MoneyGram 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

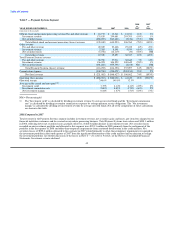

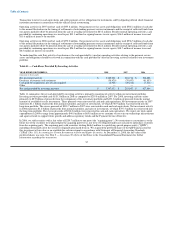

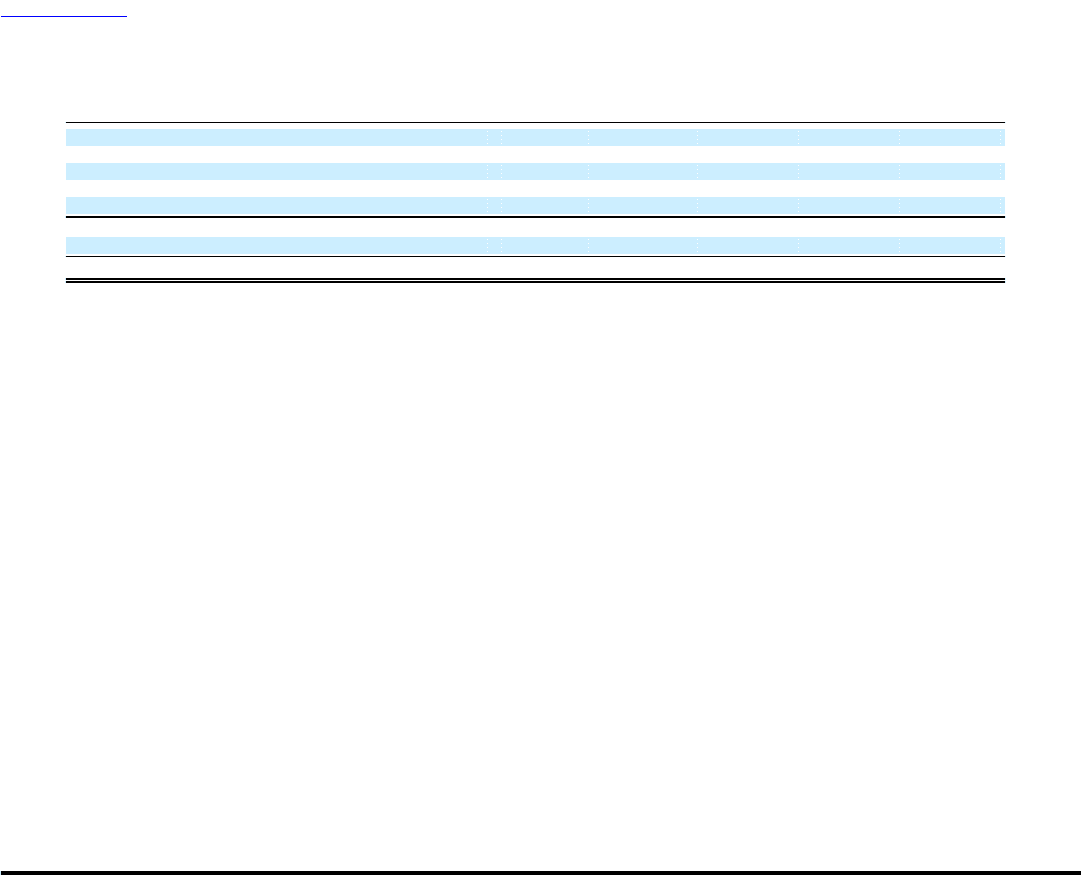

Table 8 — Unrestricted Assets

December 31, September 30, June 30, March 31, December 31,

(Amounts in thousands) 2008 2008 2008 2008 2007

Cash and cash equivalents (substantially restricted) $ 4,077,381 $ 4,561,905 $ 4,486,064 $ 4,654,341 $ 1,552,949

Receivables, net (substantially restricted) 1,264,885 1,397,179 1,959,438 1,783,241 1,408,220

Trading investments (substantially restricted) 21,485 30,285 35,210 56,413 62,105

Put options related to trading investments 26,505 — — — —

Available-for-sale investments (substantially restricted) 438,774 480,944 504,404 541,053 4,187,384

5,829,030 6,470,313 6,985,116 7,035,048 7,210,658

Amounts restricted to cover payment service obligations (5,437,999) (6,101,759) (6,636,557) (6,656,163) (7,762,470)

Excess (shortfall) of unrestricted assets $ 391,031 $ 368,554 $ 348,559 $ 378,885 $ (551,812)

As a result of the credit market disruption and accumulating credit rating downgrades on investment securities, our investment portfolio

declined in value substantially in November and December 2007. Combined with management's decision in early 2008 to realign the

portfolio, the decline in the investment portfolio value caused us to have a shortfall in our unrestricted assets. Due to the differences in the

contractual and regulatory measures, however, the Company maintained compliance with our contractual and regulatory requirements as

of December 31, 2007. During the first quarter of 2008, additional declines in the value of our investment portfolio resulted in us being

out of compliance with certain contractual and regulatory requirements described above. With the completion of the Capital Transaction,

the proceeds of which replenished our capital base, we were in compliance with all contractual and regulatory requirements as of

March 31, 2008 and have maintained compliance through December 31, 2008.

We received waivers of default through May 1, 2008 from both the clearing bank and credit agreement lenders through amendments to

their respective agreements. These waivers were superseded by amendments to these agreements made in conjunction with the Capital

Transaction. In July 2008, we received notice from one state that it is contemplating the assessment of a fine for the period of non-

compliance, although no such fine has been assessed at this time. We believe the amount of this fine would not be material to the

Consolidated Financial Statements. While we have not received notice from any other regulators, they reserve the right to take action in

the future and could impose fines and penalties related to the compliance failure.

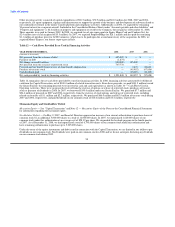

In completing the Capital Transaction, we contemplated that our investments classified as trading investments and "Other asset-backed

securities" might decline further in value. Accordingly, the capital raised in the Capital Transaction assumed a zero value for these

securities. As a result, further unrealized losses and impairments on these securities are already funded and would not cause us to seek

additional capital or financing. We believe that our current investment portfolio and operating cash flows are sufficient to ensure on-

going compliance with contractual and regulatory requirements in the future as a result of the realignment of the portfolio and the Capital

Transaction. Should capital needs exceed our investment portfolio and operating cash flows, we believe our external financing sources,

including availability under the Senior Facility, will be sufficient to meet any shortfalls. We do not anticipate the use of our Senior

Facility to maintain compliance in the future.

In the fourth quarter of 2008, we opted into a buy-back program related to all three of our auction rate securities. Under this program, we

received the right to sell the ARS to the original trading firm at par value beginning in June 30, 2010 through July 2, 2012 (the "put

options"). The trading firm will maintain the right to sell the ARS at any time through July 2, 2012 and pay us at par value. While we are

not able to liquidate these auction rate securities until June 2010, opting into the program provides us with a known cash flow from these

securities, subject to the credit worthiness of the trading firm. As the put options are separate from the auction rate security itself, opting

into the program does not impact the fair value of the auction rate security. Rather, we have recognized assets separate

54