MoneyGram 2008 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

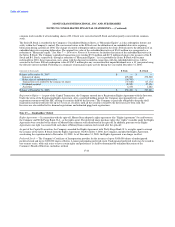

transfer transactions during the remainder of its contract. However, under the terms of certain agent contracts, the Company may

terminate the contract if the projected or actual volume of transactions falls beneath a contractually specified amount. With respect to

minimum commission guarantees expiring in 2008 and 2007, the Company paid $0.6 million and $0.8 million, respectively, or

approximately 15 percent and 14 percent of the estimated maximum payment for the year, respectively.

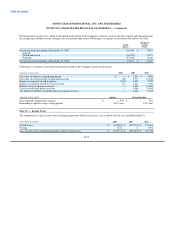

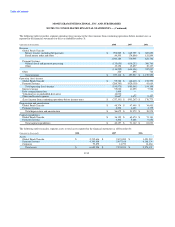

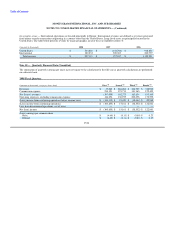

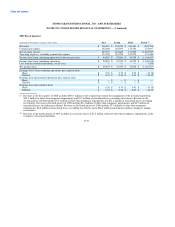

Note 17 — Segment Information

The Company's business segments are determined based upon factors such as the type of customers, the nature of products and services

provided and the distribution channels used to provide those services. Segment pre-tax operating income and segment operating margin

are used to evaluate performance and allocate resources. The Company conducts its business through two reportable segments:

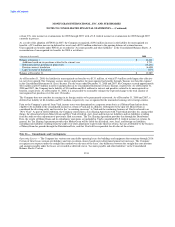

Global Funds Transfer — This segment provides global money transfer services. It also provides money orders and bill payment

services to consumers through the U.S. network of agents and, in select markets, company-operated locations. Fee revenue is driven by

transaction volume and fees per transaction. In addition, investment income is generated by investing funds received from the sale of

retail money orders until the instruments are settled. One agent in the Global Funds Transfer segment accounted for 26, 20 and

17 percent of fee and investment revenue in 2008, 2007 and 2006, respectively.

Payment Systems — This segment provides financial institutions in the United States with payment processing services, primarily

official check outsourcing services, and money orders for sale to their customers. This segment also processes controlled

disbursements. Investment income is generated by investing funds received from the sale of payment instruments until the instruments

are settled. In addition, fee revenue is derived from per-item fees paid by our financial institution customers.

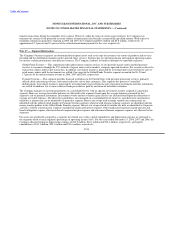

The Company manages its investment portfolio on a consolidated level, with no specific investment security assigned to a particular

segment. However, average investable balances are allocated to the segments based upon the average balances generated by that

segment's sale of payment instruments. Investment revenue and net securities gains (losses) are allocated based upon the allocation of

average investable balances. The derivatives portfolio is also managed on a consolidated level; however, each derivative instrument is

utilized in a manner that can be identified to a particular segment. Interest rate swaps used to hedge variable rate commissions are

identified with the official check product in Payment Systems segment, while forward foreign exchange contracts are identified with the

money transfer product in the Global Funds Transfer segment. Interest rate swaps related to variable rate debt are identified to Corporate

activities, with the related income (expense) included in unallocated interest expense. Other unallocated expenses include pension and

benefit obligation expense, director deferred compensation plan expense and other miscellaneous corporate expenses not allocated to the

segments.

For assets not specifically assigned to a segment, the related asset value, capital expenditures and depreciation expense are allocated to

the segments based on each segment's percentage of operating income (loss). For the years ended December 31, 2008, 2007 and 2006, the

Company allocated corporate depreciation expense of $16.9 million, $16.1 million and $12.4 million, respectively, and capital

expenditures of $14.1 million, $25.1 million and $33.6 million, respectively.

F-54