MoneyGram 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

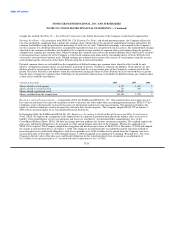

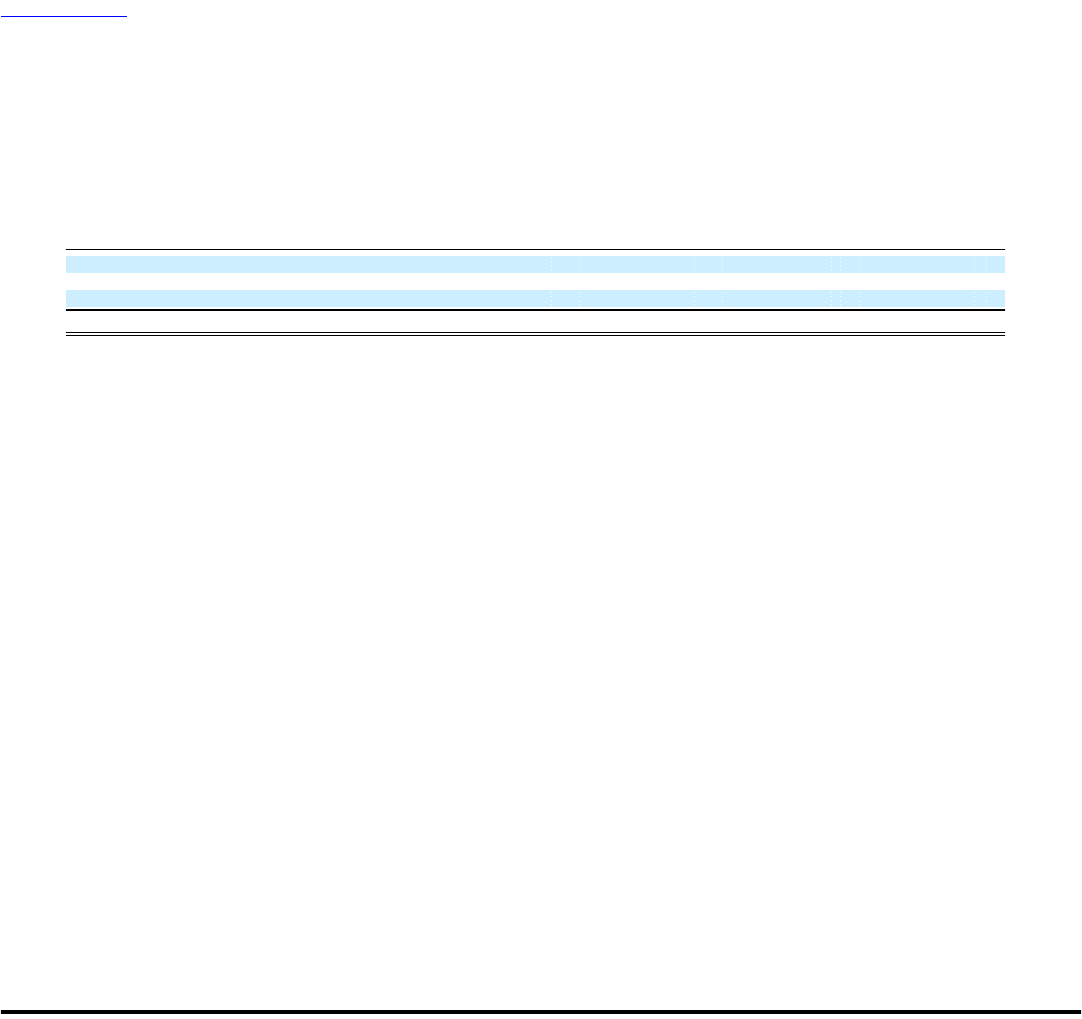

customer where an account is delinquent and a loss is deemed possible. Receivables are generally written off against the allowance one

year after becoming past due. Following is a summary of activity within the allowance for losses:

