MoneyGram 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Significant Actions and Developments

Following is a summary of significant actions taken by the Company in 2008 and economic developments during the year that impacted

our Consolidated Financial Statements:

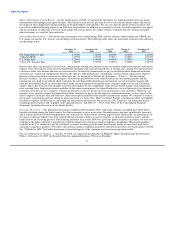

Portfolio Realignment and Losses — In the second half of 2007, the asset-backed securities and general credit markets experienced

unprecedented deterioration due to increasing concerns over defaults on mortgages and debt in general. This deterioration caused ratings

downgrades and market demands for higher risk premiums and liquidity discounts on asset-backed securities, resulting in substantial

declines in the fair value of asset-backed securities. The markets continued to deteriorate in 2008, resulting in additional losses in our

investment portfolio beyond those recognized in 2007. We completed a plan during the first quarter of 2008 to realign our investment

portfolio away from asset-backed securities and into highly liquid assets through the sale of a substantial portion of our available-for-sale

portfolio. As a result of this plan, we sold securities with a fair value of $3.2 billion (after other-than-temporary impairment charges) as of

December 31, 2007 for a net realized loss of $256.3 million. The realized loss was due to further market deterioration subsequent to the

December 31, 2007 valuation and the short timeframe over which we sold the investments. Proceeds from the sales of $2.9 billion were

reinvested in cash and cash equivalents. After the realignment, our investment portfolio is primarily comprised of cash, cash equivalents

and agency securities or securities backed solely by agency securities. As we no longer have the intent to hold our remaining investments

classified in "Other asset-backed securities," we recognized an other-than-temporary impairment charge of $70.3 million in 2008 from

the continued deterioration in the markets over increasing mortgage defaults and illiquidity and uncertainty concerns. While the realigned

portfolio will significantly reduce our exposure to fluctuations in the fair value of our investments and greatly enhance our liquidity, it

has resulted in lower investment yields than we have historically earned.

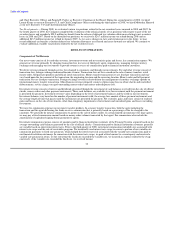

Capital Transaction — We completed a capital transaction on March 25, 2008 pursuant to which we received $1.5 billion of gross equity

and debt capital to support the long-term needs of the business and to provide necessary capital due to the investment portfolio losses (the

"Capital Transaction"). In completing the Capital Transaction, we anticipated the further deterioration of our investments classified in

"Other asset-backed securities" and "Trading investments." As a result, the proceeds from the Capital Transaction cover the investment

losses recognized in 2008 by the Company for these investments and no further capital needs are anticipated as of the date of this filing.

The equity component of the Capital Transaction consisted of a $760.0 million private placement of participating convertible preferred

stock (the "Series B Stock"). The debt component consisted of the issuance of $500.0 million of senior secured second lien notes (the

"Notes") with a 10 year maturity. Additionally, we entered into a senior secured amended and restated credit agreement (the "Senior

Facility"), amending our existing $350.0 million debt facility to increase the facility by $250.0 million to a total facility size of

$600.0 million. The new facility includes $350.0 million in two term loan tranches and a $250.0 million revolving credit facility. We

have availability under the revolving facility of $97.4 million at December 31, 2008. For a description of the terms of the equity and debt

components of the Capital Transaction, see "Liquidity and Capital Resources — Impact of the Credit Market Disruption" and Note 12 —

Mezzanine Equity and Note 10 — Debt of the Notes to the Consolidated Financial Statements. The net proceeds of the Capital

Transaction were invested in cash equivalents to supplement our unrestricted assets.

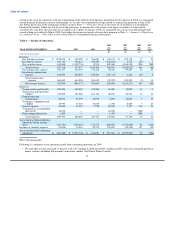

Official Check Restructuring and Repricing — In the first quarter of 2008, we initiated the restructuring of our official check business by

changing the commission structure and exiting certain large customer relationships. As of December 31, 2008, we have termination

agreements with the majority of our top 10 financial institution customers and expect to exit the remaining top 10 customers upon the

expiration of their service contracts. As of December 31, 2008, approximately $1.8 billion of balances for the top 10 customers have run

off, with the remaining balances expected to run off over the next six to 15 months as the customers cease issuing new official checks and

old issuances are presented to us for payment. Effective June 1, 2008 for most customers and July 1, 2008 for our remaining customers,

we reduced the commission rate paid to the majority of our official check financial institution customers. This repricing results in an

average contractual payout rate of the effective federal funds rate less approximately 85 basis points. See "Significant Actions and

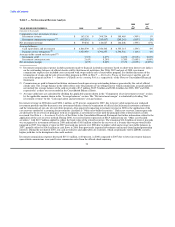

Developments — Interest Rate Environment" and "Results of Operations — Table 3 — Net Investment Revenue Analysis" for discussion

regarding the impact of the restructuring and repricing initiatives on our investment revenue and investment commissions.

30