MoneyGram 2008 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Deferred Financing Costs — In connection with the waivers obtained on the Senior Facility and the 364-Day Facility during the first

quarter of 2008, the Company capitalized transaction costs of $1.5 million. The Company also capitalized $19.6 million and

$33.4 million of transaction costs for the amendment and restatement of the Senior Facility and the issuance of the Notes, respectively.

These costs were capitalized in "Other assets" in the Consolidated Balance Sheets and are being amortized over the life of the related debt

using the effective interest method. Amortization of deferred financing costs recorded in "Interest expense" in the Consolidated

Statements of (Loss) Income for the years ended December 30, 2008, 2007 and 2006 were $5.5 million, $0.2 million and $0.2 million,

respectively. In accordance with EITF Issue No. 96-19, Debtor's Accounting for a Modification or Exchange of Debt Instruments , the

Company has accounted for the amendments to the Senior Facility as a debt extinguishment. As a result, the Company recognized a

$1.5 million debt extinguishment loss in the Consolidated Statements of (Loss) Income during the first quarter of 2008 which reduced

deferred financing costs. In addition, the Company expensed $0.4 million of unamortized deferred financing costs in connection with the

termination of the 364-Day Facility in the first quarter of 2008.

Interest Paid in Cash — The Company paid $84.0 million, $11.6 million and $8.5 million in 2008, 2007 and 2006, respectively.

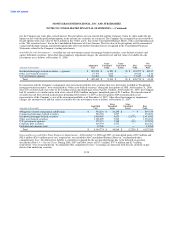

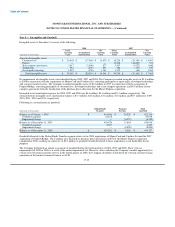

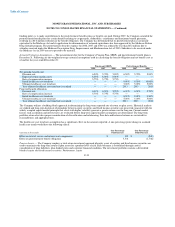

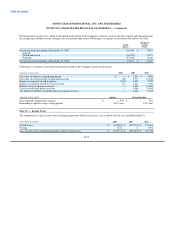

Maturities — Maturities of long-term debt for each of the five years succeeding December 31, 2008 are as follows:

(Amounts in thousands)

2009 $ 2,500

2010 2,500

2011 2,500

2012 2,500

2013 483,125

Debt Swaps — In September 2005, the Company entered into two interest rate swap agreements with a total notional amount of

$150.0 million to hedge our variable rate debt. These swap agreements were designated as cash flow hedges. At December 31, 2007, the

interest rate debt swaps had an average fixed pay rate of 4.3 percent and an average variable receive rate of 4.5 percent. In the first half of

2008, the Company terminated these agreements. See Note 7 — Derivative Financial Instruments for further information regarding the

Company's interest rate swaps.

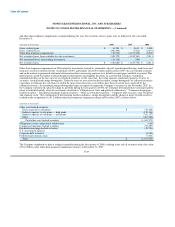

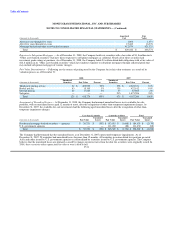

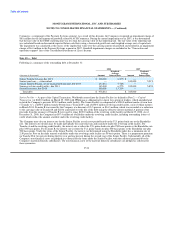

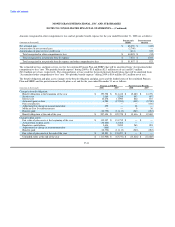

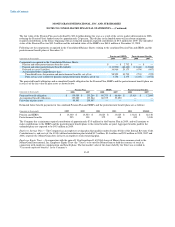

Note 11 — Pensions and Other Benefits

Pension Benefits — In connection with the spin-off, the Company assumed sponsorship of approximately 92 percent of the benefit

obligation for the Viad Corp Retirement Income Plan (the "Pension Plan") and all of the related assets. The Pension Plan is a frozen non-

contributory defined benefit pension plan under which no new service or compensation credits are accrued by the plan participants. Cash

accumulation accounts continue to be credited with interest credits until participants withdraw their money from the Pension Plan. It is

our policy to fund the minimum required contribution for the year.

Supplemental Executive Retirement Plans (SERPs) — In connection with the spin-off, the Company assumed responsibility for

approximately 87 percent of the benefit obligation for the Viad SERP. In addition, the Company is a sponsor of the MoneyGram

International, Inc. SERP. The SERPs are frozen, unfunded non-qualified defined benefit pension plans which provide postretirement

income to their participants. It is our policy to fund the SERPs as benefits are paid.

Postretirement Benefits Other Than Pensions — The Company has unfunded defined benefit postretirement plans that provide medical

and life insurance for eligible employees, retirees and dependents. The related postretirement benefit liabilities are recognized over the

period that services are provided by the employees. The Company's

F-38