MoneyGram 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

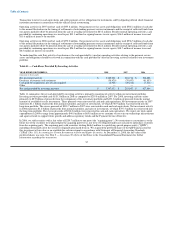

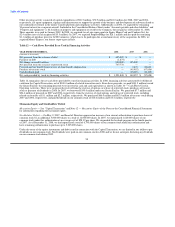

The use of different market assumptions or valuation methodologies may have a material effect on the estimated fair value amounts. Due

to the subjective nature of these assumptions, the estimates determined may not be indicative of the actual exit price if the investment was

sold at the measurement date. In the current market, the most subjective assumptions include the default rate of collateral securities and

loss severity as it relates to our other asset-backed securities and illiquidity discounts for trading investments. In 2008, we sold

substantially all of our investments classified as other asset-backed securities. As of December 31, 2008, we continue to hold investments

classified as other asset-backed securities with a fair value of $29.5 million at December 31, 2008. Using the highest and lowest prices

received as part of the valuation process described above, the range of fair value for these securities was $27.3 million to $43.3 million.

At December 31, 2008, $27.3 million, or less than one percent, of our trading and available-for-sale investments were valued using

internal pricing information. Of this amount, $16.6 million related to investments for which no price was received from the third party

pricing service or brokers. Had we used the third party price to value the remaining $10.7 million of internally priced securities, the value

of these investments would have ranged from $10.7 million to $12.6 million.

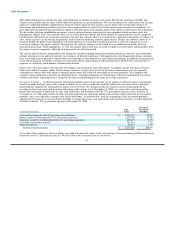

Other-Than-Temporary Impairment — Investments with gross unrealized losses at the measurement date are subject to our process for

identifying other-than-temporary impairments in accordance with SFAS No. 115, Accounting for Certain Investments in Debt and Equity

Securities, Emerging Issues Task Force ("EITF") Issue No. 99-20, Recognition of Interest Income and Impairment on Purchased

Beneficial Interests and Beneficial Interests That Continue to Be Held by a Transferor in Securitized Financial Assets, and Staff

Accounting Bulletin No. 59, Views on Accounting for Noncurrent Marketable Equity Securities. We write down to fair value investments

that we deem to be other-than-temporarily impaired through a charge against earnings in the period the securities are deemed to be

impaired. Under SFAS No. 115, the assessment of whether such impairment has occurred is based on management's evaluation of the

underlying reasons for the decline in fair value at the individual security level. We deem an individual investment to be other-than-

temporarily impaired when the underlying reasons for the decline in fair value have made it probable in management's view that we will

not receive all of the cash flows contractually stipulated for the investment. We regularly monitor our investment portfolio to ensure that

investments that may be other-than-temporarily impaired are identified in a timely manner and that any impairments are charged against

earnings in the proper period. Pursuant to our review process, changes in individual security values and credit risk characteristics are

regularly monitored to identify potential impairment indicators.

For all investments, we assess market conditions, macroeconomic factors and industry developments each period to identify any

impairment indicators. If an impairment indicator is identified, we perform a credit assessment of the impacted investments. In addition,

we review all investments meeting established thresholds and monitoring criteria to identify investments that have indications of potential

impairments or unfavorable trends that could lead to future potential impairments. These thresholds and monitoring criteria include

investments with a fair value significantly less than amortized cost, in an unrealized loss position for more than 12 months or with a

rating downgrade or significant decline in fair value from the prior period.

Through December 31, 2007, we also performed a periodic credit risk assessment for each of our asset-backed securities under a

systematic methodology, with the exception of investments backed by U.S. government agency securities. The methodology employed a

risk-driven approach, whereby securities were assigned to risk classes based on internally defined criteria. The risk classes drove the

frequency of the review, with investments in the highest risk class reviewed monthly. With the realignment of the investment portfolio in

the first quarter of 2008, this assessment is no longer meaningful as any decline in our asset-backed securities is considered an other-than-

temporary impairment as management no longer intends to hold these securities until maturity or recovery.

In assessing an investment with impairment indicators for other-than-temporary impairment, we evaluate the facts and circumstances

specific to the investment, including, but not limited to, the following:

• evaluation of current and future cash flow performance;

• reason for decline in the fair value of the investment;

• actual default rates of underlying collateral;

• subordination available as credit protection on our investment in a securitized transaction;

66