MoneyGram 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The fair value of the Pension Plan assets declined by $30.6 million during the year as a result of the severe market deterioration in 2008,

reducing the Pension Plan's funded status by approximately 20 percent. This decline in the funded status will accelerate minimum

required contributions in the future, beginning with an estimated minimum required contribution of $3.0 million for 2009. The unfunded

status of the Pension Plan was $43.5 million and the unfunded status of the SERPs was $68.4 million at December 31, 2008.

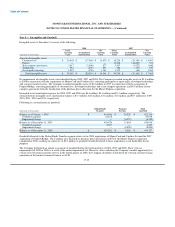

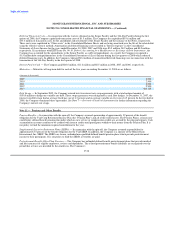

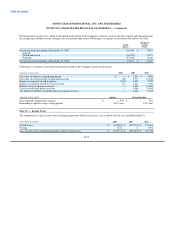

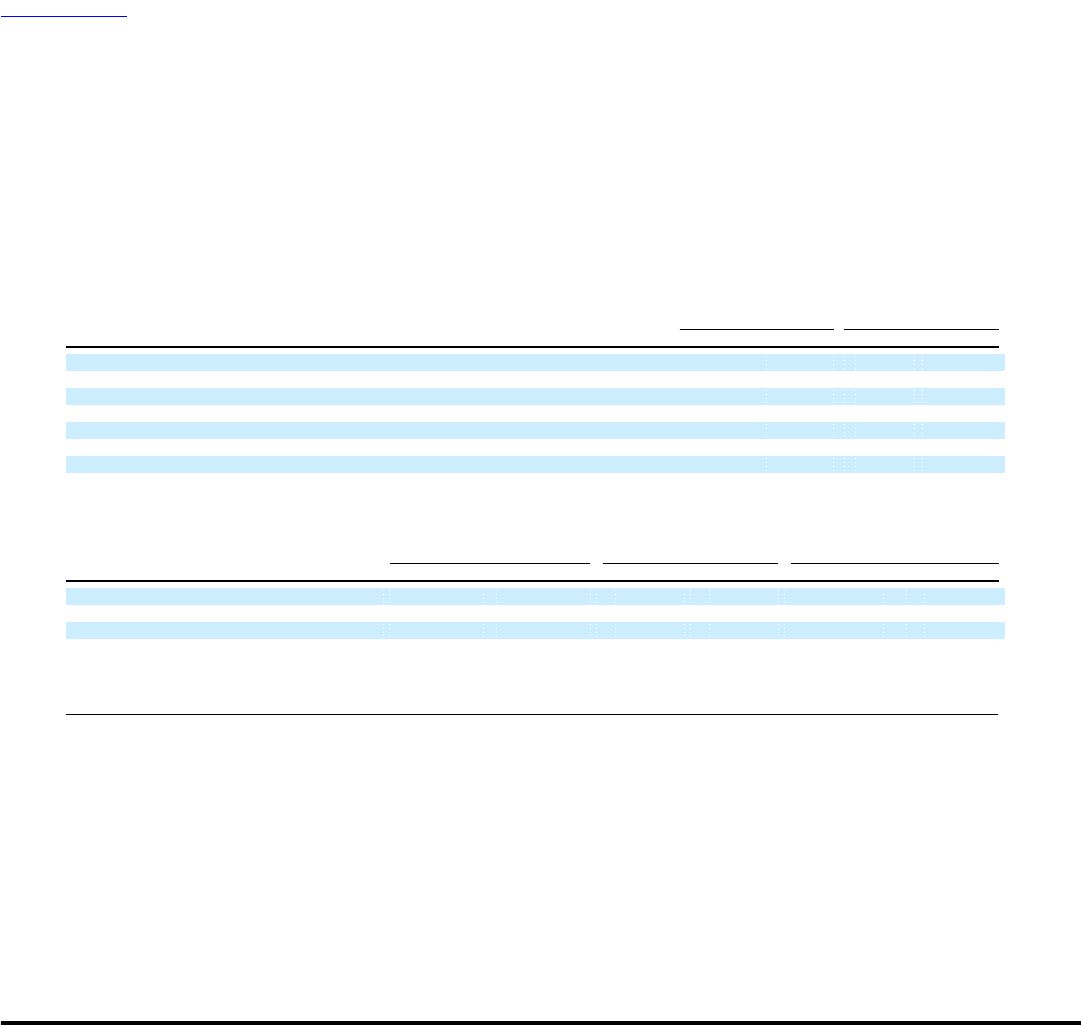

Following are the components recognized in the Consolidated Balance Sheets relating to the combined Pension Plan and SERPs and the

postretirement benefit plans at December 31:

Pension and SERPs Postretirement Benefits

(Amounts in thousands) 2008 2007 2008 2007

Components recognized in the Consolidated Balance Sheets:

Pension and other postretirement benefits assets $ — $ 2,732 $ — $ —

Pension and other postretirement benefits liability (111,904) (66,463) (13,416) (12,680)

Deferred tax asset (liability) 36,966 20,173 (474) (697)

Accumulated other comprehensive loss:

Unrealized losses for pension and postretirement benefits, net of tax 58,559 30,739 (791) (225)

Prior service cost (credit) for pension and postretirement benefits, net of tax 1,754 2,175 (1,335) (1,572)

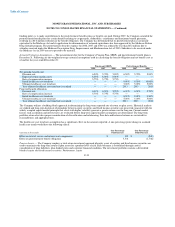

The projected benefit obligation and accumulated benefit obligation for the Pension Plan, SERPs and the postretirement benefit plans are

in excess of the fair value of plan assets as shown below:

Pension Plan SERPs Postretirement Benefits

