segment operating (loss) income (190,975) (980,540) 194,198

Interest expense 95,020 11,055 7,928

Debt extinguishment loss 1,499 — —

Valuation loss on embedded derivatives 16,030 — —

Other unallocated expenses 33,667 1,672 9,497

(Loss) income from continuing operations before income taxes $ (337,191) $ (993,267) $ 176,773

41