MoneyGram 2008 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

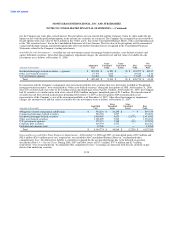

Note 9 — Intangibles and Goodwill

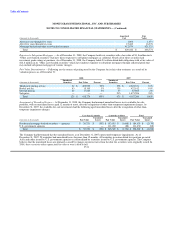

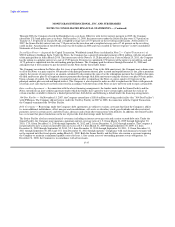

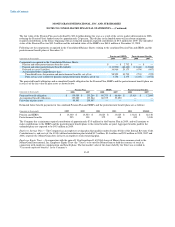

Intangible assets at December 31 consist of the following:

2008 2007

Gross Net Gross Net

Carrying Accumulated Carrying Carrying Accumulated Carrying

(Amounts in thousands) Value Amortization Value Value Amortization Value

Amortized intangible assets:

Customer lists $ 29,465 $ (17,486) $ 11,979 $ 38,226 $ (24,143) $ 14,083

Patents — — — 13,218 (12,887) 331

Non-compete agreements 3,417 (2,840) 577 3,567 (1,927) 1,640

Trademarks 981 (150) 831 384 (137) 247

Developed technology 1,519 (358) 1,161 1,373 (69) 1,304

Total intangible assets $ 35,382 $ (20,834) $ 14,548 $ 56,768 $ (39,163) $ 17,605

No impairments of intangible assets were identified during 2008, 2007 and 2006. The Company recorded intangible assets of $1.4 million

in 2008 in connection with the acquisitions of MoneyCard and Cambios Sol, consisting principally of agent rights, developed technology

and a money transfer license. The Company recorded intangible assets of $6.0 million in 2007 in connection with the acquisition of

PropertyBridge, consisting principally of customer lists, developed technology and a non-compete agreement, and $0.5 million of non-

compete agreements from the finalization of the purchase price allocation for the Money Express acquisition.

Intangible asset amortization expense for 2008, 2007 and 2006 was $4.4 million, $4.3 million and $3.1 million, respectively. The

estimated future intangible asset amortization expense is $3.3 million, $2.8 million, $1.6 million, $1.0 million and $0.7 million for 2009,

2010, 2011, 2012 and 2013, respectively.

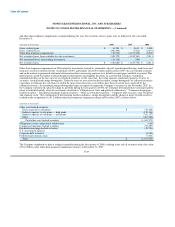

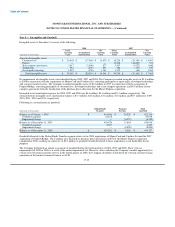

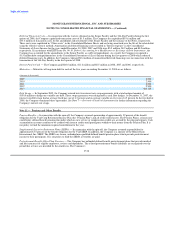

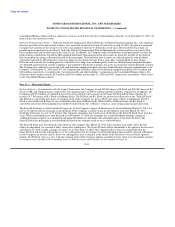

Following is a reconciliation of goodwill:

Global Funds Payment Total

(Amounts in thousands) Transfer Systems Goodwill

Balance as of January 1, 2007 $ 401,096 $ 20,220 $ 421,316

Goodwill acquired 23,878 — 23,878

Impairment charge — (6,355) (6,355)

Balance as of December 31, 2007 424,974 13,865 438,839

Goodwill acquired 4,307 — 4,307

Impairment charge — (8,809) (8,809)

Balance as of December 31, 2008 $ 429,281 $ 5,056 $ 434,337

Goodwill allocated to the Global Funds Transfer segment relates to the 2008 acquisitions of MoneyCard and Cambios Sol and the 2007

acquisition of PropertyBridge. The Company also finalized its purchase price allocation in 2007 for the Money Express acquisition

completed in 2006, resulting in a decrease of $0.3 million to goodwill. Goodwill related to these acquisitions is not deductible for tax

purposes.

The Company performed an annual assessment of goodwill during the fourth quarters of 2008, 2007 and 2006. There were no

impairments for 2008 or 2006 as a result of the annual impairment test. However, after evaluating the Company's market opportunity for

certain of its electronic payment services in the fourth quarter of 2008, the Company decided to wind-down the external customer-facing

operations of the business formerly known as ACH

F-35