MoneyGram 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

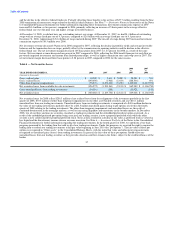

issuing the put options. See Note 7 — Derivative Financial Instruments of the Notes to the Consolidated Financial Statements for further

information regarding these put options.

We had net securities losses of $1.2 billion in 2007 compared to net securities losses of $2.8 million in 2006. The net securities losses

recorded in 2007 reflect other-than-temporary impairments recorded in December 2007 as a result of the substantial market deterioration

and our decision to realign the investment portfolio. See Note 6 — Investment Portfolio of the Notes to the Consolidated Financial

Statements for further discussion of the other-than-temporary impairments.

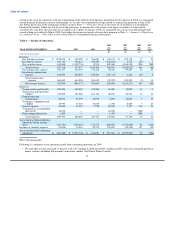

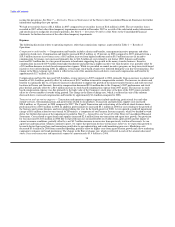

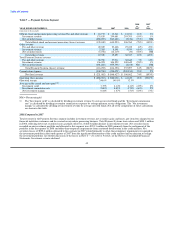

Expenses

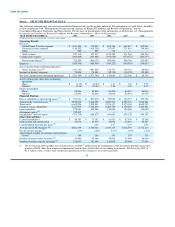

The following discussion relates to operating expenses, other than commissions expense, as presented in Table 1 — Results of

Operations.

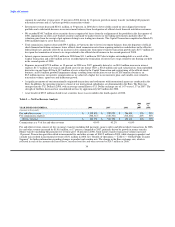

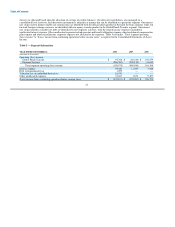

Compensation and benefits — Compensation and benefits includes salaries and benefits, management incentive programs and other

employee related costs. Compensation and benefits increased $36.5 million, or 19 percent, in 2008 compared to 2007, primarily from a

$19.5 million increase in severance costs, a $8.5 million increase from higher headcount and an $8.5 million increase in incentive

compensation. Severance costs increased primarily due to $16.5 million of costs related to our former CEO. Salaries and benefits

increased $8.5 million due to a two percent increase in headcount supporting the growth in the money transfer business. Incentive

compensation increased $10.9 million from higher headcount and achieving a higher incentive tier than the prior year, partially offset by

a $2.4 million decrease in stock-based compensation expense. While we provided an annual incentive program, no long-term stock-based

incentives were offered during 2008. In addition, several large stock-based awards were forfeited during the year due to terminations. The

change in the Euro exchange rate, which is reflected in each of the amounts discussed above, increased compensation and benefits by

approximately $2.7 million in 2008.

Compensation and benefits increased $15.8 million, or nine percent, in 2007 compared to 2006, primarily from an increase in salaries and

benefits of $31.4 million, partially offset by a decrease of $16.7 million in incentive compensation accruals. The increase in salaries and

benefits was primarily due to a 10 percent increase in headcount to support the growth of the money transfer business and staff our retail

locations in France and Germany. Incentive compensation decreased $18.6 million due to the Company's 2007 performance and stock

price decline, partially offset by a $2.0 million increase in stock-based compensation expense from 2007 grants. The increase in stock-

based compensation expense was due primarily to the high value of the Company's stock price at the date of the 2007 grants, partially

offset by a lower number of awards being granted. The change in the Euro exchange rate, which is reflected in each of the amounts

discussed above, increased compensation and benefits by approximately $1.4 million compared to 2006.

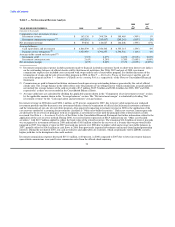

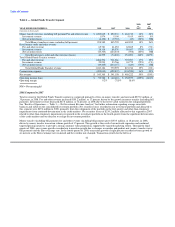

Transaction and operations support — Transaction and operations support expenses include marketing, professional fees and other

outside services, telecommunications and agent forms related to our products. Transaction and operations support costs increased

$28.8 million, or 15 percent, in 2008 compared to 2007. The Capital Transaction and restructuring of the official check business drove

professional fees of $9.5 million in 2008. In addition, professional fees increased $5.1 million in 2008 for costs relating to the growth of

the business and various business analyses initiated during the year. In the fourth quarter of 2008, we recognized a goodwill impairment

charge of $8.8 million related to our external ACH business, a component of our Payment Systems segment, which we decided to wind

down. See further discussion of the impairment recorded in Note 9 — Intangibles and Goodwill of the Notes to Consolidated Financial

Statements. Costs related to agent forms and supplies increased $2.8 million from our transaction and agent base growth. Our provision

for loss increased by $4.6 million in 2008 due to expected increases in uncollectible receivables from agent growth and the impact of

current economic conditions, partially offset by a net $0.7 million increase in recoveries from previously written-off accounts. As our

agent base and transaction volumes continue to grow, we expect that provision for loss will increase; however, we expect this growth to

be much slower than agent base and transaction growth due to our underwriting and credit monitoring processes. Marketing costs

decreased $3.6 million in 2008 from controlled spending, partially offset by higher costs from agent location growth and a new marketing

campaign to enhance our brand positioning. The change in the Euro exchange rate, which is reflected in each of the amounts discussed

above, increased transaction and operations support by approximately $1.9 million in 2008.

38