MoneyGram 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

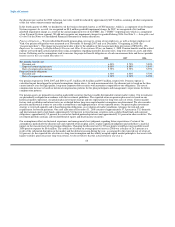

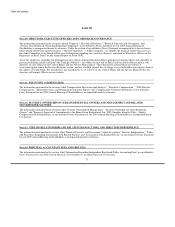

and "Interest expense." As a result of the current federal funds rate environment, the outcome of the income statement simulation analysis

on "Investment commissions expense" in a declining rate scenario is not meaningful as we have no downside risk. In the current federal

funds rate environment, the worst case scenario is that we would not owe any commissions to our financial institution customers as the

commission rate would decline to zero or become negative. Accordingly, we have not presented the impact of the simulation in a

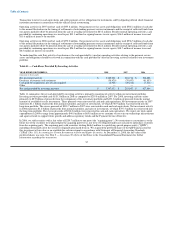

declining rate environment for "Investment commissions expense." The following table summarizes the changes to affected components

of the income statement under various scenarios.

Table 13 — Interest Rate Sensitivity Analysis

Basis Point Change in Interest Rates

Down Down Down Up Up Up

(Amounts in thousands) 200 100 50 50 100 200

Interest income $ (2,589) $ (2,391) $ (2,222) $ 11,275 $ 22,737 $ 45,556

Percent change (9.0%) (8.3%) (7.7%) 39.0% 78.7% 157.6%

Investment commissions expense NM NM NM $ (3,215) $ (9,652) $ (23,094)

Percent change NM NM NM NM NM NM

Interest expense $ 915 $ 900 $ 832 $ (1,048) $ (2,097) $ (4,193)

Percent change 0.9% 0.9% 0.8% (1.0%) (2.1%) (4.1%)

Pre-tax loss from continuing operations NM NM NM $ 7,012 $ 10,988 $ 18,268

Percent change NM NM NM 9.4% 14.8% 24.6%

NM = Not meaningful

Foreign Currency Exchange Risk

Foreign currency exchange risk represents the potential adverse effect on our earnings from fluctuations in foreign exchange rates

affecting certain receivables and payables denominated in foreign currencies, as well as the potential adverse effect on our earnings

originating in foreign currencies. We offer our products and services through a network of agents and financial institutions with locations

in over 189 countries. Foreign exchange risk is managed through the structure of our business and certain business processes. We are

primarily affected by fluctuations in the U.S. Dollar as compared to the Euro as a significant amount of our international transactions and

settlements with international agents are conducted in the Euro. Our foreign currency exposure is naturally limited by the fact that foreign

currency denominated assets and liabilities are generally very short-term in nature. We primarily utilize forward contracts with maturities

of less than thirty days to hedge our balance sheet exposure to fluctuations in exchange rates. By policy, we do not speculate in foreign

currencies and we promptly buy and sell foreign currencies as necessary to cover our net payables and receivables which are denominated

in foreign currencies. The forward contracts are recorded on the Consolidated Balance Sheets. The net effect of changes in exchange rates

and the related forward contracts was not significant for 2008.

The operating expenses of our international subsidiaries are substantially denominated in the Euro. The impact of changes in the Euro

exchange rate have historically not been material to our Consolidated Statement of (Loss) Income as the changes in revenue are

substantially offset by changes in operating expenses. As we continue to grow our business internationally, the impact of fluctuations in

the Euro may become material to our operating results. We are currently undergoing an analysis of the various foreign currency exchange

risk mitigation tools available to us and may utilize foreign currency instruments more frequently in the future.

In 2008, the strength of the Euro decreased our consolidated net loss by approximately $4.9 million for 2008. Had the Euro appreciated

relative to the U.S. Dollar by 20 percent over actual exchange rates for 2008, pre-tax operating income would have increased $2.2 million

for the year. Had the Euro depreciated by 20 percent under actual rates for 2008, pre-tax operating income would have decreased

$7.0 million for the year. This sensitivity analysis considers both the impact on translation of our foreign denominated revenue and

expense streams and the impact on our hedging program.

64