MoneyGram 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

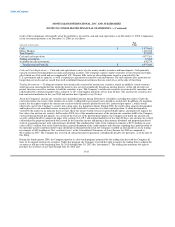

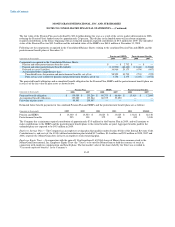

Through 2008, the Company elected the Eurodollar rate as its basis. Effective with its first interest payment in 2009, the Company

elected the U.S. bank prime rate as its basis. On December 31, 2008, the interest rates under the Senior Facility were 5.75 percent on

Tranche A, 7.25 percent on Tranche B and a weighted-average rate of 5.75 percent on the revolving credit facility. At December 31,

2007, the Senior Facility interest rate was 7.58 percent on the term loan and a weighted average rate of 7.64 percent on the revolving

credit facility. Amortization of the debt discount was $2.0 million in 2008 and was recorded in "Interest expense" in the Consolidated

Statements of (Loss) Income.

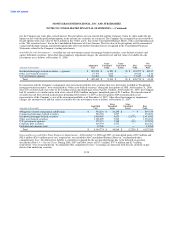

Second Lien Notes — As part of the Capital Transaction, Worldwide issued Notes (as defined in Note 2 — Capital Transaction ) of

$500.0 million to Goldman Sachs. Under the Notes, the Company has a quarterly principal payment of $0.6 million, with the remainder

of the principal due in full in March 2018. The interest rate on the Notes is 13.25 percent per year. Prior to March 25, 2011, the Company

has the option to capitalize interest at a rate of 15.25 percent. If interest is capitalized, 0.50 percent of the interest is payable in cash and

14.75 percent is capitalized into the outstanding principal balance. The Company paid the interest through December 31, 2008 and

anticipates that it will continue to pay the interest on the Notes for the foreseeable future.

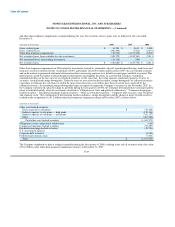

The Company can redeem the Notes after five years at specified premiums. Prior to the fifth anniversary, the Company may redeem some

or all of the Notes at a price equal to 100 percent of the principal amount thereof, plus accrued and unpaid interest, if any, plus a premium

equal to the greater of one percent or an amount calculated by discounting the sum of (a) the redemption payment that would be due upon

the fifth anniversary plus (b) all required interest payments due through such fifth anniversary using the treasury rate plus 50 basis points.

Upon a change of control, the Company is required to make an offer to repurchase the Notes at a price equal to 101 percent of the

principal amount plus accrued and unpaid interest. The Company is also required to make an offer to repurchase the Notes with proceeds

of certain asset sales that have not been reinvested in accordance with the terms of the Notes or have not been used to repay certain debt.

Inter-creditor Agreement — In connection with the above financing arrangements, the lenders under both the Senior Facility and the

Notes entered into an inter-creditor agreement under which the lenders have agreed to waive certain rights and limit the exercise of

certain remedies available to them for a limited period of time, both before and following a default under the financing arrangements.

364-Day Facility — On November 15, 2007, the Company entered into a $150.0 million revolving credit facility (the "364-Day Facility")

with JPMorgan. The Company did not borrow under the 364-Day Facility in 2007 or 2008. In connection with the Capital Transaction,

the Company terminated the 364-Day Facility.

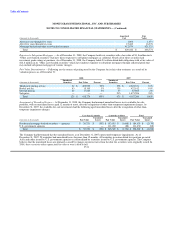

Debt Covenants — Borrowings under the Company's debt agreements are subject to various covenants that limit the Company's ability

to: incur additional indebtedness; effect mergers and consolidations; sell assets or subsidiary stock; pay dividends and other restricted

payments; invest in certain assets; and effect loans, advances and certain other transactions with affiliates. In addition, the Senior Facility

has a covenant that places limitations on the use of proceeds from borrowings under the facility.

The Senior Facility also has certain financial covenants, including an interest coverage ratio and a senior secured debt ratio. Under the

Senior Facility, the Company must maintain a minimum interest coverage ratio of 1.5:1 from March 31, 2009 through September 30,

2010, 1.75:1 from December 31, 2010 through September 30, 2012 and 2:1 from December 31, 2012 through maturity. The Company is

not permitted to have a senior secured debt ratio in excess of 6.5:1 from March 31, 2009 through September 30, 2009, 6:1 from

December 31, 2009 through September 30, 2010, 5.5:1 from December 31, 2010 through September 30, 2011, 5:1 from December 31,

2011 through September 30, 2012 and 4.5:1 from December 31, 2012 through maturity. Compliance with such financial covenants will

not be required until the fiscal quarter ending March 31, 2009. Both the Senior Facility and the Notes also contain a covenant requiring

the Company to maintain a minimum liquidity ratio of at least 1:1 for certain assets to outstanding payment service obligations. At

December 31, 2008, the Company is in compliance with all covenants.

F-37