MoneyGram 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

• requires that the use of observable inputs be maximized and the use of unobservable inputs be minimized; and

• expands disclosures about instruments measured at fair value.

The adoption of SFAS No. 157 had no impact on the Company's Consolidated Financial Statements or the valuation methods consistently

followed by the Company.

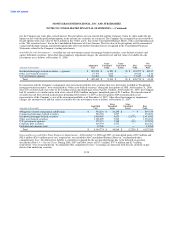

The fair value hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities

(Level 1) and the lowest priority to unobservable inputs (Level 3). A financial instrument's level within the hierarchy is based on the

lowest level of any input that is significant to the fair value measurement. The levels of the fair value hierarchy are defined as follows:

Level 1 Observable inputs that reflect unadjusted quoted prices for identical assets or liabilities in active markets that the Company

has the ability to access at the measurement date. The Company's financial instruments categorized as Level 1 relate to cash

equivalents.

Level 2 Observable inputs such as quoted prices for similar instruments and quoted prices in markets that are not active, and inputs

that are directly observable or can be corroborated by observable market data. The Company's financial instruments

categorized as Level 2 relate to U.S. government agency investments, residential mortgage-backed securities collateralized

by U.S. government agency investments, obligations of state and political subdivisions, corporate debt and derivative

instruments.

Level 3 Valuations that require inputs that are both significant to the fair value measurement and unobservable. The Company's

financial instruments categorized as Level 3 relate to its trading investments, commercial mortgage-backed securities,

residential mortgage-backed securities other than those categorized as Level 2, other asset-backed securities, preferred stock,

investments in limited partnerships, embedded derivatives in the Series B Stock and put options related to trading

investments.

Following is a description of the Company's valuation methodologies for assets and liabilities measured at fair value:

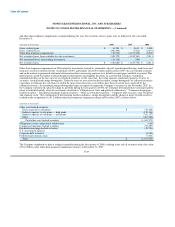

Cash equivalents — The estimated fair values for cash equivalents approximate their carrying values due to the short-term maturities of

these instruments. Accordingly, cash equivalents are classified as Level 1.

Investments — Trading and available-for-sale investments are valued using quoted market prices for identical or similar securities where

possible, including broker quotes. If market quotes are not available, or broker quotes could not be corroborated by market observable

data, the Company will value a security using a pricing service and externally developed cash flow models.

For U.S. government agencies, residential mortgage-backed securities collateralized by U.S. government agency securities, obligations of

states and political subdivisions and corporate debt, fair value measures are generally obtained from independent sources, including a

pricing service. As market quotes are generally not readily available or accessible for these specific securities, the pricing service

generally measures fair value through the use of pricing models and observable inputs for similar assets and market data. Accordingly,

these securities are classified as Level 2 financial instruments. The Company periodically corroborates the valuations provided by the

pricing service through internal valuations utilizing externally developed cash flow models, comparison to actual transaction prices for

sold securities and any broker quotes received on the same security.

For commercial mortgage-backed securities, residential mortgage-backed securities, other asset-backed securities, preferred stock.

investments in limited partnerships and trading investments, market quotes are generally not available. If available, the Company will

utilize a fair value measurement from a pricing service. The pricing service utilizes a pricing model based on market observable data and

indices, such as quotes for comparable securities, yield curves, default indices, interest rates and historical prepayment speeds. If a fair

value measurement is not available from the pricing service, the Company will utilize a broker quote if available. Due to a general lack of

transparency in the process that the brokers use to develop prices, most valuations that are based on brokers' quotes are classified

F-24