(Amounts in thousands) 2008 2007 2008 2007 2008 2007

Projected benefit obligation $ 139,080 $ 133,264 $ 68,375 $ 66,464 $ 13,416 $ 12,680

Accumulated benefit obligation 139,080 133,264 68,375 53,250 — —

Fair value of plan assets 95,551 135,997 — — — —

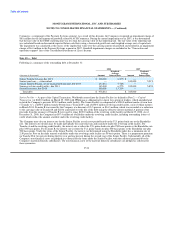

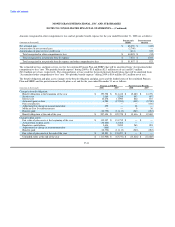

Estimated future benefit payments for the combined Pension Plan and SERPs and the postretirement benefit plans are as follows:

(Amounts in thousands) 2009 2010 2011 2012 2013 2014-18

Pension and SERPs $ 13,340 $ 13,523 $ 13,623 $ 13,825 $ 13,821 $ 82,158

Postretirement benefits 295 338 372 404 455 3,108

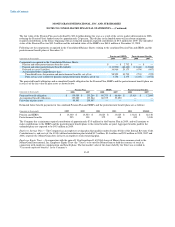

The Company has a minimum required contribution of approximately $3.0 million for the Pension Plan in 2009, and will continue to

make contributions to the SERPs and the postretirement benefit plans to the extent benefits are paid. Aggregate benefits paid for the

unfunded plans are expected to be $4.5 million in 2009.

Employee Savings Plan — The Company has an employee savings plan that qualifies under Section 401(k) of the Internal Revenue Code.

Contributions to, and costs of, the 401(k) defined contribution plan totaled $3.7 million, $3.4 million and $2.8 million in 2008, 2007 and

2006, respectively. MoneyGram does not have an employee stock ownership plan.

Employee Equity Trust — In connection with the spin-off, Viad transferred 1,632,964 shares of MoneyGram common stock to the

MoneyGram International, Inc. Employee Equity Trust (the "Trust") to be used by MoneyGram to fund the issuance of stock in

connection with employee compensation and benefit plans. The fair market value of the shares held by the Trust was recorded in

"Unearned employee benefits" in the Company's

F-42