MoneyGram 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

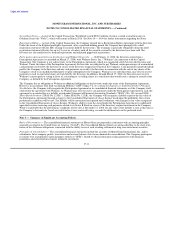

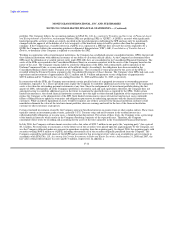

impairment using a fair-value based approach, and is assessed at the reporting unit level, which is determined to be the lowest level at

which management reviews cash flows for a business. The carrying value of the reporting unit is compared to its estimated fair value; any

excess of carrying value over fair value is deemed to be an impairment. Intangible and other long-lived assets are tested for impairment

by comparing the carrying value of the assets to the estimated future undiscounted cash flows to be generated by the asset. If an

impairment is determined to exist for goodwill and intangible assets, the carrying value of the asset is reduced to the estimated fair value.

See Note 9 — Intangibles and Goodwill for further discussion.

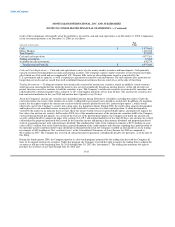

Payments on Long-Term Contracts — We make payments to certain agents and financial institution customers as an incentive to enter

into long-term contracts. The payments, or signing bonuses, are generally required to be refunded pro rata in the event of nonperformance

under, or cancellation of, the contract by the customer. For contracts requiring payments to be refunded, the signing bonuses are

capitalized and amortized over the life of the related contract as management is satisfied that such costs are recoverable through future

operations and minimum requirements or in the case of early termination, through penalties or refunds. Amortization of signing bonuses

on long-term contracts is recorded in "Fee commissions expense" in the Consolidated Statements of (Loss) Income. The carrying values

of the signing bonuses are reviewed whenever events or changes in circumstances indicate that the carrying amounts may not be

recoverable in accordance with the provisions of SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets.

Signing bonuses for contracts that do not require a refund in the event of nonperformance or cancellation are expensed upon payment in

the "Fee commissions expense" line in the Consolidated Statements of (Loss) Income.

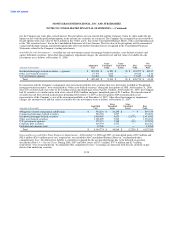

Income Taxes — Prior to the Distribution, income taxes were determined on a separate return basis as if MoneyGram had not been

eligible to be included in the consolidated income tax return of Viad and its affiliates. The provision for income taxes is computed based

on the pre-tax income included in the Consolidated Statements of (Loss) Income. Deferred income taxes result from temporary

differences between the financial reporting basis of assets and liabilities and their respective tax-reporting basis. Deferred tax assets and

liabilities are measured using the enacted tax rates expected to apply to taxable income in the years in which those temporary differences

are expected to reverse. Valuation allowances are recorded to reduce deferred tax assets when it is more likely than not that a tax benefit

will not be realized.

The Company adopted the provisions of FIN 48, Accounting for Uncertainty in Income Taxes, on January 1, 2007. The cumulative effect

of applying FIN 48 was reported as an adjustment to the opening balance of retained income. As a result of the implementation of

FIN 48, in 2007, the Company recognized a $29.6 million increase in the liability for unrecognized tax benefits, a $7.6 million increase in

deferred tax assets and a $22.0 million reduction to the opening balance of retained income. The liability for unrecognized tax benefits is

recorded as a non-cash item in "Accounts payable and other liabilities" in the Consolidated Balance Sheets. The Company records

interest and penalties for unrecognized tax benefits in "Income tax expense" in the Consolidated Statements of (Loss) Income. See

Note 15 — Income Taxes for further discussion.

Treasury Stock — Repurchased common stock is stated at cost and is presented as a separate reduction of stockholders' deficit. See

Note 13 — Stockholders' Deficit for further discussion.

Foreign Currency Translation — The Company converts assets and liabilities of foreign operations to their U.S. Dollar equivalents at

rates in effect at the balance sheet dates and records translation adjustments in "Accumulated other comprehensive loss" in the

Consolidated Balance Sheets. Income statements of foreign operations are translated from the operation's functional currency to

U.S. Dollar equivalents at the average exchange rate for the month. Foreign currency exchange transaction gains and losses are reported

in "Transaction and operations support" in the Consolidated Statements of (Loss) Income.

Revenue Recognition — The Company derives revenue primarily through service fees charged to consumers and its investing activity. A

description of these revenues and recognition policies is as follows:

• Fee and other revenues primarily consist of transaction fees and foreign exchange revenue.

F-18