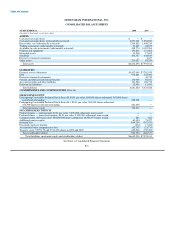

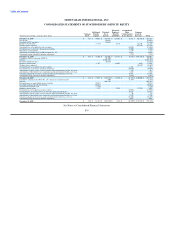

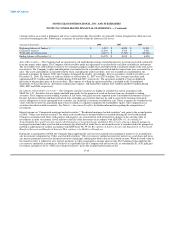

(Amounts in thousands) 2008 2007 2006

Beginning balance at January 1, $ 8,019 $ 6,824 $ 13,819

Charged to expense 12,396 $ 8,532 $ 3,931

Write-offs, net of recoveries (4,237) $ (7,337) $ (10,926)

Ending balance at December 31, $ 16,178 $ 8,019 $ 6,824

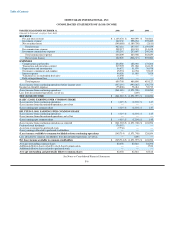

Sale of Receivables — The Company had an agreement to sell undivided percentage ownership interests in certain receivables, primarily

from our money order agents. The Company sold receivables under this agreement to accelerate the cash flow available for investment.

The receivables were sold without recourse to two commercial paper conduit trusts and represented a small percentage of the total assets

in each trust. The Company's rights and obligations were limited to the receivables transferred and the transactions were accounted for as

sales. The assets and liabilities associated with the trusts, including the sold receivables, were not recorded or consolidated in our

financial statements. In January 2008, the Company terminated the facility. Accordingly, there is no balance of sold receivables as of

December 31, 2008. The balance of sold receivables as of December 31, 2007 was $239.0 million. The average receivables sold

approximated $3.7 million and $349.9 million during 2008 and 2007, respectively. The agreement included a 5 percent holdback

provision of the purchase price of the receivables. This expense of selling the agent receivables is included in the Consolidated

Statements of (Loss) Income in "Investment commissions expense" and totaled $0.2 million, $23.3 million and $23.9 million during

2008, 2007 and 2006, respectively.

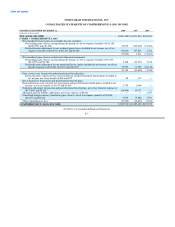

Investments (substantially restricted) — The Company classifies securities as trading or available-for-sale in accordance with

SFAS No. 115. Securities that are bought and held principally for the purpose of resale in the near term are classified as trading

securities. The Company records trading securities at fair value, with gains or losses reported in the Consolidated Statements of (Loss)

Income. Securities held for indefinite periods of time, including any securities that may be sold to assist in the clearing of payment

service obligations or in the management of securities, are classified as securities available-for-sale. These securities are recorded at fair

value, with the net after-tax unrealized gain or loss recorded as a separate component of stockholders' equity. The Company has no

securities classified as held-to-maturity. See Note 6 — Investment Portfolio for further information regarding the composition of

investments.

Interest income on "Commercial mortgage-backed securities," "Residential mortgage-backed securities" and, prior to the second quarter

of 2008, "Other asset-backed securities" for which risk of credit loss is deemed remote is recorded utilizing the level yield method.

Changes in estimated cash flows, both positive and negative, are accounted for with retrospective changes to the carrying value of

investments in order to maintain a level yield over the life of the investment in accordance with SFAS No. 91, Accounting for

Nonrefundable Fees and Costs Associated with Originating or Acquiring Loans and Initial Direct Costs of Leases. Interest income on

mortgage-backed and other asset-backed investments for which risk of credit loss is not deemed remote is recorded under the prospective

method as adjustments of yield in accordance with EITF Issue No. 99-20, Recognition of Interest Income and Impairment on Purchased

Beneficial Interests and Beneficial Interests That continue to be Held by a Transferor.

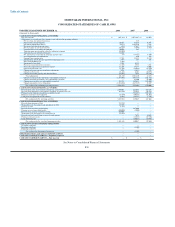

During the second quarter of 2008, the Company began applying the cost recovery method of accounting for interest to its available-for-

sale investments categorized as "Other asset-backed securities." The cost recovery method accounts for interest on a cash basis and treats

any interest payments received as deemed recoveries of principal, reducing the book value of the related security. When the book value of

the related security is reduced to zero, interest payments are then recognized as income upon receipt. The Company began applying the

cost recovery method of accounting as it believes it is probable that the Company will not recover all, or substantially all, of its principal

investment and interest for its "Other asset-backed securities" given the sustained deterioration in the

F-15