MoneyGram 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

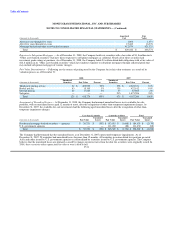

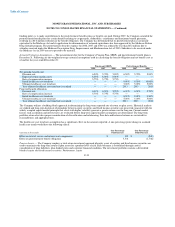

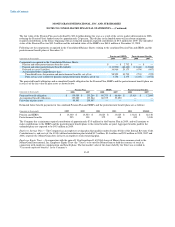

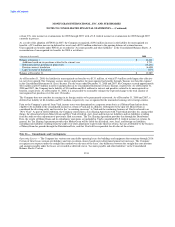

Amounts recognized in other comprehensive loss and net periodic benefit expense for the year ended December 31, 2008 are as follows:

Pension and Postretirement

(Amounts in thousands) SERPs Benefits

Net actuarial gain $ 48,039 $ (442)

Amortization of net actuarial gain (2,740) —

Amortization of prior service (credit) cost (414) 352

Total recognized in other comprehensive loss $ 44,885 $ (90)

Total recognized in net periodic benefit expense $ 7,072 $ 1,013

Total recognized in net periodic benefit expense and other comprehensive loss $ 51,957 $ 923

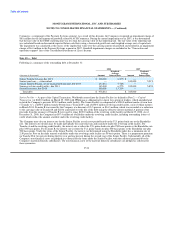

The estimated net loss and prior service cost for the combined Pension Plan and SERPs that will be amortized from "Accumulated other

comprehensive loss" into "Net periodic benefit expense" during 2009 is $3.8 million ($2.3 million net of tax) and $0.3 million

($0.2 million net of tax), respectively. The estimated prior service credit for the postretirement benefit plans that will be amortized from

"Accumulated other comprehensive loss" into "Net periodic benefit expense" during 2009 is $0.4 million ($0.2 million net of tax).

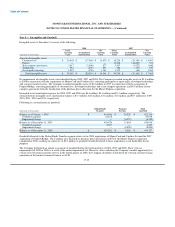

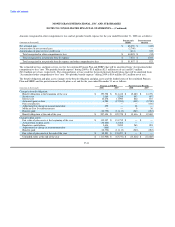

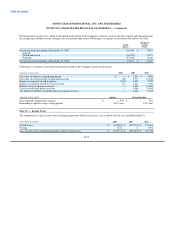

The benefit obligation and plan assets, changes to the benefit obligation and plan assets and the funded status of the combined Pension

Plan and SERPs and the postretirement benefit plans as of and for the year ended December 31 are as follows:

Pension and SERPs Postretirement Benefits

(Amounts in thousands) 2008 2007 2008 2007

Change in benefit obligation:

Benefit obligation at the beginning of the year $ 199,728 $ 214,412 $ 12,680 $ 14,778

Service cost 1,069 2,298 543 697

Interest cost 12,678 11,900 822 837

Actuarial (gain) or loss 6,280 (17,769) (442) (2,749)

Plan amendments — — — (636)

Adjustment for change in measurement date 490 — 68 —

Medicare Part D reimbursements — — 8 36

Benefits paid (12,790) (11,113) (263) (283)

Benefit obligation at the end of the year $ 207,454 $ 199,728 $ 13,416 $ 12,680

Change in plan assets:

Fair value of plan assets at the beginning of the year $ 135,997 $ 131,752 $ — $ —

Actual return on plan assets (30,626) 12,468 — —

Employer contributions 3,636 2,890 263 283

Adjustment for change in measurement date (666) — — —

Benefits paid (12,790) (11,113) (263) (283)

Fair value of plan assets at the end of the year $ 95,551 $ 135,997 $ — $ —

Unfunded status at the end of the year $ (111,904) $ (63,731) $ (13,416) $ (12,680)

F-41